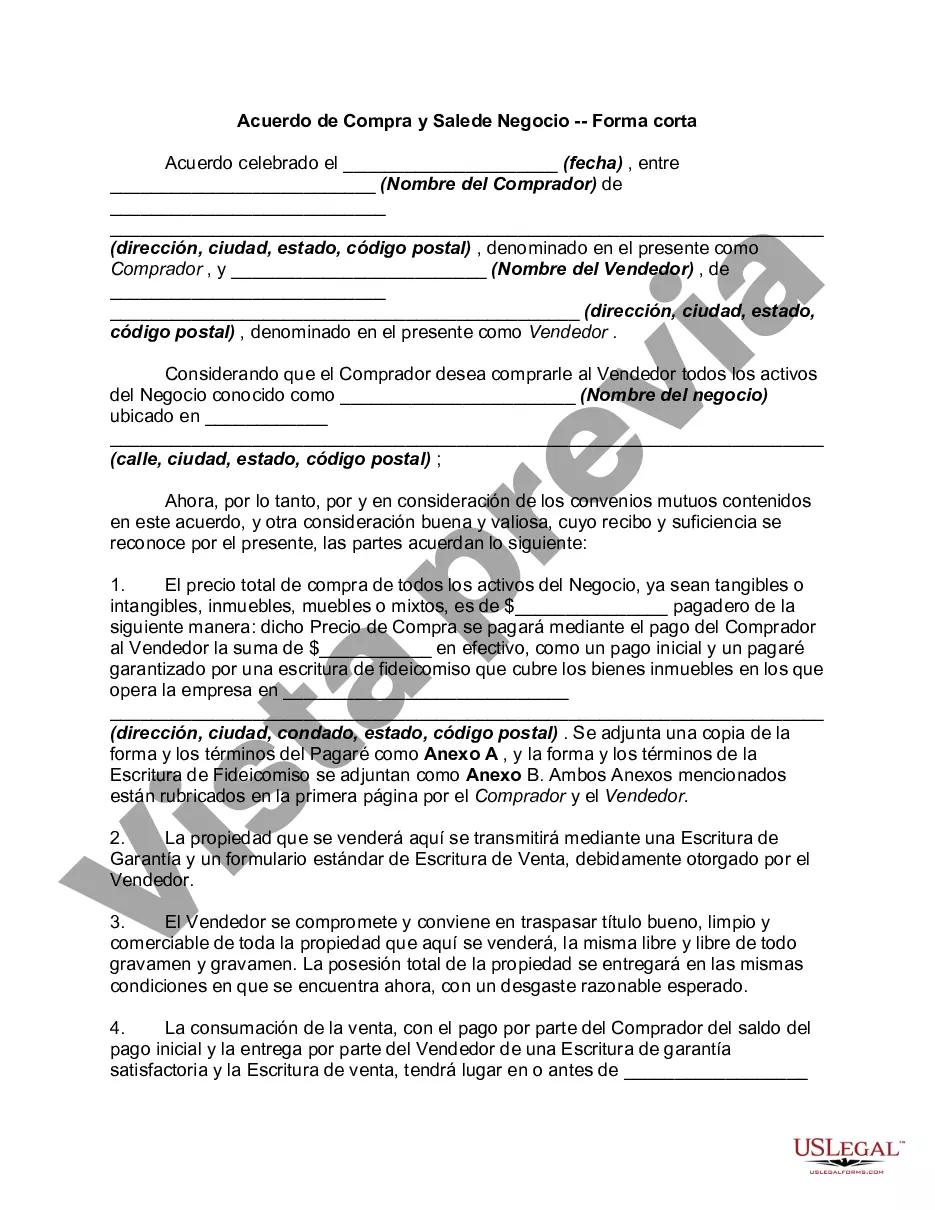

This form involves the sale of a small business. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Santa Clara California Agreement of Purchase and Sale of Business — Short Form is a legally binding document that outlines the terms and conditions for buying or selling a business in the city of Santa Clara, California. This agreement covers various aspects of the transaction, ensuring a smooth and fair deal for both parties involved. The terms and conditions of the Santa Clara California Agreement of Purchase and Sale of Business — Short Form typically include the following key elements: 1. Parties Involved: The agreement identifies the buyer and seller, providing their complete legal names, addresses, and contact information. 2. Purchase Price and Payment Terms: This section specifies the agreed-upon purchase price of the business and describes the payment terms, such as the amount of the initial deposit, payment schedule, and the preferred method of payment (cash, check, etc.). 3. Assets and Liabilities: The agreement clearly outlines what assets and liabilities are included in the sale. This may include equipment, inventory, intellectual property, contracts, leases, and permits. 4. Due Diligence Period: The agreement often allows for a due diligence period in which the buyer can thoroughly examine the business's financial records, contracts, and other relevant documents to ensure the accuracy of the information provided by the seller. 5. Closing Date: This section determines the date on which the sale will be finalized, and ownership of the business will be transferred to the buyer. 6. Contingencies: The agreement may include contingencies that need to be met for the sale to proceed. For example, securing necessary licenses or permits, obtaining financing, or receiving third-party consents. 7. Representations and Warranties: Both parties may provide representations and warranties about their respective abilities to enter into the agreement. These are legally binding statements that ensure the accuracy of the information provided. 8. Confidentiality: Confidentiality clauses may be included to protect sensitive business information and trade secrets from being shared with unauthorized parties. Different types or variations of the Santa Clara California Agreement of Purchase and Sale of Business — Short Form may exist based on specific industry requirements, unique seller demands, or special circumstances of the sale. It is recommended to consult with legal professionals to ensure compliance with local laws and to customize the agreement accordingly.Santa Clara California Agreement of Purchase and Sale of Business — Short Form is a legally binding document that outlines the terms and conditions for buying or selling a business in the city of Santa Clara, California. This agreement covers various aspects of the transaction, ensuring a smooth and fair deal for both parties involved. The terms and conditions of the Santa Clara California Agreement of Purchase and Sale of Business — Short Form typically include the following key elements: 1. Parties Involved: The agreement identifies the buyer and seller, providing their complete legal names, addresses, and contact information. 2. Purchase Price and Payment Terms: This section specifies the agreed-upon purchase price of the business and describes the payment terms, such as the amount of the initial deposit, payment schedule, and the preferred method of payment (cash, check, etc.). 3. Assets and Liabilities: The agreement clearly outlines what assets and liabilities are included in the sale. This may include equipment, inventory, intellectual property, contracts, leases, and permits. 4. Due Diligence Period: The agreement often allows for a due diligence period in which the buyer can thoroughly examine the business's financial records, contracts, and other relevant documents to ensure the accuracy of the information provided by the seller. 5. Closing Date: This section determines the date on which the sale will be finalized, and ownership of the business will be transferred to the buyer. 6. Contingencies: The agreement may include contingencies that need to be met for the sale to proceed. For example, securing necessary licenses or permits, obtaining financing, or receiving third-party consents. 7. Representations and Warranties: Both parties may provide representations and warranties about their respective abilities to enter into the agreement. These are legally binding statements that ensure the accuracy of the information provided. 8. Confidentiality: Confidentiality clauses may be included to protect sensitive business information and trade secrets from being shared with unauthorized parties. Different types or variations of the Santa Clara California Agreement of Purchase and Sale of Business — Short Form may exist based on specific industry requirements, unique seller demands, or special circumstances of the sale. It is recommended to consult with legal professionals to ensure compliance with local laws and to customize the agreement accordingly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.