A Short Sale Affidavit of Buyer is a legal document required during the short sale process in Mecklenburg County, North Carolina. It serves as a sworn statement by the buyer, affirming their intentions, understanding, and acknowledgment of the terms and conditions associated with purchasing a property through a short sale. The affidavit is a crucial step in the transaction, ensuring that all parties involved have a clear understanding of the short sale process and their responsibilities. In Mecklenburg County, several types of Short Sale Affidavits of Buyer may be used, depending on the specific circumstances and requirements of the transaction. Some of these variations include: 1. Mecklenburg County Short Sale Affidavit of Buyer for Residential Properties: This type of affidavit is used when a buyer intends to purchase a residential property through a short sale. It outlines the buyer's understanding of the property's condition, potential risks, and necessary repairs, as well as their ability to finance the purchase and commitment to completing the transaction. 2. Mecklenburg County Short Sale Affidavit of Buyer for Commercial Properties: This affidavit is specific to commercial properties involved in a short sale. It addresses the buyer's comprehension of zoning regulations, building codes, tenant agreements, and any other commercial property aspects that may affect the transaction. 3. Mecklenburg County Short Sale Affidavit of Buyer for Investment Properties: This type of affidavit is designed for buyers purchasing properties with the intention of using them as investment properties. It may include additional clauses or disclosures related to rental agreements, property management, and anticipated rental income. Regardless of the type, a Mecklenburg County Short Sale Affidavit of Buyer generally includes essential information such as the buyer's name, contact details, the property address, purchase price, earnest money deposit, and contingencies. It also acknowledges the buyer's awareness and acknowledgment of potential risks associated with the short sale process, including the possibility of delays, lender approval challenges, and potential liens or encumbrances on the property. The affidavit assures the short sale seller, lender, and other parties involved that the buyer is committed to completing the purchase, understanding the risks and responsibilities associated with a short sale transaction, and will adhere to the agreed-upon terms and conditions. It establishes a level of transparency and facilitates a smoother short sale process for all parties involved in Mecklenburg County, North Carolina.

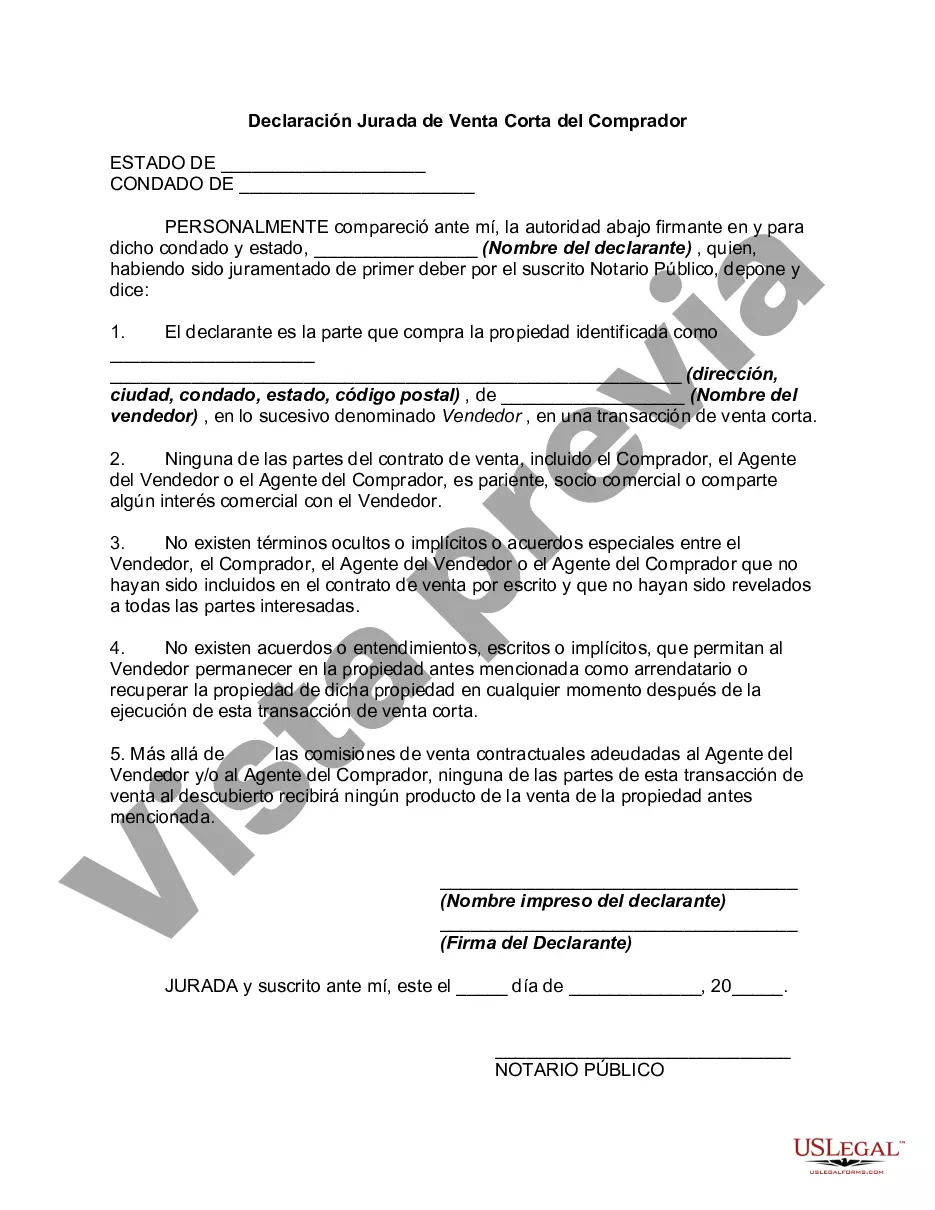

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Declaracion Jurada De Venta - Short Sale Affidavit of Buyer

Description

How to fill out Mecklenburg North Carolina Declaración Jurada De Venta Corta Del Comprador?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Mecklenburg Short Sale Affidavit of Buyer, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Mecklenburg Short Sale Affidavit of Buyer from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Mecklenburg Short Sale Affidavit of Buyer:

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!