A San Antonio Texas Short Sale Affidavit of Buyer is a legal document that plays a crucial role in the real estate industry when it comes to purchasing a property through a short sale process in San Antonio, Texas. This affidavit serves as proof that the buyer acknowledges and understands the terms and conditions associated with a short sale transaction. In a short sale scenario, the homeowner is selling the property for an amount less than what is owed to the mortgage company, and the mortgage lender agrees to accept this amount as a full payoff. The Short Sale Affidavit of Buyer is a document typically required by the lender to ensure that the buyer is aware of the unique aspects and potential risks involved in purchasing a property through a short sale. The affidavit outlines the responsibilities and obligations of the buyer, ensuring they understand that the property is being sold "as-is" and that they will not be entitled to any repairs or modifications prior to closing. It also confirms that the buyer accepts any existing liens, encumbrances, or judgments against the property and agrees to assume them upon closing. Furthermore, the affidavit may include a statement declaring that the buyer has conducted their due diligence on the property, including inspections, and is aware of any potential issues. It could also state that the buyer has received and reviewed all the necessary disclosures related to the property, such as its current condition, known defects, and any outstanding legal or environmental matters. As for the different types of San Antonio Texas Short Sale Affidavit of Buyer, there may not be specific variations solely based on the locality. However, the content within the affidavit can vary depending on the specific requirements of the mortgage lender or the terms negotiated between the buyer and seller. It is essential for both parties, and their respective real estate agents or attorneys, to carefully review and adhere to the specific guidelines provided by the lender. In conclusion, a San Antonio Texas Short Sale Affidavit of Buyer is a vital document required in the purchase of a property through a short sale process in the San Antonio region. It emphasizes the buyer's understanding of the unique circumstances associated with a short sale, including the property's condition, potential issues, and accepting any existing liens or encumbrances. Adhering to this affidavit ensures transparency and helps protect the interests of all parties involved in the transaction.

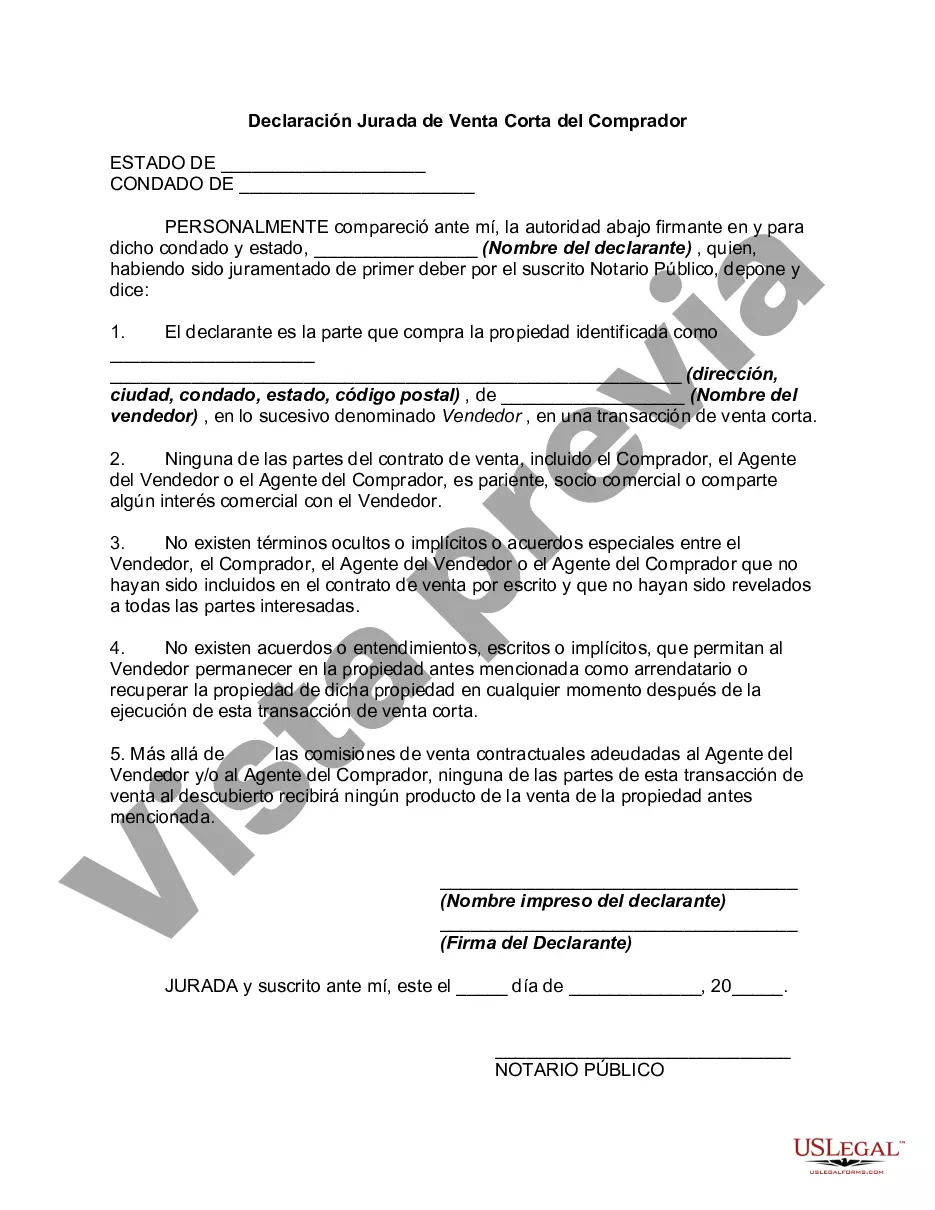

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Declaración Jurada de Venta Corta del Comprador - Short Sale Affidavit of Buyer

Description

How to fill out San Antonio Texas Declaración Jurada De Venta Corta Del Comprador?

Creating documents, like San Antonio Short Sale Affidavit of Buyer, to take care of your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can acquire your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for different scenarios and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the San Antonio Short Sale Affidavit of Buyer form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before downloading San Antonio Short Sale Affidavit of Buyer:

- Ensure that your document is compliant with your state/county since the rules for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the San Antonio Short Sale Affidavit of Buyer isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin utilizing our service and download the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment information.

- Your template is all set. You can try and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!