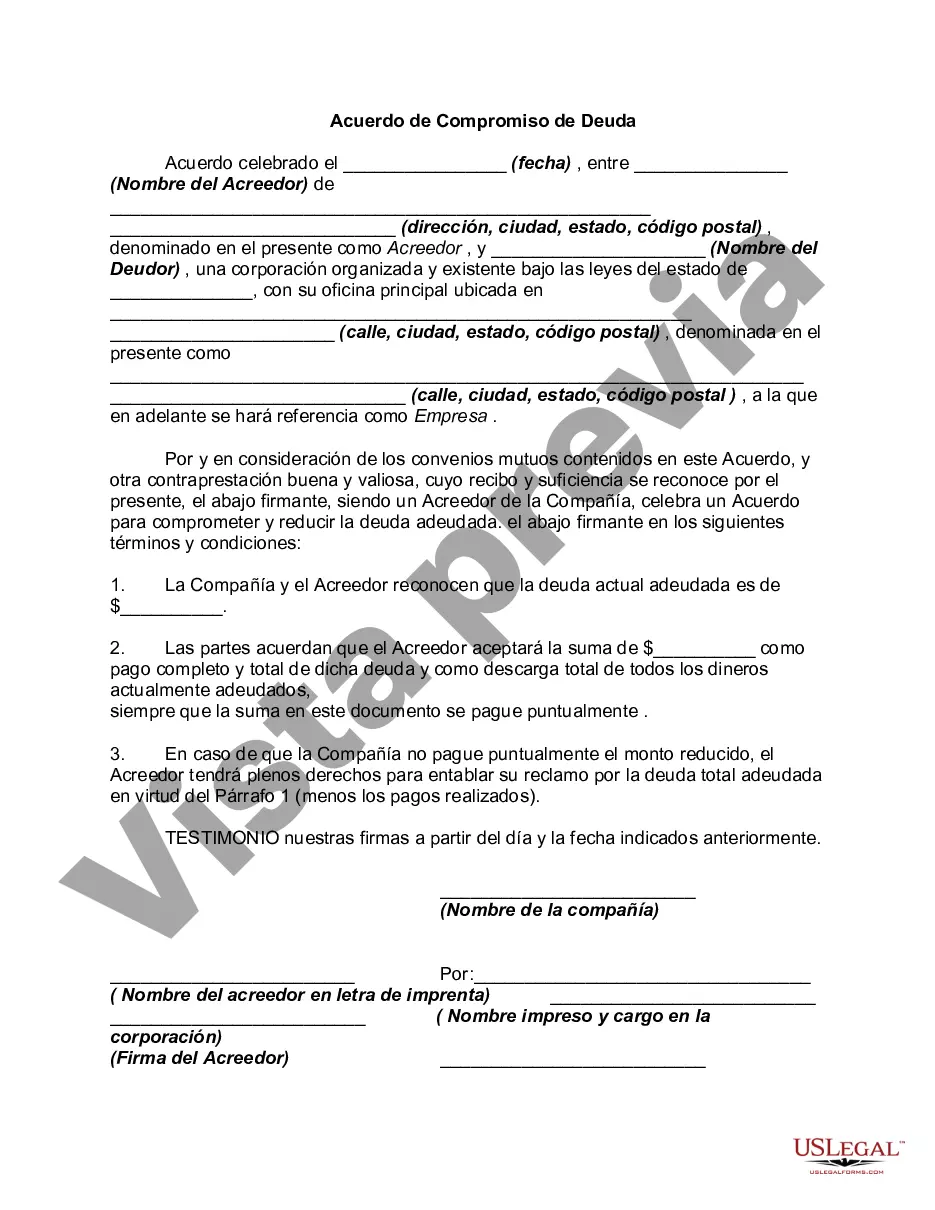

The Tarrant Texas Agreement to Compromise Debt is a legally binding contract entered into by debtors and their creditors to settle outstanding debts. This agreement allows both parties to negotiate mutually beneficial terms to address the debtor's inability to pay the full amount owed. One type of Tarrant Texas Agreement to Compromise Debt is the "Debt Settlement Agreement." This type of agreement is commonly used when a debtor is unable to meet their financial obligations and strives for a reduction in the total amount owed. By negotiating a lower payment, debtors can avoid bankruptcy and creditors can recover a portion of the debt that may have otherwise been lost. Another type of Tarrant Texas Agreement to Compromise Debt is the "Debt Management Agreement." This agreement is typically sought by debtors who are unable to make timely payments or are struggling with high interest rates. In a debt management agreement, debtors work with a certified credit counseling agency to create a revised payment plan that is acceptable to both parties involved. This plan often includes reduced interest rates and monthly payments, allowing the debtor to gradually settle their outstanding debt. Key terms and clauses often found in a Tarrant Texas Agreement to Compromise Debt include: 1. Scope of Agreement: Clearly outlines that the agreement's purpose is to settle the specified debt between the debtor and creditor. 2. Parties Involved: Clearly identifies and provides contact information for all parties involved, including debtors, creditors, and any third-party entities involved in the negotiation process. 3. Debt Amount: Specifies the exact amount of the debt owed. 4. Repayment Terms: Details the terms and conditions for repayment, including the proposed reduced payment amount, the schedule of payments, and the preferred method of payment. 5. Release and Waiver: States that upon successful completion of the agreed-upon settlement terms, the creditor releases the debtor from any remaining obligation, and the debtor waives any claims against the creditor related to the debt in question. 6. Confidentiality: Ensures that all sensitive financial information discussed during the negotiation process remains confidential, protecting both parties' privacy. The Tarrant Texas Agreement to Compromise Debt is an effective legal tool for debtors seeking financial relief and creditors looking to recover a portion of their outstanding debts. By establishing mutually beneficial terms, this agreement provides a structured method for resolving debt issues and offers a potential solution for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Acuerdo de Compromiso de Deuda - Agreement to Compromise Debt

Description

How to fill out Tarrant Texas Acuerdo De Compromiso De Deuda?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Tarrant Agreement to Compromise Debt, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the recent version of the Tarrant Agreement to Compromise Debt, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Tarrant Agreement to Compromise Debt:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Tarrant Agreement to Compromise Debt and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!