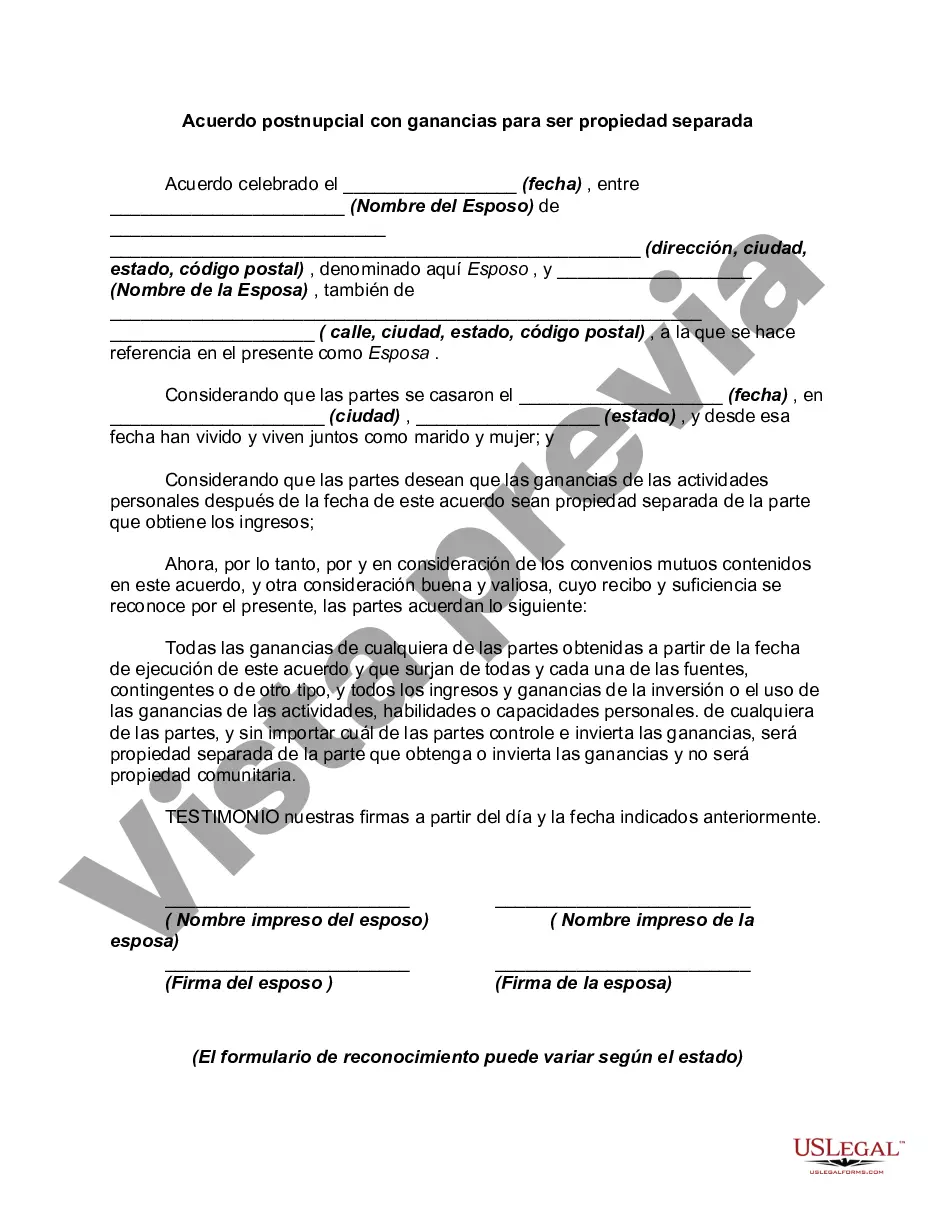

A postnuptial agreement is a written contract executed after a couple gets married to settle the couple's affairs and assets in the event of a separation or divorce.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Mecklenburg North Carolina Postnuptial Agreement with Earnings to be Separate Property is a legal document that allows married couples in Mecklenburg County, North Carolina, to establish clear guidelines and provisions regarding the separate property rights of each spouse. This agreement becomes effective after the marriage has taken place. A postnuptial agreement is an essential tool for couples who wish to protect their personal assets and financial interests in the event of a divorce or separation. It helps prevent disputes and provides a reliable framework for dividing marital property, debts, and earnings. This agreement is especially beneficial for individuals with significant personal wealth or business interests they wish to safeguard. The primary purpose of a Mecklenburg North Carolina Postnuptial Agreement with Earnings to be Separate Property is to outline that any income or earnings acquired during the course of the marriage by either spouse will be regarded as separate property, meaning it will not be subject to division in the event of a divorce. Several types or variations of Postnuptial Agreements with Earnings to be Separate Property may exist and can be tailored to meet specific circumstances and preferences. Some common variations include: 1. Complete Separation of Earnings: This type of agreement ensures that each spouse's earnings and income during the marriage will be treated as entirely separate property, inaccessible to the other party in the event of a divorce. 2. Earnings Allocation Agreement: In this variation, the couple agrees to allocate a specific percentage or portion of their individual earnings as separate property while treating the remaining portion as marital property subject to division upon divorce. 3. Limited Earnings Partnership Agreement: This type of agreement outlines specific conditions under which a portion of the earnings can be shared or combined, such as for joint investments, shared purchases, or joint savings. The agreement still maintains that the remaining earnings will be treated as separate property. 4. Gradual Transition Agreement: This agreement establishes a timeline or structure for gradually shifting the character of earnings from separate to marital property. It may specify that after a certain number of years, a portion of the income will become marital property subject to division. It is crucial to consult with an experienced family law attorney in Mecklenburg County, North Carolina, to ensure the validity and enforceability of any postnuptial agreement. These agreements should be drafted carefully