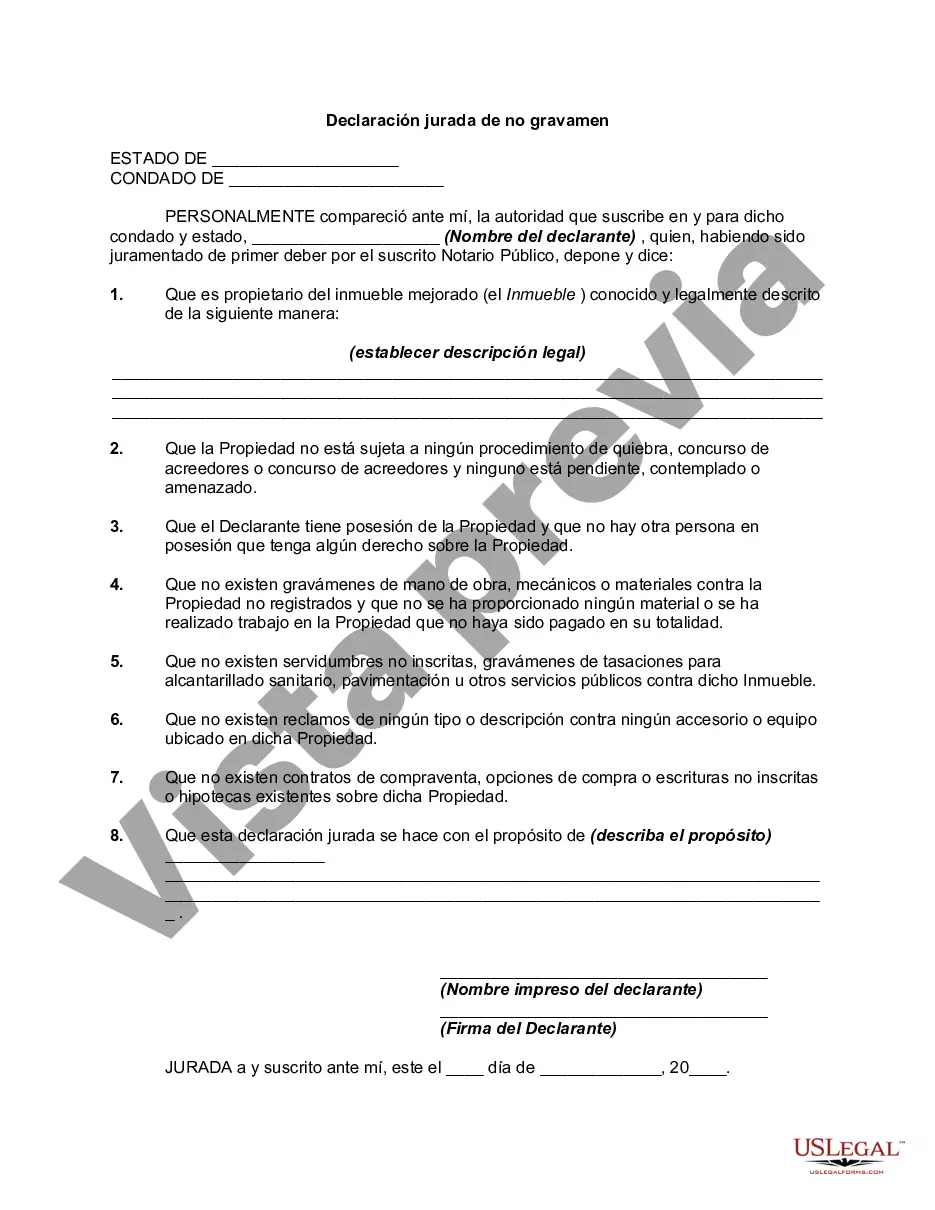

Collin Texas Affidavit of No Lien is a legal document used in Collin County, Texas, to verify that a property or real estate asset is free and clear of any outstanding liens or encumbrances. This affidavit is typically required during real estate transactions, including property sales, refinancing, or obtaining a mortgage. The Collin Texas Affidavit of No Lien serves as a declaration by the property owner or seller that there are no unpaid debts, claims, or legal actions against the property. The affidavit certifies that the property has no outstanding liens, such as mortgages, outstanding taxes, judgments, or mechanic's liens, which could potentially hinder the transfer of ownership or affect the property's title. By filing this affidavit, the property owner or seller makes a sworn statement, under penalty of perjury, that there are no undisclosed liens on the property. This is crucial as it assures potential buyers or lenders that they will not inherit any financial or legal burdens related to the property. Various types of Collin Texas Affidavit of No Lien can be specific to different real estate transactions or circumstances. Some common types include: 1. Collin Texas Affidavit of No Lien for Property Sales: This affidavit is typically required by buyers and lenders during a property sale. It affirms that the property being sold is free of any liens or encumbrances, providing reassurance to the parties involved in the transaction. 2. Collin Texas Affidavit of No Lien for Refinancing: When homeowners refinance their mortgage, lenders often require this affidavit to ensure there are no additional liens discovered during the process. It certifies that the property is still clear of any unforeseen debts or obligations. 3. Collin Texas Affidavit of No Lien for Construction Projects: In the context of construction projects, contractors may be required to submit this affidavit to guarantee that there are no outstanding liens from subcontractors or suppliers. This provides protection for property owners and lenders from potential complications or claims against the property during or after construction. 4. Collin Texas Affidavit of No Lien for Title Insurance: Title insurance companies may request this affidavit when issuing title insurance policies. It verifies that the property has no undisclosed liens or encumbrances, supporting the insurer's commitment to protecting the buyer's or lender's interests. It is important to note that the specific requirements, forms, and procedures for the Collin Texas Affidavit of No Lien may vary depending on the type of transaction or the parties involved. Consulting with a real estate attorney or a qualified professional can help ensure compliance with the applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Declaración jurada de no gravamen - Affidavit of No Lien

Description

How to fill out Collin Texas Declaración Jurada De No Gravamen?

Do you need to quickly create a legally-binding Collin Affidavit of No Lien or maybe any other form to handle your personal or corporate affairs? You can select one of the two options: contact a legal advisor to draft a valid document for you or create it entirely on your own. Luckily, there's another solution - US Legal Forms. It will help you receive neatly written legal papers without paying sky-high prices for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-compliant form templates, including Collin Affidavit of No Lien and form packages. We offer documents for an array of use cases: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- First and foremost, carefully verify if the Collin Affidavit of No Lien is tailored to your state's or county's laws.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the search again if the form isn’t what you were seeking by utilizing the search box in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Collin Affidavit of No Lien template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the documents we offer are updated by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!