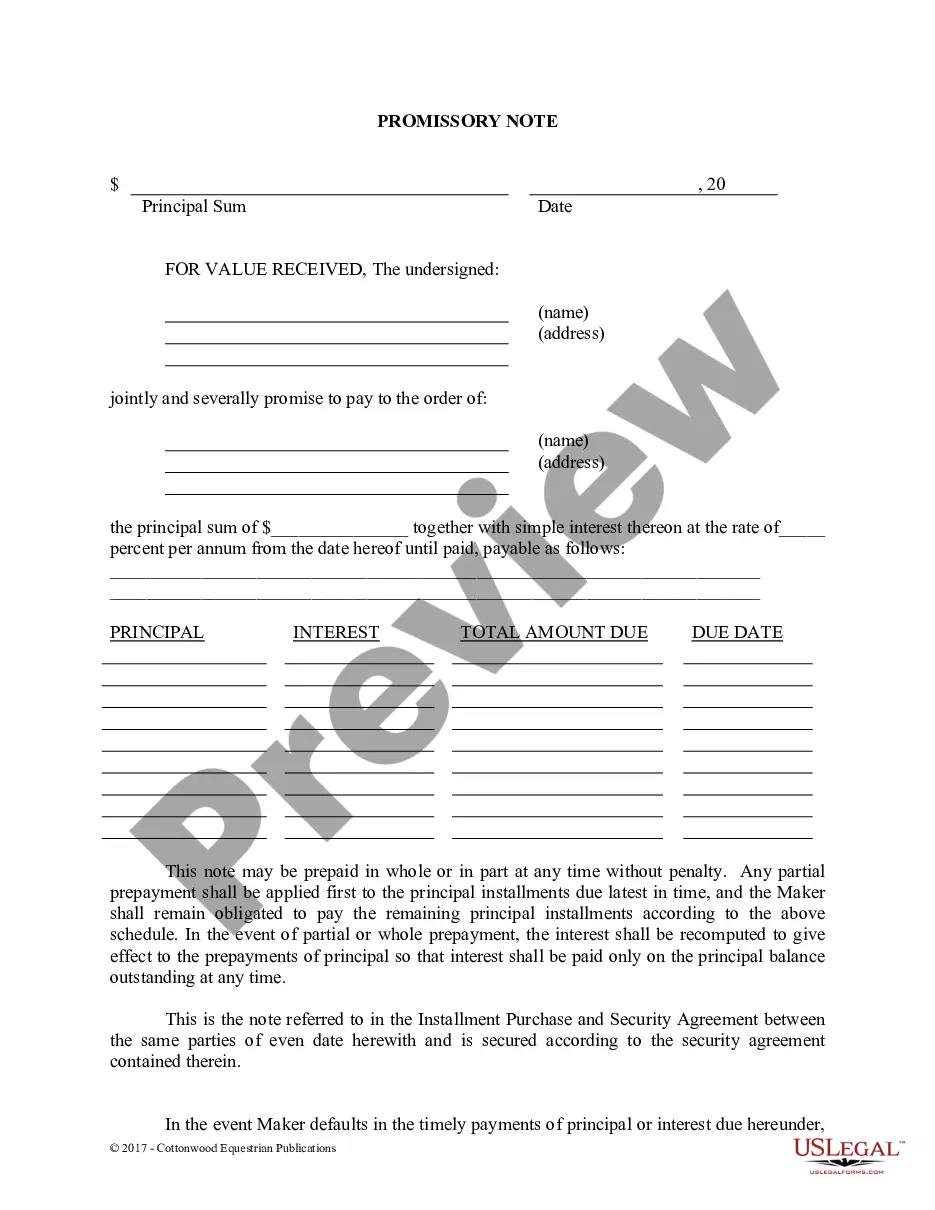

The Kings New York Agreement to Compromise Debt is a legally binding contract established between a debtor and a creditor with the aim of resolving outstanding debts through a mutually agreed settlement. This agreement is commonly utilized in the financial industry and can encompass various types of debts, such as personal loans, credit card debts, mortgage debts, or business debts. The Kings New York Agreement to Compromise Debt provides a framework for negotiations between the debtor and creditor, facilitating a compromise that allows both parties to find a middle ground and avoid protracted legal battles. It requires a thorough analysis of the debtor's financial situation, including income, assets, and liabilities, to determine the capacity to repay the debt and the amount that can reasonably be compromised. One type of Kings New York Agreement to Compromise Debt is known as a debt settlement agreement. In this scenario, the creditor agrees to accept a reduced lump-sum payment as full satisfaction of the outstanding debt, relieving the debtor of the remaining balance. This type of agreement often involves negotiation and may require the debtor to provide proof of financial hardship or inability to repay the entire debt. Another variation is the debt repayment plan under the Kings New York Agreement. This option allows the debtor and creditor to agree upon a revised payment schedule, potentially extending the repayment period or reducing the interest rate to make the debt more manageable for the debtor. This arrangement allows the debtor to address their financial obligations gradually while ensuring the creditor receives some form of repayment. It's crucial to note that each Kings New York Agreement to Compromise Debt is unique and can differ depending on the specific circumstances, the parties involved, and the nature of the debt. The agreement typically involves legal professionals who help draft the terms and conditions, ensuring compliance with applicable laws and regulations. In summary, the Kings New York Agreement to Compromise Debt is a versatile tool for resolving outstanding debts through negotiation and compromise. Whether through a debt settlement agreement or a revised payment plan, this agreement aims to provide a fair solution for both debtors and creditors, ultimately offering financial relief to those burdened by overwhelming debt.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Acuerdo de Compromiso de Deuda - Agreement to Compromise Debt

Description