to reflect individuals' unique circumstances and conform to North Carolina marriage and property laws.A Mecklenburg North Carolina Postnuptial Agreement with Earnings to be Separate Property is a legal document that allows married couples in Mecklenburg County, North Carolina, to establish clear guidelines and provisions regarding the separate property rights of each spouse. This agreement becomes effective after the marriage has taken place. A postnuptial agreement is an essential tool for couples who wish to protect their personal assets and financial interests in the event of a divorce or separation. It helps prevent disputes and provides a reliable framework for dividing marital property, debts, and earnings. This agreement is especially beneficial for individuals with significant personal wealth or business interests they wish to safeguard. The primary purpose of a Mecklenburg North Carolina Postnuptial Agreement with Earnings to be Separate Property is to outline that any income or earnings acquired during the course of the marriage by either spouse will be regarded as separate property, meaning it will not be subject to division in the event of a divorce. Several types or variations of Postnuptial Agreements with Earnings to be Separate Property may exist and can be tailored to meet specific circumstances and preferences. Some common variations include: 1. Complete Separation of Earnings: This type of agreement ensures that each spouse's earnings and income during the marriage will be treated as entirely separate property, inaccessible to the other party in the event of a divorce. 2. Earnings Allocation Agreement: In this variation, the couple agrees to allocate a specific percentage or portion of their individual earnings as separate property while treating the remaining portion as marital property subject to division upon divorce. 3. Limited Earnings Partnership Agreement: This type of agreement outlines specific conditions under which a portion of the earnings can be shared or combined, such as for joint investments, shared purchases, or joint savings. The agreement still maintains that the remaining earnings will be treated as separate property. 4. Gradual Transition Agreement: This agreement establishes a timeline or structure for gradually shifting the character of earnings from separate to marital property. It may specify that after a certain number of years, a portion of the income will become marital property subject to division. It is crucial to consult with an experienced family law attorney in Mecklenburg County, North Carolina, to ensure the validity and enforceability of any postnuptial agreement. These agreements should be drafted carefully to reflect individuals' unique circumstances and conform to North Carolina marriage and property laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.