In real estate, a short sale occurs when a bank or mortgage lender agrees to discount a loan balance due to an economic hardship on the part of the mortgagor (i.e., the seller). Circumstances determine whether or not banks will discount a loan balance. These circumstances are usually related to the current real estate market climate and the individual borrower's financial situation. A short sale typically is executed to prevent a home foreclosure. Often a bank will choose to allow a short sale if they believe that it will result in a smaller financial loss than foreclosing.

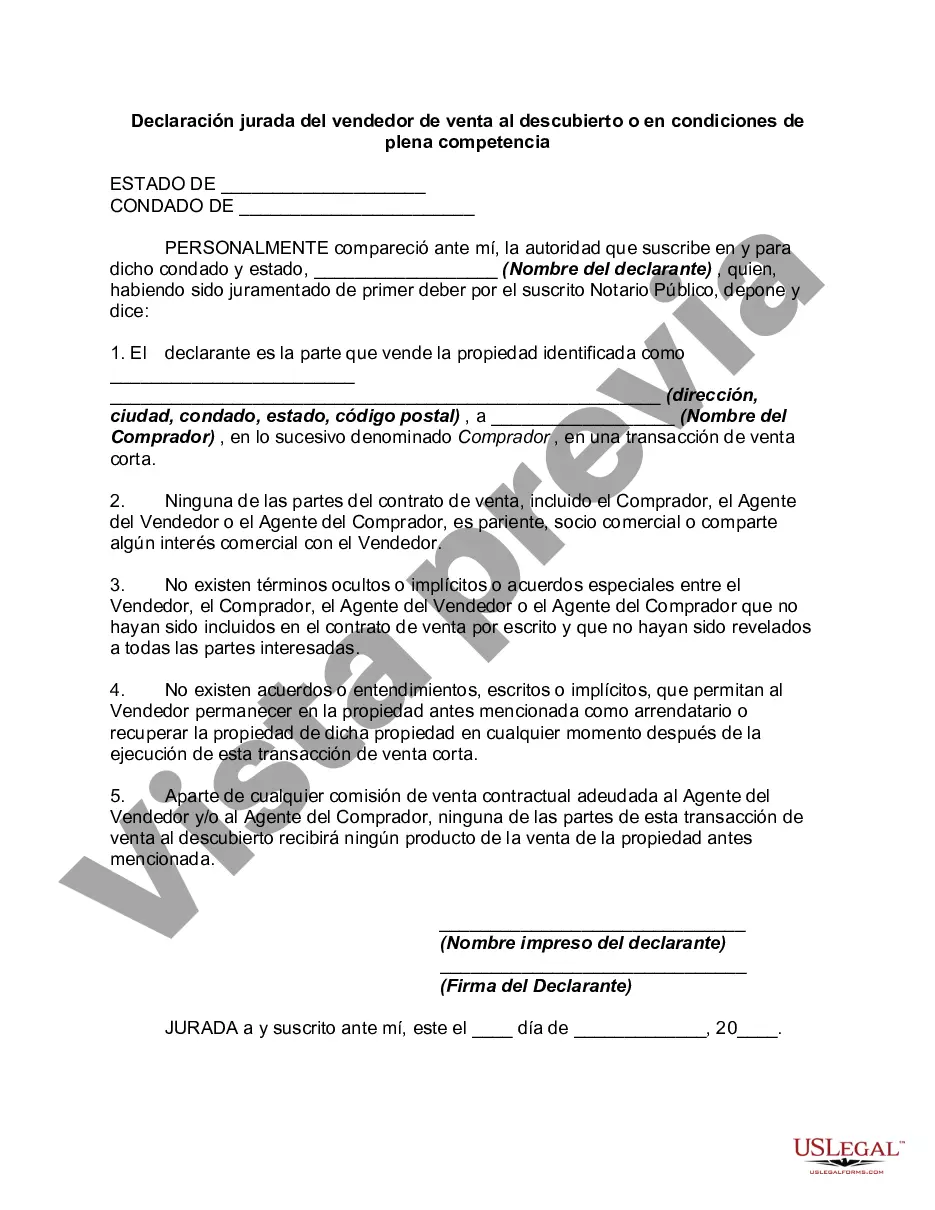

An arms-length or short sale affidavit is a document created by a bank in an attempt to prevent sellers from selling to relatives or friends to act as a straw buyer. Sometimes sellers make such side agreements. Then, after the transaction closes, the pretend buyers quickly transfer title back to the seller. This practice, in affect, means the sellers have repurchased their home at maybe half the cost, which greatly benefits those sellers.

