In real estate, a short sale occurs when a bank or mortgage lender agrees to discount a loan balance due to an economic hardship on the part of the mortgagor (i.e., the seller). Circumstances determine whether or not banks will discount a loan balance. These circumstances are usually related to the current real estate market climate and the individual borrower's financial situation. A short sale typically is executed to prevent a home foreclosure. Often a bank will choose to allow a short sale if they believe that it will result in a smaller financial loss than foreclosing.

An arms-length or short sale affidavit is a document created by a bank in an attempt to prevent sellers from selling to relatives or friends to act as a straw buyer. Sometimes sellers make such side agreements. Then, after the transaction closes, the pretend buyers quickly transfer title back to the seller. This practice, in affect, means the sellers have repurchased their home at maybe half the cost, which greatly benefits those sellers.

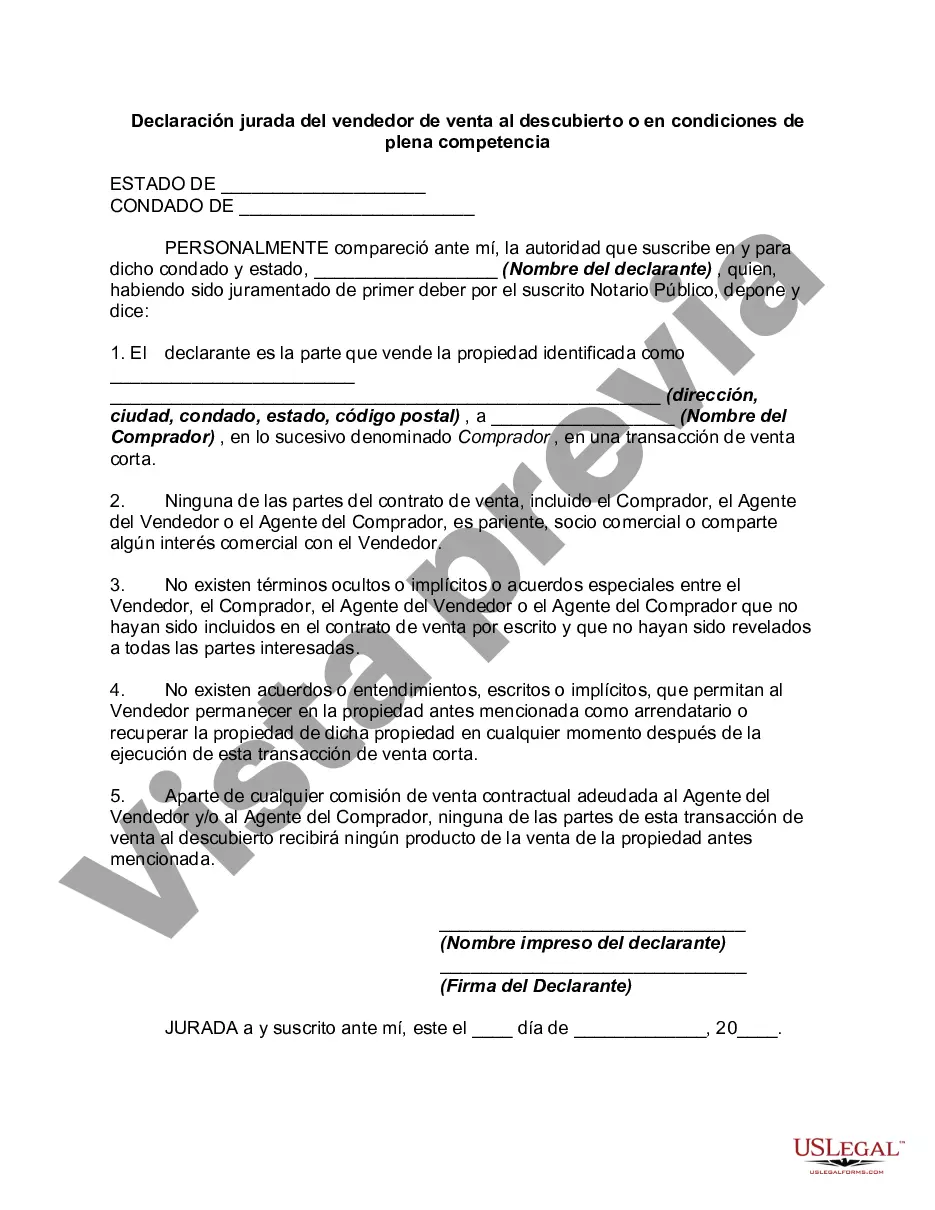

San Jose, California Short Sale or Arms Length Affidavit: Explained in Detail In the realm of real estate and property transactions, particularly in San Jose, California, a Short Sale or Arms Length Affidavit is a legal document that is essential for completing a successful property sale. This affidavit provides significant information, ensuring transparency and legality throughout the transaction process. Now, let's delve into the intricacies of the San Jose, California Short Sale or Arms Length Affidavit, along with its various types. What is a Short Sale or Arms Length Affidavit? A Short Sale or Arms Length Affidavit is a sworn legal statement made by the buyer, seller, and any involved parties in a property sale transaction. Its primary purpose is to declare that the transaction is being conducted in an arms-length manner, meaning that there is no pre-existing relationship or collusion between the parties involved that could potentially influence the sale terms. This affidavit is crucial to provide assurance to lenders, investors, and other stakeholders that the sale is fair, equitable, and not designed to defraud or manipulate the market. Different Types of San Jose, California Short Sale or Arms Length Affidavits: 1. Buyer's Short Sale or Arms Length Affidavit: This type of affidavit emphasizes the buyer's commitment to acting in an arms-length manner during the property transaction. It declares that the buyer has no undisclosed agreements, financial incentives, or hidden agreements influencing the purchase. 2. Seller's Short Sale or Arms Length Affidavit: Similarly, the seller is required to sign a Short Sale or Arms Length Affidavit, confirming that they are not involved in any side deals or collusive activities that could impact the transaction outcome. This affidavit acts as a safeguard against fraudulent practices. 3. Third-Party Affidavit: In some instances, a third party may be involved in the transaction, such as a real estate agent, attorney, or family member. This affidavit is signed by the third party, confirming their lack of personal interest and their impartiality in the property sale. Importance of San Jose, California Short Sale or Arms Length Affidavits: — Compliance and Mitigating Fraud: Short Sale or Arms Length Affidavits are essential for complying with lender requirements, as well as federal and state regulations. By declaring an arms-length transaction, lenders can be assured that there are no hidden agreements or fraudulent activities taking place. — Preventing Collusion: San Jose, California Short Sale or Arms Length Affidavits actively discourage collusion and undisclosed agreements between buyers and sellers. This ensures a fair market value for the property, preventing artificially inflated prices or other manipulations. — Protecting Lenders and Investors: These affidavits play a crucial role in protecting lenders and investors by providing transparency and liability protection. They instill confidence in the transaction's integrity, reducing the risk of losses for the parties involved. — Legal Requirement: In many instances, San Jose, California Short Sale or Arms Length Affidavits are