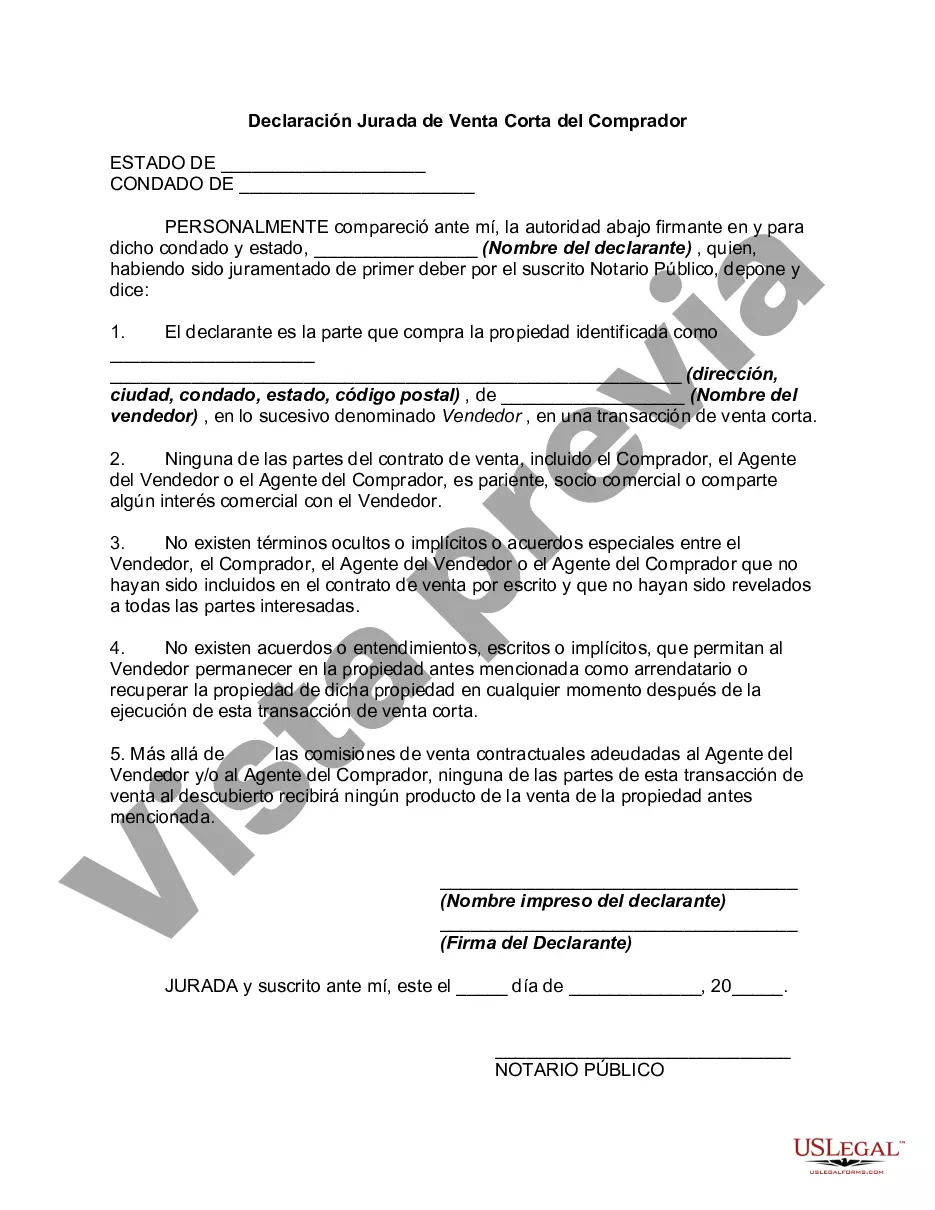

The Orange California Short Sale Affidavit of Buyer is a legal document required during the purchase of a property in the Orange County area that is being sold through a short sale. A short sale occurs when a homeowner is not able to pay their mortgage and agrees to sell the property for less than the outstanding balance on the loan. The Affidavit of Buyer is a crucial part of the short sale process as it verifies the buyer's understanding of the unique circumstances of the purchase. It ensures that the buyer is aware of the potential risks and benefits associated with buying a short sale property. This document includes various key details, such as the buyer's name, address, contact information, and the property address they are interested in purchasing. It also outlines the terms and conditions of the purchase agreement, the buyer's financial capacity to complete the transaction, and their acceptance of the property in its current condition, often known as "as-is" condition. Additionally, the Affidavit of Buyer may cover the buyer's acknowledgement of any potential delays or obstacles that may arise during the short sale approval process. This includes understanding that the lender's approval is required before the sale can be finalized and that it may take an extended period of time. The affidavit may also include disclosures of previous relationships or business connections between the buyer and the seller, ensuring transparency in the transaction. In Orange County, different types of Short Sale Affidavit of Buyer may exist depending on specific local requirements or lender preferences. Examples of these variations could include the Orange County Short Sale Affidavit of Buyer for residential properties, the Orange County Short Sale Affidavit of Buyer for multi-unit properties, or the Orange County Short Sale Affidavit of Buyer for commercial properties. In conclusion, the Orange California Short Sale Affidavit of Buyer serves as an essential legal document during the purchase of a short sale property in Orange County. It protects both the buyer and the seller by ensuring transparency, disclosing potential risks, and providing a clear understanding of the terms of the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Declaración Jurada de Venta Corta del Comprador - Short Sale Affidavit of Buyer

Description

How to fill out Orange California Declaración Jurada De Venta Corta Del Comprador?

Do you need to quickly draft a legally-binding Orange Short Sale Affidavit of Buyer or probably any other form to manage your own or business matters? You can select one of the two options: contact a professional to write a legal document for you or draft it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-compliant form templates, including Orange Short Sale Affidavit of Buyer and form packages. We offer templates for an array of use cases: from divorce papers to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, carefully verify if the Orange Short Sale Affidavit of Buyer is adapted to your state's or county's regulations.

- In case the document comes with a desciption, make sure to verify what it's intended for.

- Start the searching process again if the form isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Orange Short Sale Affidavit of Buyer template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the templates we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!