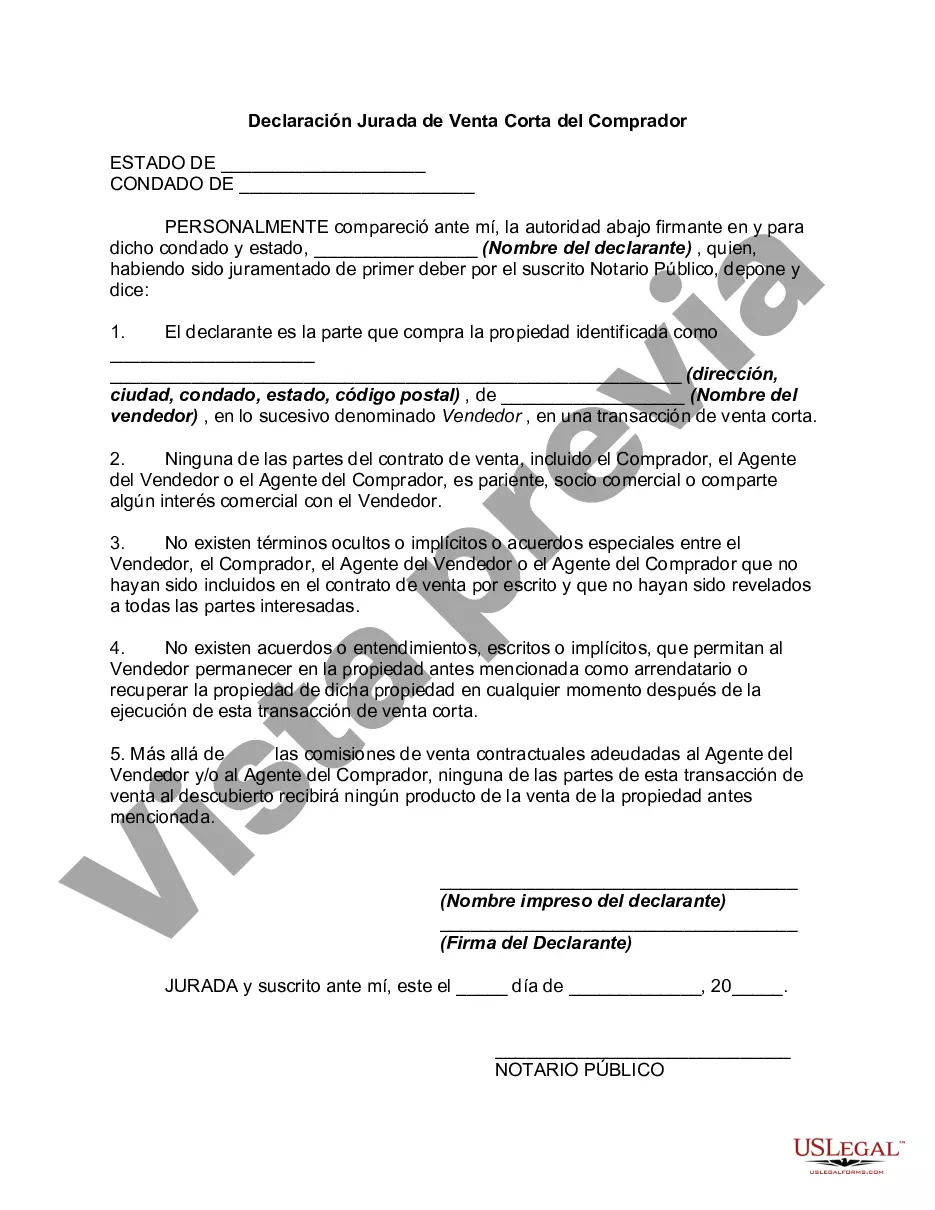

The Suffolk New York Short Sale Affidavit of Buyer is an essential document used in the real estate industry to facilitate the purchase of a property that is being sold through a short sale in Suffolk County, New York. A short sale refers to a situation where a homeowner is unable to keep up with their mortgage payments, and the bank agrees to accept an offer that is less than the amount owed on the loan. The Suffolk New York Short Sale Affidavit of Buyer is a legal statement made by the buyer, declaring their intentions, verifying their financial ability, and affirming their understanding of the short sale process. It is typically required by the bank or the lender before they accept an offer, ensuring that the buyer is serious and capable of completing the purchase. This affidavit plays a crucial role in the short sale transaction as it protects both the buyer and the seller and helps to establish transparency and clear communication between all parties involved. It helps ensure that the buyer has thoroughly reviewed the potential risks and challenges associated with a short sale and is willing to proceed with the purchase. The Suffolk New York Short Sale Affidavit of Buyer may include various sections such as: 1. Buyer's Information: This section requires the buyer's full legal name, contact information, address, and social security number. 2. Property Details: This section includes the address of the property being purchased, including the legal description and any associated parcel numbers. 3. Financing Details: This section requires the buyer to disclose the financing terms they intend to use for the purchase, such as all-cash, mortgage loan, or any other form of financing. 4. Buyer's Statements: This section includes several statements that the buyer must affirm, such as their financial stability, ability to complete the transaction, and their awareness of the risks involved in a short sale. 5. Seller's Disclosure: This section allows the seller to disclose any known defects, issues, or encumbrances associated with the property. 6. Signatures and Notarization: The affidavit must be signed by the buyer in the presence of a notary public, who will then affix their seal and signature to authenticate the document. While there may not be different types of Suffolk New York Short Sale Affidavit of Buyer, variations in formatting and specific requirements may exist based on the bank or lender handling the short sale transaction. It is always advisable to consult with a real estate attorney or professional to understand the specific requirements and customize the affidavit accordingly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Declaración Jurada de Venta Corta del Comprador - Short Sale Affidavit of Buyer

Description

How to fill out Suffolk New York Declaración Jurada De Venta Corta Del Comprador?

Preparing papers for the business or personal needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Suffolk Short Sale Affidavit of Buyer without expert assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Suffolk Short Sale Affidavit of Buyer by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Suffolk Short Sale Affidavit of Buyer:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!