This form involves the sale of a small business. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Mecklenburg North Carolina Agreement of Purchase and Sale of Business — Short Form is a legally binding document that outlines the terms and conditions of a business transaction in Mecklenburg County, North Carolina. This agreement serves as a comprehensive contract between the buyer and seller, establishing the rights, responsibilities, and obligations of both parties involved. It is essential for anyone engaging in a business sale or purchase in Mecklenburg County to understand the specifics of this agreement to ensure a smooth and transparent transaction process. The Mecklenburg North Carolina Agreement of Purchase and Sale of Business — Short Form typically includes the following key elements: 1. Parties: This section identifies the buyer and seller involved in the transaction, including their names, addresses, and contact information. 2. Purchase Price: It outlines the agreed-upon purchase price for the business, including any applicable terms of payment or financing arrangements. 3. Assets and Liabilities: This section details the included assets and liabilities being transferred as part of the purchase. It covers tangible assets (equipment, inventory, etc.), intangible assets (intellectual property, trademarks, etc.), and liabilities (debts, obligations, etc.). 4. Due Diligence: This clause permits the buyer to conduct thorough investigations and inspections of the business being purchased, ensuring the accuracy of information provided by the seller. 5. Closing Date: It stipulates the agreed-upon date for the completion of the transaction and the transfer of ownership. 6. Representations and Warranties: This section includes statements made by the seller regarding the business's condition, accuracy of financial statements, legal compliance, and other relevant aspects. The buyer relies on these representations to make an informed decision. 7. Confidentiality: This clause ensures the confidentiality of all business-related information exchanged during the transaction process and prohibits its disclosure to third parties. 8. Dispute Resolution: It outlines the process to resolve any disputes that may arise during or after the transaction. This may include negotiation, mediation, or legal action. It's important to note that while there may not be different types of Mecklenburg North Carolina Agreement of Purchase and Sale of Business — Short Form, variations can still exist. Different businesses may have unique requirements and conditions that can be addressed through additional addendums or amendments to the agreement. It's advisable to consult with a legal professional to ensure the inclusion of any specific clauses or language relevant to the business being bought or sold.The Mecklenburg North Carolina Agreement of Purchase and Sale of Business — Short Form is a legally binding document that outlines the terms and conditions of a business transaction in Mecklenburg County, North Carolina. This agreement serves as a comprehensive contract between the buyer and seller, establishing the rights, responsibilities, and obligations of both parties involved. It is essential for anyone engaging in a business sale or purchase in Mecklenburg County to understand the specifics of this agreement to ensure a smooth and transparent transaction process. The Mecklenburg North Carolina Agreement of Purchase and Sale of Business — Short Form typically includes the following key elements: 1. Parties: This section identifies the buyer and seller involved in the transaction, including their names, addresses, and contact information. 2. Purchase Price: It outlines the agreed-upon purchase price for the business, including any applicable terms of payment or financing arrangements. 3. Assets and Liabilities: This section details the included assets and liabilities being transferred as part of the purchase. It covers tangible assets (equipment, inventory, etc.), intangible assets (intellectual property, trademarks, etc.), and liabilities (debts, obligations, etc.). 4. Due Diligence: This clause permits the buyer to conduct thorough investigations and inspections of the business being purchased, ensuring the accuracy of information provided by the seller. 5. Closing Date: It stipulates the agreed-upon date for the completion of the transaction and the transfer of ownership. 6. Representations and Warranties: This section includes statements made by the seller regarding the business's condition, accuracy of financial statements, legal compliance, and other relevant aspects. The buyer relies on these representations to make an informed decision. 7. Confidentiality: This clause ensures the confidentiality of all business-related information exchanged during the transaction process and prohibits its disclosure to third parties. 8. Dispute Resolution: It outlines the process to resolve any disputes that may arise during or after the transaction. This may include negotiation, mediation, or legal action. It's important to note that while there may not be different types of Mecklenburg North Carolina Agreement of Purchase and Sale of Business — Short Form, variations can still exist. Different businesses may have unique requirements and conditions that can be addressed through additional addendums or amendments to the agreement. It's advisable to consult with a legal professional to ensure the inclusion of any specific clauses or language relevant to the business being bought or sold.

