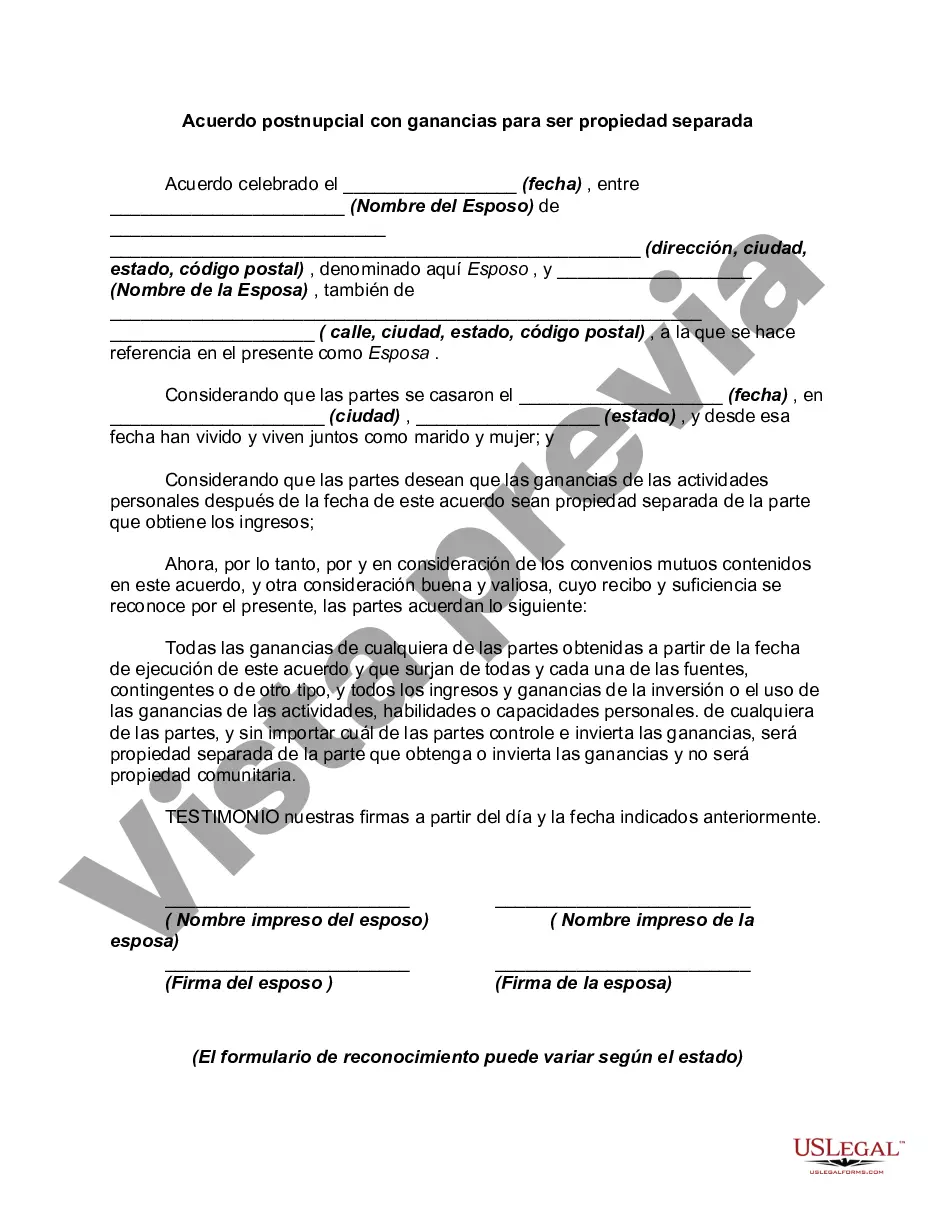

A postnuptial agreement is a written contract executed after a couple gets married to settle the couple's affairs and assets in the event of a separation or divorce.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Bronx New York Postnuptial Agreement with Earnings to be Separate Property is a legally binding contract entered into by married couples who wish to establish that their earnings will be classified as separate property rather than marital property. In the event of a divorce or separation, this agreement ensures the protection and preservation of each spouse's individual earnings. This type of postnuptial agreement is commonly used by couples residing in the Bronx, an influential and culturally diverse borough in New York City. The Bronx is known for its vibrant neighborhoods, iconic landmarks such as Yankee Stadium and the Bronx Zoo, and its rich history. Postnuptial agreements in the Bronx are subject to the laws of New York, specifically the New York Domestic Relations Law. Bronx New York Postnuptial Agreements with Earnings to be Separate Property may come in various forms tailored to meet couples' specific needs, circumstances, and concerns. Here are a few types of postnuptial agreements that Bronx couples might consider: 1. Basic Postnuptial Agreement with Separate Property Clause: This type of agreement establishes that any earnings or assets acquired individually during the marriage will remain separate property and not subject to division in the event of divorce or separation. 2. Comprehensive Postnuptial Agreement: This agreement goes beyond addressing separate property concerns and covers a broader range of marital issues. It may include provisions for property division, spousal support, asset allocation, and child custody arrangements, among others. 3. Business-Focused Postnuptial Agreement: For spouses who own a business or may acquire business interests during their marriage, this agreement specifically outlines the treatment of business assets and earnings. It can establish that the business remains the separate property of the owning spouse. 4. Retirement Account Postnuptial Agreement: This type of agreement comes into play when couples have substantial retirement accounts or pensions. It governs the distribution of retirement savings in the case of divorce or separation, ensuring that these assets are separate property. Bronx New York Postnuptial Agreements with Earnings to be Separate Property provide couples with the opportunity to customize their financial arrangements and protect their individual earnings. By establishing clear guidelines, these agreements can help reduce the potential for disputes and uncertainty during a divorce or separation. It is worth noting that consulting an experienced family law attorney is essential when creating any type of postnuptial agreement. This ensures that the