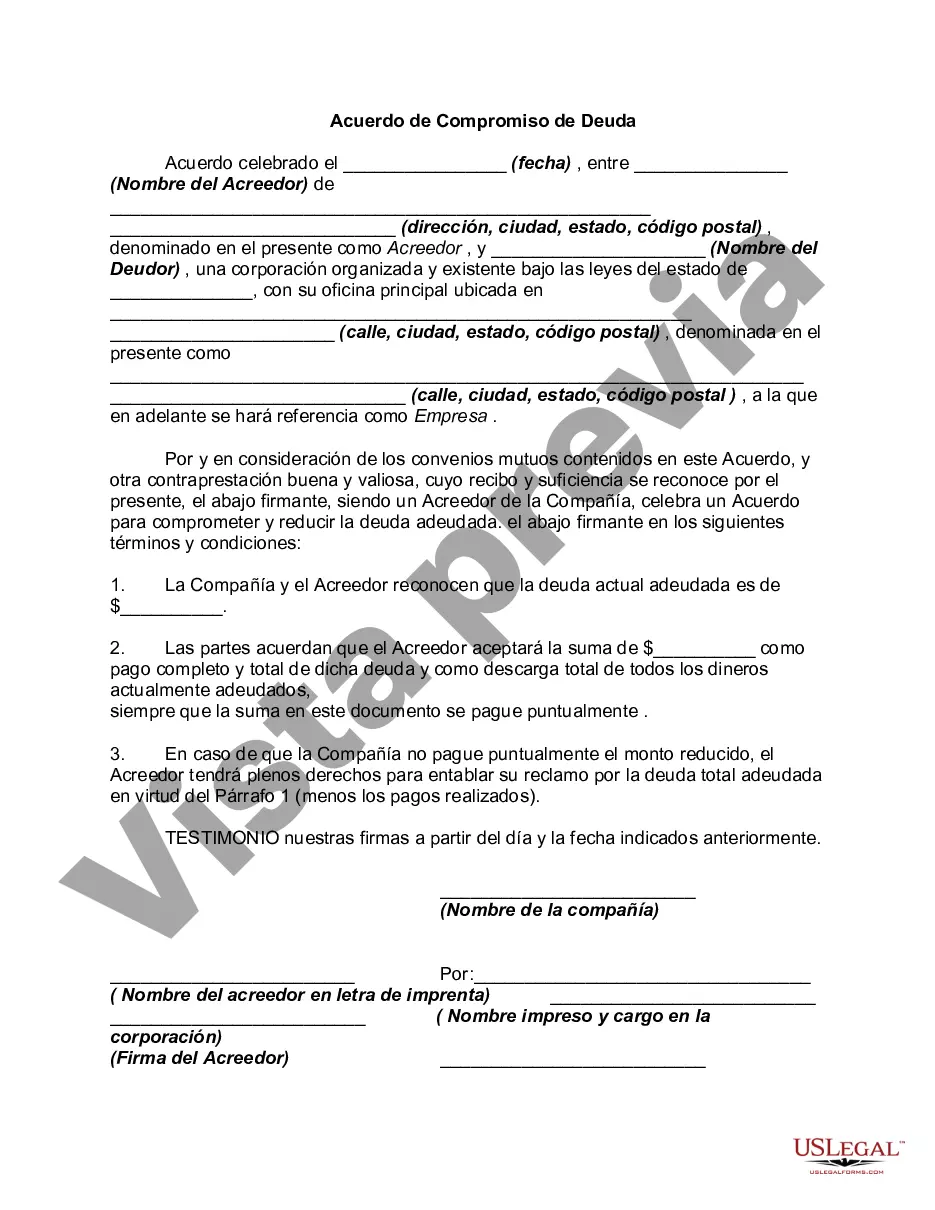

Montgomery Maryland Agreement to Compromise Debt is a legal agreement between a debtor and creditor in Montgomery, Maryland. This agreement aims to settle and reduce the amount of debt owed by the debtor in order to avoid further financial turmoil and potential bankruptcy. Montgomery Maryland Agreement to Compromise Debt is a viable option for individuals or businesses facing overwhelming debt as it provides an opportunity to negotiate a lower, more manageable repayment amount with their creditors. Under this agreement, the debtor and creditor engage in open dialogue to reach a mutual understanding and compromise regarding the outstanding debt. The creditor may agree to accept a reduced lump sum payment or establish a new repayment plan that better suits the debtor's financial capabilities. This negotiation process often involves assessing the debtor's financial situation, including income, expenses, and assets. It is important to note that there may be different types of Montgomery Maryland Agreement to Compromise Debt, depending on the specific circumstances and preferences of the parties involved. Some common variations may include: 1. Lump-sum Settlement Agreement: This agreement involves the debtor paying a reduced, one-time payment to the creditor, which is typically less than the total outstanding debt. Upon receiving the agreed-upon amount, the creditor will consider the debt fully settled, and no further obligations will remain. 2. Installment Payment Agreement: In this type of agreement, the debtor and creditor establish a new repayment plan that allows the debtor to make regular, affordable installment payments over a specified period. The creditor may agree to reduce the overall debt amount or waive certain interest charges to facilitate the debt repayment process. 3. Debt Restructuring Agreement: If the debtor's financial situation allows, a debt restructuring agreement may be pursued. This involves renegotiating the terms of the original debt agreement, potentially reducing interest rates, extending the repayment period, or altering other terms to make the debt more manageable for the debtor. Montgomery Maryland Agreement to Compromise Debt offers a lifeline to debt-laden individuals and businesses, providing a structured and legally-binding approach to debt settlement. By addressing the issue head-on and working in collaboration with creditors, debtors in Montgomery, Maryland can regain financial stability and avoid the detrimental consequences of insurmountable debt.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Acuerdo de Compromiso de Deuda - Agreement to Compromise Debt

Description

How to fill out Montgomery Maryland Acuerdo De Compromiso De Deuda?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Montgomery Agreement to Compromise Debt is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Montgomery Agreement to Compromise Debt. Follow the guidelines below:

- Make certain the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Montgomery Agreement to Compromise Debt in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!