Tarrant Texas Short Sale or Arms Length Affidavit: A Detailed Description In Tarrant, Texas, a Short Sale or Arms Length Affidavit plays a crucial role in real estate transactions, specifically during short sales. It is a legally binding document that serves to ensure a fair and transparent sale process for all parties involved. This affidavit acts as proof that the buyer and seller in the transaction are unrelated and operate at arm's length, meaning they have no personal or financial connection. This measure is in place to prevent fraudulent and unscrupulous activities in the real estate market. In a short sale, a homeowner facing financial hardship sells their property for less than the amount owed on the mortgage. Lenders, who must approve the short sale, want to ensure that the sale price reflects fair market value and is not being manipulated or inflated by colluding parties. The Tarrant Texas Short Sale or Arms Length Affidavit helps to establish the impartiality and arms-length nature of the transaction. Key components typically included in a Tarrant Texas Short Sale or Arms Length Affidavit are: 1. Buyer and Seller Information: The affidavit includes the full legal names, contact details, and addresses of both the buyer and seller involved in the real estate transaction. 2. Confirmation of Arm's Length Transaction: The affidavit explicitly states that the buyer and seller are not related by blood, marriage, or business partnerships. It asserts that they have no direct or indirect financial ties, ensuring an unbiased and fair negotiation process. 3. Seller's Financial Hardship Statement: The document may require the seller to provide a statement, explaining the financial difficulties leading to the short sale. This helps lenders evaluate the legitimacy of the seller's situation. It is important to note that specific requirements for Short Sale or Arms Length Affidavits can vary among lenders, and Tarrant, Texas may have its own unique guidelines as well. Lenders want to ensure compliance with local regulations and verify the authenticity of the parties involved. Failure to provide an accurate affidavit can lead to severe legal consequences and can result in the lender rejecting the short sale. Different Types of Tarrant Texas Short Sale or Arms Length Affidavits: While there may not be different types of Tarrant Texas Short Sale or Arms Length Affidavits, variations in the affidavit requirements can arise based on the individual lender's preferences or specific circumstances of the transaction. Some lenders may request additional supporting documents or modifications to the standard affidavit language. Hence, it is essential for buyers and sellers involved in short sale transactions in Tarrant, Texas to consult their lender and adhere to their precise stipulations. In conclusion, the Tarrant Texas Short Sale or Arms Length Affidavit ensures fair and arms-length transactions in real estate, particularly during short sales. By confirming the unbiased nature of the transaction, this document aims to prevent fraudulent activities and maintain transparency in the Tarrant County real estate market.Tarrant Texas Short Sale or Arms Length Affidavit: A Detailed Description In Tarrant, Texas, a Short Sale or Arms Length Affidavit plays a crucial role in real estate transactions, specifically during short sales. It is a legally binding document that serves to ensure a fair and transparent sale process for all parties involved. This affidavit acts as proof that the buyer and seller in the transaction are unrelated and operate at arm's length, meaning they have no personal or financial connection. This measure is in place to prevent fraudulent and unscrupulous activities in the real estate market. In a short sale, a homeowner facing financial hardship sells their property for less than the amount owed on the mortgage. Lenders, who must approve the short sale, want to ensure that the sale price reflects fair market value and is not being manipulated or inflated by colluding parties. The Tarrant Texas Short Sale or Arms Length Affidavit helps to establish the impartiality and arms-length nature of the transaction. Key components typically included in a Tarrant Texas Short Sale or Arms Length Affidavit are: 1. Buyer and Seller Information: The affidavit includes the full legal names, contact details, and addresses of both the buyer and seller involved in the real estate transaction. 2. Confirmation of Arm's Length Transaction: The affidavit explicitly states that the buyer and seller are not related by blood, marriage, or business partnerships. It asserts that they have no direct or indirect financial ties, ensuring an unbiased and fair negotiation process. 3. Seller's Financial Hardship Statement: The document may require the seller to provide a statement, explaining the financial difficulties leading to the short sale. This helps lenders evaluate the legitimacy of the seller's situation. It is important to note that specific requirements for Short Sale or Arms Length Affidavits can vary among lenders, and Tarrant, Texas may have its own unique guidelines as well. Lenders want to ensure compliance with local regulations and verify the authenticity of the parties involved. Failure to provide an accurate affidavit can lead to severe legal consequences and can result in the lender rejecting the short sale. Different Types of Tarrant Texas Short Sale or Arms Length Affidavits: While there may not be different types of Tarrant Texas Short Sale or Arms Length Affidavits, variations in the affidavit requirements can arise based on the individual lender's preferences or specific circumstances of the transaction. Some lenders may request additional supporting documents or modifications to the standard affidavit language. Hence, it is essential for buyers and sellers involved in short sale transactions in Tarrant, Texas to consult their lender and adhere to their precise stipulations. In conclusion, the Tarrant Texas Short Sale or Arms Length Affidavit ensures fair and arms-length transactions in real estate, particularly during short sales. By confirming the unbiased nature of the transaction, this document aims to prevent fraudulent activities and maintain transparency in the Tarrant County real estate market.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.