How to fill out Kings New York Acuerdo De Compromiso De Deuda?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Kings Agreement to Compromise Debt, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Therefore, if you need the current version of the Kings Agreement to Compromise Debt, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Kings Agreement to Compromise Debt:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Kings Agreement to Compromise Debt and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Si desea hacer una propuesta para pagar la deuda, le mostramos algunas consideraciones: Sea honesto consigo mismo sobre cuanto puede pagar cada mes.Haga un resumen de su ingreso neto mensual y de todos sus gastos mensuales (incluyendo el monto que desea pagar cada mes y otros pagos de deuda).

La carta de compromiso debe escribirse como cualquier carta formal con efectos legales, asi que es importante tomar en cuenta lo siguiente al momento de escribirla: Revisa la informacion.Incluye a los involucrados.Describe roles y responsabilidades.Redacta una carta clara y concisa.

La carta de compromiso debe escribirse como cualquier carta formal con efectos legales, asi que es importante tomar en cuenta lo siguiente al momento de escribirla: Revisa la informacion.Incluye a los involucrados.Describe roles y responsabilidades.Redacta una carta clara y concisa.

Como responder a un cobrador de deudas Identidad del cobrador de deudas, incluyendo nombre, direccion y numero de telefono. El monto de la deuda, incluyendo los honorarios tales como intereses o costos de cobranza. Para que es la deuda y cuando se contrajo la deuda.

Los elementos imprescindibles de un acuerdo de pago son: Datos del acreedor y del deudor: El nombre y los apellidos, asi como el documento nacional de identidad deben estar presentes en los documentos. Clausulas: Deben establecerse las clausulas o declaraciones que modifican o cumplimentan al acuerdo original.

Formato de la carta de compromiso de pago Datos del pagador: Despues incluye los datos del particular o empresa a quien va dirigida. Fecha de la carta: En lado superior derecho coloca la fecha en la que se redacta la carta. Cantidad de pago y condiciones: En el cuerpo de la carta haz constar el compromiso de pago.

¿Como llenar la carta compromiso? Fecha y lugar. Nombre de la escuela. Nombre del alumno, grado y grupo. Nombre y firma de la madre, padre o tutor. Especificar si el alumno trabajara de forma virtual, presencial o mixta. Telefonos de contacto en caso de que el alumno presente sintomas de Covid-19.

Se refiere a las promesas que una persona se hace a si misma para mejorar o para modificar algun aspecto de su vida. Por ejemplo: un hombre que decide inscribirse en un gimnasio para comenzar a hacer ejercicio y tener una vida mas saludable. Compromiso moral.

La carta compromiso (contrato de servicios) siempre debe constar por escrito, e incluir la aceptacion formal del cliente. Este documento hace parte de los papeles de trabajo que debe conservar y mantener el auditor.