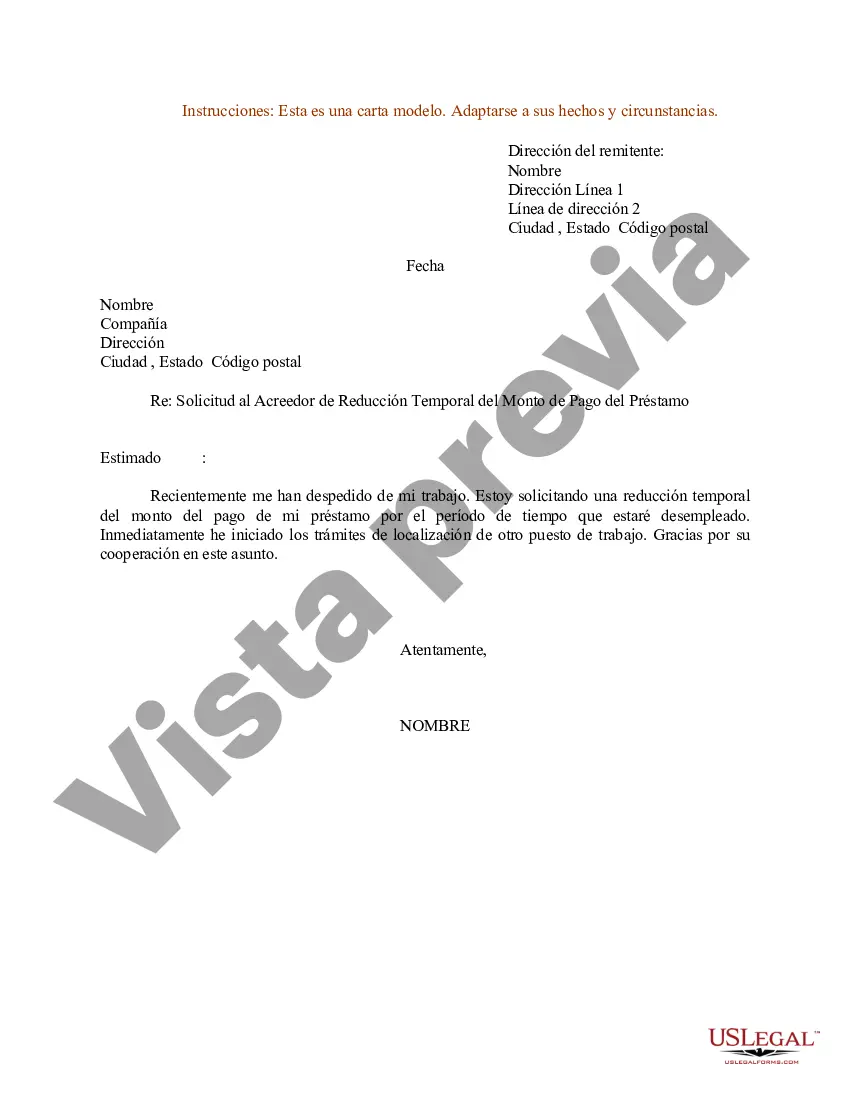

Title: Harris, Texas Sample Letter for Requesting Temporary Reduction of Loan Payment Amount Introduction: In the fast-paced world we live in, financial challenges can arise unexpectedly, leaving individuals in need of temporary relief. If you find yourself facing difficulty meeting your loan payment obligations, a well-crafted written request to your creditor in Harris, Texas can be an effective way to seek a temporary reduction of your loan payment amount. This article provides a detailed description of what the Harris, Texas Sample Letter for Request to Creditor for Temporary Reduction of Loan Payment Amount should include, tailored to help you during these challenging times. Key Points to Include in the Letter: 1. Opening: Begin by addressing your creditor formally and professionally, including their name, contact information, and your own contact details. Introduce yourself and state the purpose of the letter clearly: to request a temporary reduction of your loan payment amount. 2. Explanation of Financial Hardship: In this section, provide a detailed explanation of the financial hardship you are currently experiencing. Highlight any specific circumstances such as job loss, reduced income, increased medical expenses, or unexpected personal emergencies. Communicate the impact of these circumstances on your ability to meet your loan payment obligations. 3. Request for Temporary Reduction: Clearly express your request for a temporary reduction in the loan payment amount. State the exact amount or percentage reduction that you believe would allow you to navigate your financial difficulties while demonstrating your commitment to fulfilling your obligations. 4. Duration of Temporary Reduction: Specify the duration for which you are requesting the reduction. This can vary based on your specific circumstances, but ensure it is reasonable and allows you sufficient time to regain financial stability. 5. Presentation of Supporting Documentation: Where appropriate, attach relevant supporting documentation that substantiates your hardship claims. This may include letters of termination or furlough, medical bills, bank statements, or any other relevant evidence that strengthens your case. 6. Commitment to Future Payments: Demonstrate your reliability and commitment by assuring the creditor that once your financial situation improves, you will resume your regular payments without fail. Emphasize your willingness to work collaboratively with the creditor to find a mutually agreeable solution. 7. Gratitude and Sincerely Closing: Express your gratitude for the creditor's consideration and response to your request. Make sure to sign the letter with your full name and include any supporting identification numbers related to your loan account. Different Types of Harris, Texas Sample Letters for Requesting Temporary Reduction of Loan Payment Amount: 1. Harris, Texas Sample Letter for Requesting Temporary Reduction of Home Mortgage Payment 2. Harris, Texas Sample Letter for Requesting Temporary Reduction of Auto Loan Payment 3. Harris, Texas Sample Letter for Requesting Temporary Reduction of Personal Loan Payment 4. Harris, Texas Sample Letter for Requesting Temporary Reduction of Student Loan Payment 5. Harris, Texas Sample Letter for Requesting Temporary Reduction of Credit Card Loan Payment Remember, the key to a successful to request a temporary reduction of loan payment amount is to provide a clear and detailed explanation of your current financial situation and propose a reasonable temporary relief plan. With an informative and well-structured letter, you can increase your chances of securing the financial assistance you need.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Modelo de carta de solicitud al acreedor para la reducción temporal del monto del pago del préstamo - Sample Letter for Request to Creditor for Temporary Reduction of Loan Payment Amount

