The San Jose California Short Sale Affidavit of Buyer is a legal document that plays a crucial role in the short sale process. It is designed to protect the interests of the buyer who is looking to purchase a property in San Jose, California, through a short sale transaction. This affidavit serves as a declaration of important information provided by the buyer regarding their financial situation, intent to purchase, and knowledge of the property being sold. Keywords: San Jose California, Short Sale Affidavit of Buyer, short sale process, legal document, buyer, purchase, property, financial situation, intent to purchase, knowledge, sold. Different types of San Jose California Short Sale Affidavits of Buyer may include: 1. Financial Affidavit of Buyer: This type of affidavit focuses on the buyer's financial position, requiring them to provide accurate and up-to-date information about their income, assets, liabilities, and credit history. It helps lenders assess the buyer's ability to purchase the property and sets a basis for negotiation during the short sale process. 2. Statement of Intent to Purchase: This affidavit highlights the buyer's commitment to completing the purchase of the property in question. It typically outlines their intention to buy the property at the agreed-upon price and includes a timeline for completion. This statement serves as a reassurance to the seller and their lender that the buyer is serious about the purchase. 3. Knowledge and Understanding Affidavit: This type of affidavit confirms that the buyer has thoroughly reviewed and understood all the pertinent information related to the short sale property. It may include details about the property's condition, any pending dues or liens, disclosures provided by the seller, and potential risks associated with the purchase. By signing this affidavit, the buyer acknowledges their responsibility for conducting due diligence before finalizing the transaction. 4. Short Sale Transaction Acknowledgment: This affidavit acknowledges that the buyer understands the unique nature of a short sale transaction. It typically covers key points such as the potential delays, risks, and uncertainties that come with this type of purchase. By signing it, the buyer confirms their acceptance of these conditions and that they are proceeding with the transaction willingly. In summary, the San Jose California Short Sale Affidavit of Buyer is an essential document used in the short sale process to protect the interests of the buyer. It may encompass various types of affidavits such as the Financial Affidavit of Buyer, Statement of Intent to Purchase, Knowledge and Understanding Affidavit, and Short Sale Transaction Acknowledgment. These affidavits provide critical information regarding the buyer's financial standing, commitment to purchase, understanding, and acceptance of the short sale conditions.

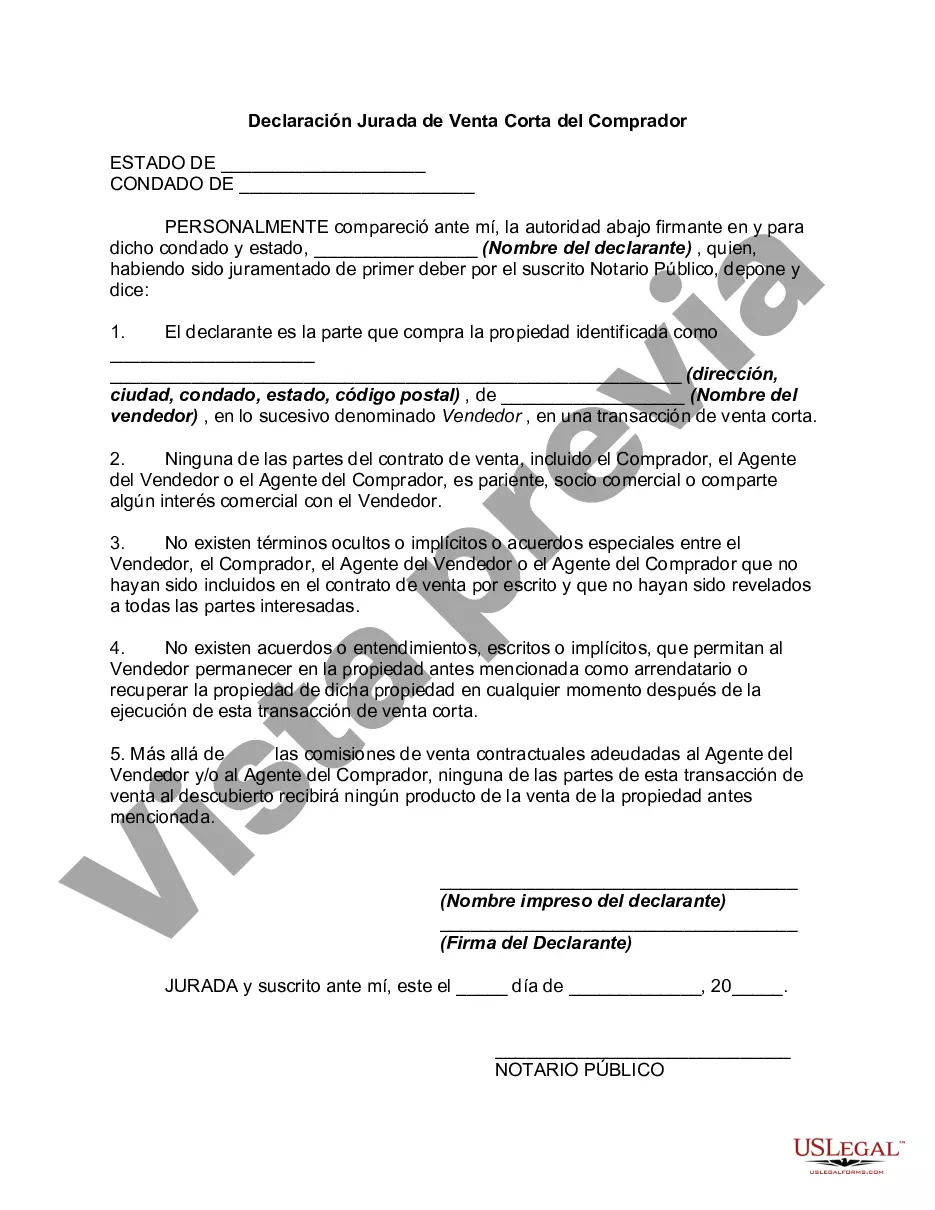

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ejemplo De Declaración Jurada Para Inmigración - Short Sale Affidavit of Buyer

Description

How to fill out San Jose California Declaración Jurada De Venta Corta Del Comprador?

Whether you intend to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business case. All files are collected by state and area of use, so opting for a copy like San Jose Short Sale Affidavit of Buyer is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the San Jose Short Sale Affidavit of Buyer. Adhere to the instructions below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Short Sale Affidavit of Buyer in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!