This form involves the sale of a small business. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Tarrant Texas Agreement of Purchase and Sale of Business — Short Form is a legally binding document used to outline the terms and conditions of a business sale between a buyer and seller. This agreement is specifically designed for use in Tarrant County, Texas and ensures that both parties are protected throughout the transaction process. Key elements included in the Tarrant Texas Agreement of Purchase and Sale of Business — Short Form are: 1. Parties involved: The agreement clearly identifies the buyer and seller of the business, ensuring that both parties are properly represented. 2. Business description: This section provides a detailed description of the business being sold, including its name, address, and any other relevant details. 3. Purchase price and payment terms: The agreement outlines the purchase price of the business, including any down payment requirements and the method of payment (e.g., lump sum, installment, or financing options). 4. Assets and liabilities: The agreement identifies the assets and liabilities that will be included in the sale, ensuring that both parties have a clear understanding of what is being transferred. 5. Conditions of closing: This section outlines any conditions that must be met before the closing of the sale, such as obtaining necessary permits or approvals. 6. Representations and warranties: Both the buyer and seller are required to provide representations and warranties regarding the accuracy of the information provided, the authority to enter into the agreement, and other relevant matters. 7. Allocation of purchase price: If applicable, the agreement may include the allocation of the purchase price to different assets or liabilities for tax purposes. It is important to note that while this description provides a general overview of the Tarrant Texas Agreement of Purchase and Sale of Business — Short Form, there may be variations of this agreement depending on the specific circumstances of the transaction. Different types of Tarrant Texas Agreement of Purchase and Sale of Business — Short Form may include variations tailored for specific industries, such as retail, manufacturing, or service-oriented businesses. Additionally, there could be modifications to the agreement based on the buyer's or seller's preferences, such as adjusting payment terms, including non-compete clauses, or including specific conditions related to licenses or permits.The Tarrant Texas Agreement of Purchase and Sale of Business — Short Form is a legally binding document used to outline the terms and conditions of a business sale between a buyer and seller. This agreement is specifically designed for use in Tarrant County, Texas and ensures that both parties are protected throughout the transaction process. Key elements included in the Tarrant Texas Agreement of Purchase and Sale of Business — Short Form are: 1. Parties involved: The agreement clearly identifies the buyer and seller of the business, ensuring that both parties are properly represented. 2. Business description: This section provides a detailed description of the business being sold, including its name, address, and any other relevant details. 3. Purchase price and payment terms: The agreement outlines the purchase price of the business, including any down payment requirements and the method of payment (e.g., lump sum, installment, or financing options). 4. Assets and liabilities: The agreement identifies the assets and liabilities that will be included in the sale, ensuring that both parties have a clear understanding of what is being transferred. 5. Conditions of closing: This section outlines any conditions that must be met before the closing of the sale, such as obtaining necessary permits or approvals. 6. Representations and warranties: Both the buyer and seller are required to provide representations and warranties regarding the accuracy of the information provided, the authority to enter into the agreement, and other relevant matters. 7. Allocation of purchase price: If applicable, the agreement may include the allocation of the purchase price to different assets or liabilities for tax purposes. It is important to note that while this description provides a general overview of the Tarrant Texas Agreement of Purchase and Sale of Business — Short Form, there may be variations of this agreement depending on the specific circumstances of the transaction. Different types of Tarrant Texas Agreement of Purchase and Sale of Business — Short Form may include variations tailored for specific industries, such as retail, manufacturing, or service-oriented businesses. Additionally, there could be modifications to the agreement based on the buyer's or seller's preferences, such as adjusting payment terms, including non-compete clauses, or including specific conditions related to licenses or permits.

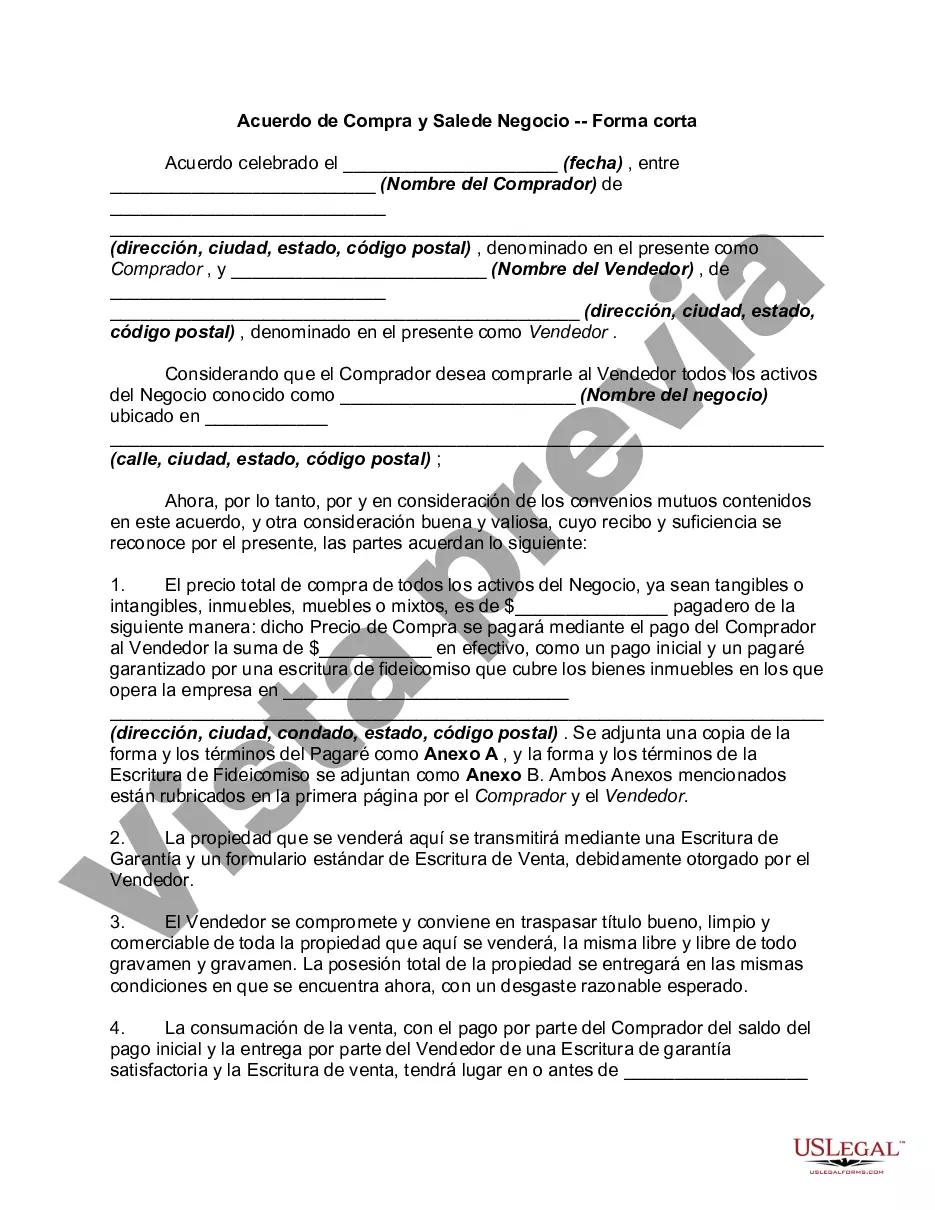

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.