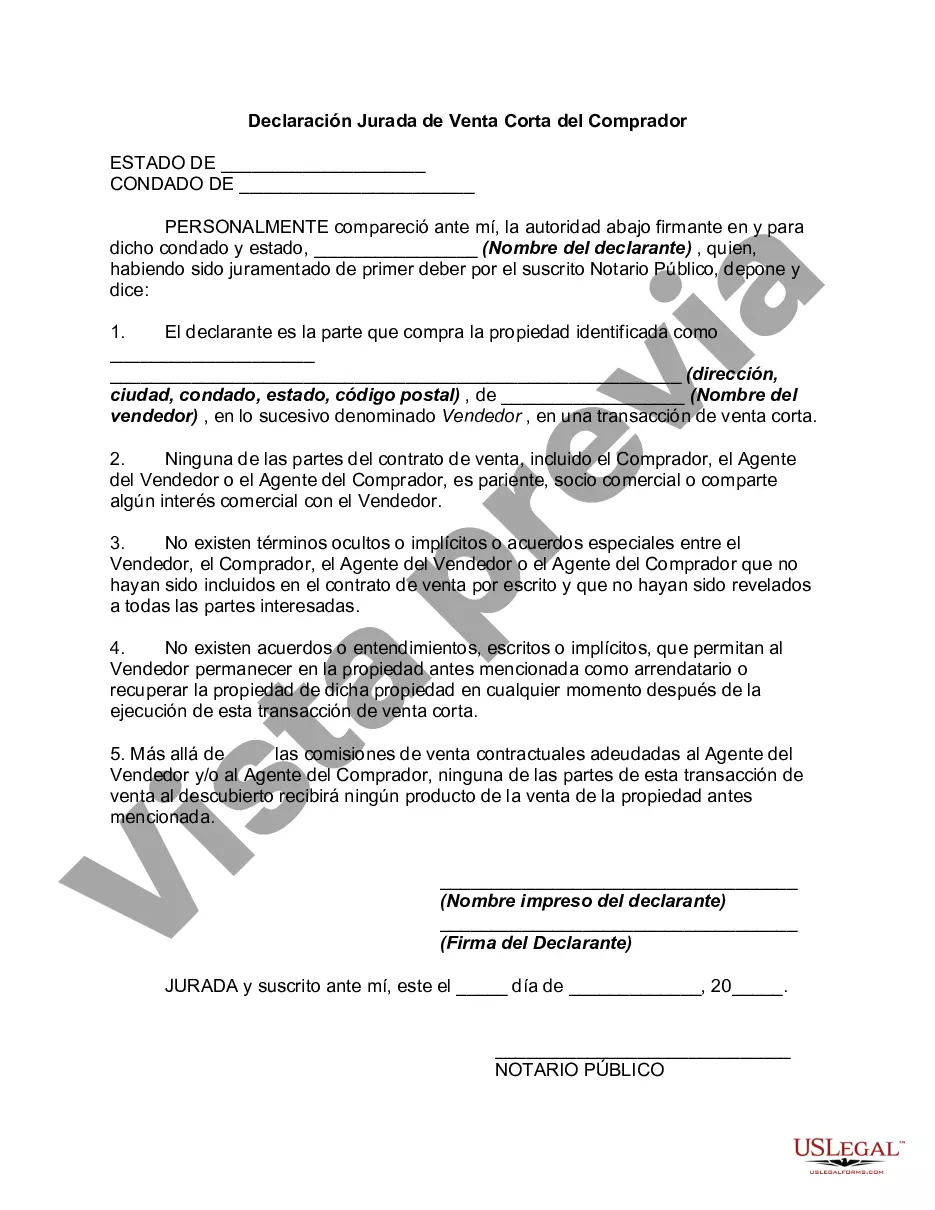

The Nassau New York Short Sale Affidavit of Buyer is a crucial document in real estate transactions in Nassau County, New York. It is designed to verify the buyer's commitment to purchase a property under short sale conditions. By providing a detailed account of the buyer's financial situation, intentions, and knowledge about the property, the affidavit plays a vital role in facilitating the short sale process. Key elements of the Nassau New York Short Sale Affidavit of Buyer include: 1. Buyer Information: This section requires the buyer to provide their full name, address, contact details, and social security number. It ensures that the affidavit is legally binding and that all parties involved can identify the buyer accurately. 2. Property Details: Here, the buyer is required to list the property they are seeking to purchase under short sale conditions. This includes the property address, ownership details, and any other pertinent information. 3. Financial Information: The buyer needs to disclose their financial status honestly. This includes providing information about their income, assets, liabilities, outstanding debts, and credit history. This section enables the seller and their lender to assess the buyer's ability to fulfill their financial obligations. 4. Intentions and Experience: The buyer must state their intentions to purchase the property for their personal use or as an investment. Additionally, they may need to disclose any prior experience with short sales or real estate transactions to provide the seller with confidence in their commitment. 5. Knowledge and Understanding: This section ensures that the buyer fully comprehends the implications of a short sale. They are required to acknowledge their understanding of the potential consequences, such as any deficiency judgments or tax liabilities that may arise from the transaction. 6. Declaration: The buyer must sign a sworn statement verifying that the information provided in the affidavit is true and accurate to the best of their knowledge. In case of any misrepresentation, the buyer could be held legally accountable. Different types of Nassau New York Short Sale Affidavit of Buyer may exist depending on specific circumstances or assistance programs. For example: 1. Nassau New York FHA Short Sale Affidavit of Buyer: This version would contain additional clauses or requirements specific to Federal Housing Administration (FHA) insured loans or programs. 2. Nassau New York HAIFA Short Sale Affidavit of Buyer: The Home Affordable Foreclosure Alternatives (HAIFA) program provides guidelines for streamlined short sales. As such, the affidavit may have sections or questions related to HAIFA's eligibility criteria and regulations. 3. Nassau New York Investor Short Sale Affidavit of Buyer: In cases where the buyer is an investor, additional disclosures related to investment properties and income-generating potential may be included. It is important for buyers, sellers, and their respective real estate agents or attorneys to thoroughly review and understand the specific requirements of the Nassau New York Short Sale Affidavit of Buyer. The accuracy and completeness of this document are crucial for the successful completion of a short sale transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Declaración Jurada de Venta Corta del Comprador - Short Sale Affidavit of Buyer

Description

How to fill out Nassau New York Declaración Jurada De Venta Corta Del Comprador?

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business case. All files are collected by state and area of use, so opting for a copy like Nassau Short Sale Affidavit of Buyer is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several more steps to obtain the Nassau Short Sale Affidavit of Buyer. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Short Sale Affidavit of Buyer in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!