agreement complies with the specific requirements of New York law and reflects both spouses' best interests.A Bronx New York Postnuptial Agreement with Earnings to be Separate Property is a legally binding contract entered into by married couples who wish to establish that their earnings will be classified as separate property rather than marital property. In the event of a divorce or separation, this agreement ensures the protection and preservation of each spouse's individual earnings. This type of postnuptial agreement is commonly used by couples residing in the Bronx, an influential and culturally diverse borough in New York City. The Bronx is known for its vibrant neighborhoods, iconic landmarks such as Yankee Stadium and the Bronx Zoo, and its rich history. Postnuptial agreements in the Bronx are subject to the laws of New York, specifically the New York Domestic Relations Law. Bronx New York Postnuptial Agreements with Earnings to be Separate Property may come in various forms tailored to meet couples' specific needs, circumstances, and concerns. Here are a few types of postnuptial agreements that Bronx couples might consider: 1. Basic Postnuptial Agreement with Separate Property Clause: This type of agreement establishes that any earnings or assets acquired individually during the marriage will remain separate property and not subject to division in the event of divorce or separation. 2. Comprehensive Postnuptial Agreement: This agreement goes beyond addressing separate property concerns and covers a broader range of marital issues. It may include provisions for property division, spousal support, asset allocation, and child custody arrangements, among others. 3. Business-Focused Postnuptial Agreement: For spouses who own a business or may acquire business interests during their marriage, this agreement specifically outlines the treatment of business assets and earnings. It can establish that the business remains the separate property of the owning spouse. 4. Retirement Account Postnuptial Agreement: This type of agreement comes into play when couples have substantial retirement accounts or pensions. It governs the distribution of retirement savings in the case of divorce or separation, ensuring that these assets are separate property. Bronx New York Postnuptial Agreements with Earnings to be Separate Property provide couples with the opportunity to customize their financial arrangements and protect their individual earnings. By establishing clear guidelines, these agreements can help reduce the potential for disputes and uncertainty during a divorce or separation. It is worth noting that consulting an experienced family law attorney is essential when creating any type of postnuptial agreement. This ensures that the agreement complies with the specific requirements of New York law and reflects both spouses' best interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.