Description

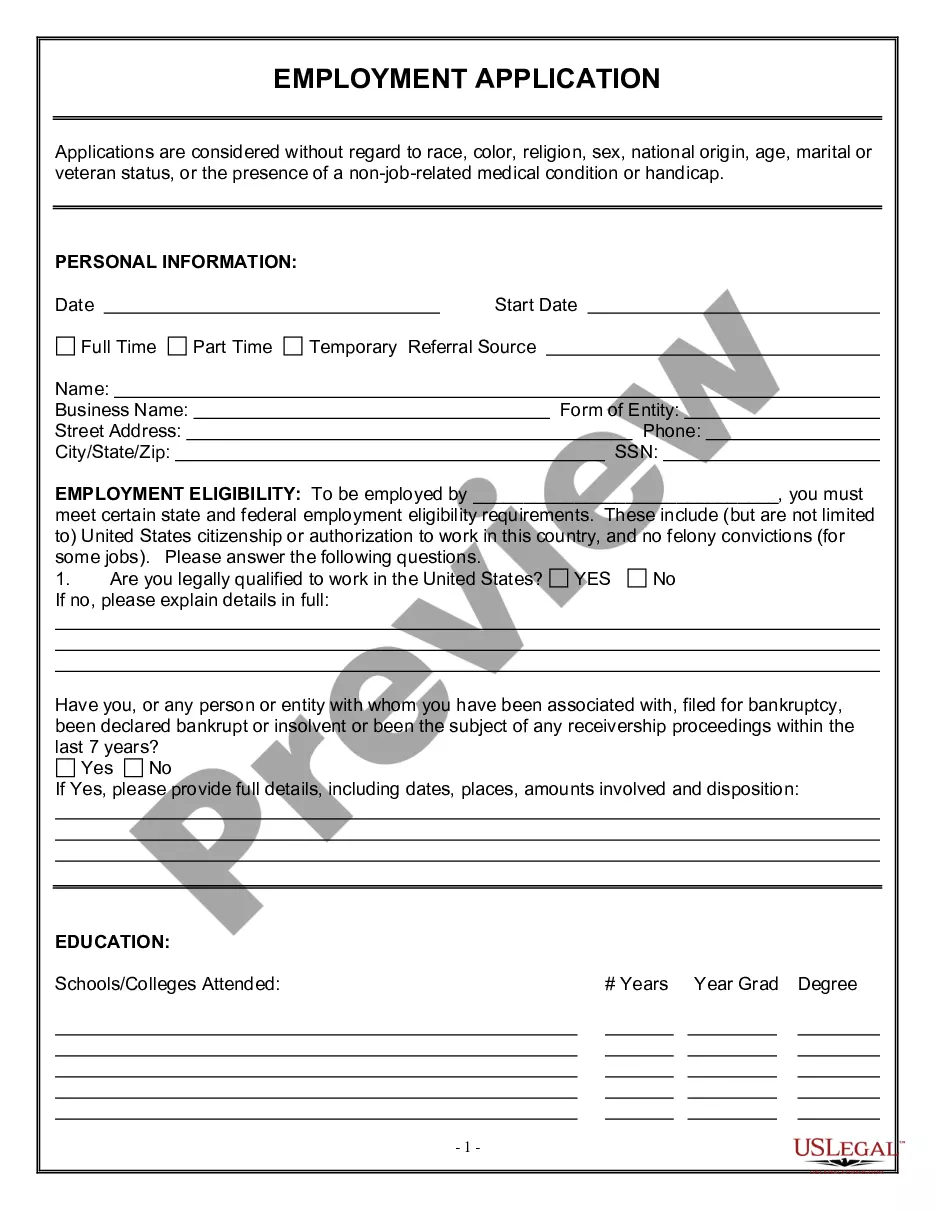

How to fill out Harris Texas Modelo De Carta De Solicitud Al Acreedor Para La Reducción Temporal Del Monto Del Pago Del Préstamo?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business objective utilized in your county, including the Harris Sample Letter for Request to Creditor for Temporary Reduction of Loan Payment Amount.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Harris Sample Letter for Request to Creditor for Temporary Reduction of Loan Payment Amount will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Harris Sample Letter for Request to Creditor for Temporary Reduction of Loan Payment Amount:

- Ensure you have opened the correct page with your regional form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Harris Sample Letter for Request to Creditor for Temporary Reduction of Loan Payment Amount on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!