Title: Lima Arizona Agreement to Compromise Debt: Explained in Detail Introduction: In Lima, Arizona, an Agreement to Compromise Debt is a legally binding contract entered into by a debtor and a creditor to settle outstanding debts through a mutually agreed-upon reduced payment or modified terms. This agreement serves as a formal arrangement to resolve debt-related disputes and facilitate debt resolution. Let's dive into the specifics of Lima Arizona Agreement to Compromise Debt. Key Components of a Lima Arizona Agreement to Compromise Debt: 1. Debtor and Creditor Information: The agreement should include the names, addresses, and contact information of both the debtor and creditor, ensuring accurate identification of the parties involved. 2. Debt Details: It is crucial to outline the specific debts being compromised, including the original amount owed, the interest rate or fees, and the total outstanding balance. 3. Negotiated Terms: This section details the mutually agreed-upon terms of the debt settlement, such as the revised repayment amount, payment schedule, interest rate adjustments, or any modifications to the original terms. 4. Payment Plan: Clearly define the payment plan that the debtor will adhere to, specifying due dates, frequency (monthly, weekly, etc.), and acceptable payment methods. 5. Default Consequences: Specify the consequences if the debtor fails to fulfill their obligations under the agreement, which may include additional penalties, interest, or potential legal actions. 6. Release of Liability: Clarify that upon successful completion of the agreed-upon payments, the creditor releases the debtor from any further obligation or legal action related to the compromised debt. 7. Confidentiality Clause: Address the confidentiality of the agreement to ensure that neither party discloses sensitive information or terms of the settlement to third parties. 8. Governing Law and Jurisdiction: State the governing law (in this case, Lima, Arizona) that will apply to the agreement and the jurisdiction where any potential disputes will be resolved. Types of Lima Arizona Agreement to Compromise Debt (if applicable): 1. Lima Arizona Agreement to Compromise Credit Card Debt: Specifically designed for resolving credit card debts between debtors and creditors in Lima, Arizona. 2. Lima Arizona Agreement to Compromise Medical Debt: Tailored for the settlement of medical bills, allowing debtors to negotiate revised payment plans best suited to their financial situation. 3. Lima Arizona Agreement to Compromise Business Debt: Geared towards resolving debts incurred by businesses, enabling companies to restructure their obligations and avoid bankruptcy. Conclusion: Lima Arizona Agreement to Compromise Debt is an essential legal instrument that facilitates debt resolution between debtors and creditors. Whether it concerns credit card debt, medical debt, or business debt, this agreement helps parties negotiate manageable repayment terms and reach a mutually beneficial outcome. By following the outlined guidelines and including the necessary details, debtors and creditors can formalize a compromise that suits their specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Acuerdo de Compromiso de Deuda - Agreement to Compromise Debt

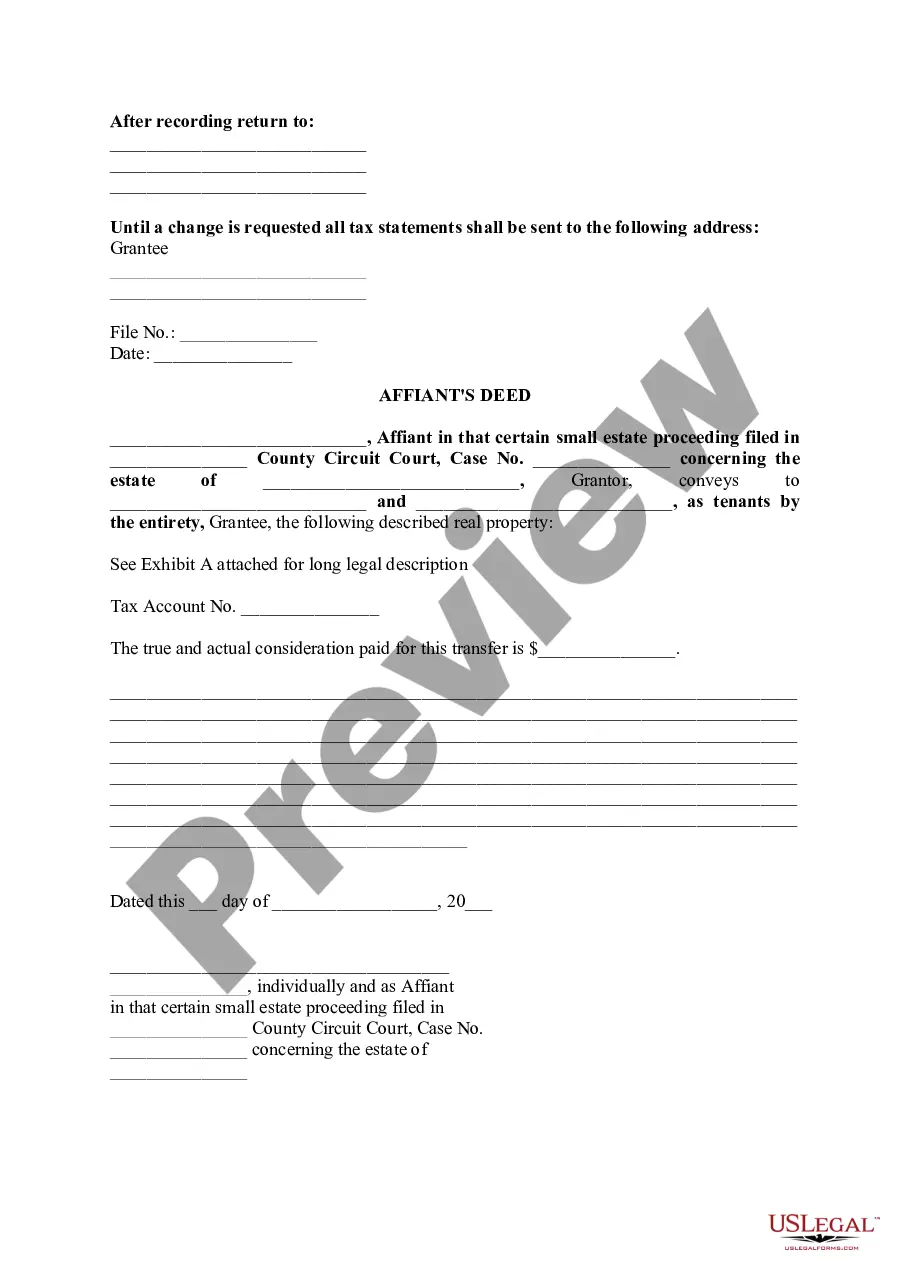

Description

How to fill out Pima Arizona Acuerdo De Compromiso De Deuda?

If you need to get a reliable legal form provider to get the Pima Agreement to Compromise Debt, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it simple to get and execute various papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to search or browse Pima Agreement to Compromise Debt, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Pima Agreement to Compromise Debt template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less pricey and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate agreement, or complete the Pima Agreement to Compromise Debt - all from the convenience of your home.

Join US Legal Forms now!