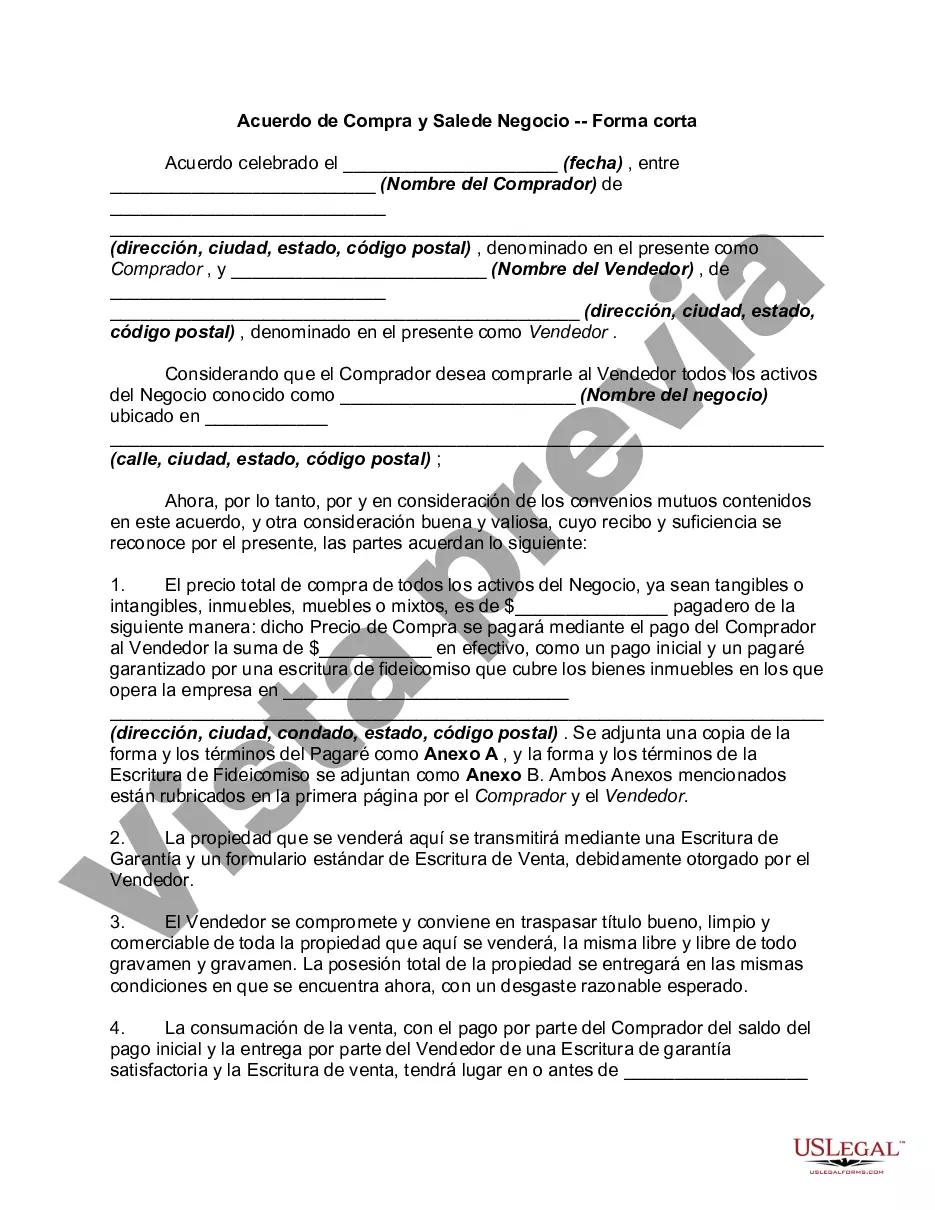

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.