required by lenders as a condition for approving a short sale. Failing to provide the affidavit may hinder the completion of the transaction. In conclusion, a Short Sale or Arms Length Affidavit is a cornerstone for a smooth and fair property transaction in San Jose, California. It ensures transparency, prevents collusion, and protects all parties involved. Understanding the different types of affidavits and their significance is imperative to successfully navigate the real estate landscape in San Jose.San Jose, California Short Sale or Arms Length Affidavit: Explained in Detail In the realm of real estate and property transactions, particularly in San Jose, California, a Short Sale or Arms Length Affidavit is a legal document that is essential for completing a successful property sale. This affidavit provides significant information, ensuring transparency and legality throughout the transaction process. Now, let's delve into the intricacies of the San Jose, California Short Sale or Arms Length Affidavit, along with its various types. What is a Short Sale or Arms Length Affidavit? A Short Sale or Arms Length Affidavit is a sworn legal statement made by the buyer, seller, and any involved parties in a property sale transaction. Its primary purpose is to declare that the transaction is being conducted in an arms-length manner, meaning that there is no pre-existing relationship or collusion between the parties involved that could potentially influence the sale terms. This affidavit is crucial to provide assurance to lenders, investors, and other stakeholders that the sale is fair, equitable, and not designed to defraud or manipulate the market. Different Types of San Jose, California Short Sale or Arms Length Affidavits: 1. Buyer's Short Sale or Arms Length Affidavit: This type of affidavit emphasizes the buyer's commitment to acting in an arms-length manner during the property transaction. It declares that the buyer has no undisclosed agreements, financial incentives, or hidden agreements influencing the purchase. 2. Seller's Short Sale or Arms Length Affidavit: Similarly, the seller is required to sign a Short Sale or Arms Length Affidavit, confirming that they are not involved in any side deals or collusive activities that could impact the transaction outcome. This affidavit acts as a safeguard against fraudulent practices. 3. Third-Party Affidavit: In some instances, a third party may be involved in the transaction, such as a real estate agent, attorney, or family member. This affidavit is signed by the third party, confirming their lack of personal interest and their impartiality in the property sale. Importance of San Jose, California Short Sale or Arms Length Affidavits: — Compliance and Mitigating Fraud: Short Sale or Arms Length Affidavits are essential for complying with lender requirements, as well as federal and state regulations. By declaring an arms-length transaction, lenders can be assured that there are no hidden agreements or fraudulent activities taking place. — Preventing Collusion: San Jose, California Short Sale or Arms Length Affidavits actively discourage collusion and undisclosed agreements between buyers and sellers. This ensures a fair market value for the property, preventing artificially inflated prices or other manipulations. — Protecting Lenders and Investors: These affidavits play a crucial role in protecting lenders and investors by providing transparency and liability protection. They instill confidence in the transaction's integrity, reducing the risk of losses for the parties involved. — Legal Requirement: In many instances, San Jose, California Short Sale or Arms Length Affidavits are required by lenders as a condition for approving a short sale. Failing to provide the affidavit may hinder the completion of the transaction. In conclusion, a Short Sale or Arms Length Affidavit is a cornerstone for a smooth and fair property transaction in San Jose, California. It ensures transparency, prevents collusion, and protects all parties involved. Understanding the different types of affidavits and their significance is imperative to successfully navigate the real estate landscape in San Jose.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.