This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

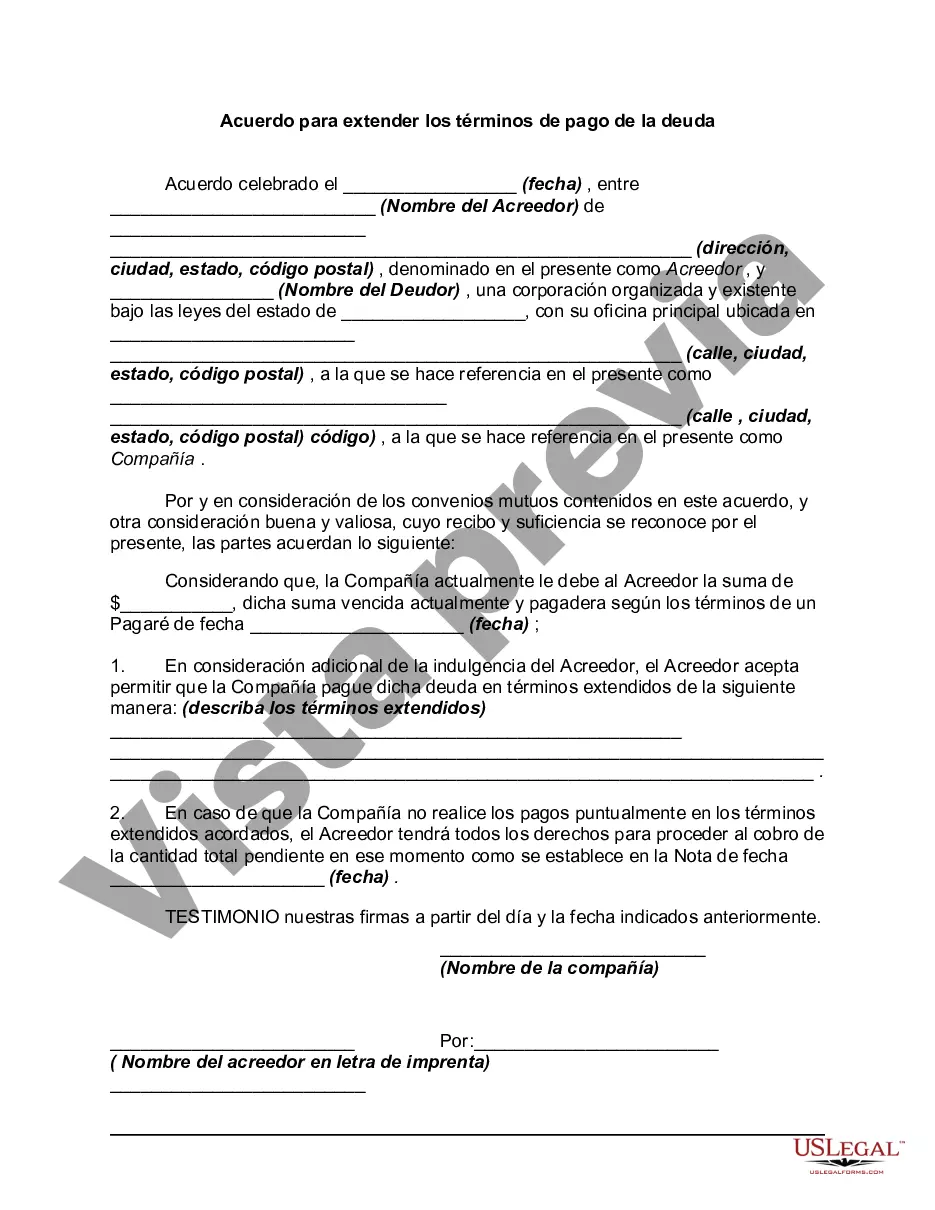

The Alameda California Agreement to Extend Debt Payment Terms is a legal document that outlines the specific terms and conditions under which a debtor can extend the repayment period for their outstanding debts. This agreement is typically entered into between a debtor, who may be an individual or a business entity, and a creditor, such as a financial institution or a lending company. The purpose of the Alameda California Agreement to Extend Debt Payment Terms is to provide a viable solution for debtors who are facing financial hardships and are unable to meet the original repayment schedule. It offers them a chance to renegotiate the terms of their debt, ensuring they can still repay the amount owed without going into default. There are several types of Alameda California Agreement to Extend Debt Payment Terms that can be tailored to suit the unique circumstances of each debtor. These variations may include: 1. Personal Debt Extension Agreement: This type of agreement applies to individuals who are struggling to meet their personal financial obligations, such as credit card debts, personal loans, or medical bills. It allows them to extend the repayment period, potentially reducing the monthly payment amount to make it more manageable. 2. Business Debt Extension Agreement: Designed specifically for businesses, this agreement focuses on addressing outstanding debts incurred by companies. It enables businesses to negotiate revised payment terms for loans, lines of credit, or outstanding invoices, providing them with much-needed flexibility during challenging economic times. 3. Mortgage Debt Extension Agreement: Homeowners who are facing difficulty in making their mortgage payments may enter into this type of agreement. It allows them to extend the repayment period of their mortgage loan, helping to prevent foreclosure and enabling them to retain ownership of their property. 4. Student Loan Debt Extension Agreement: With the rising costs of education, many individuals struggle to meet their student loan obligations. This type of agreement enables borrowers to restructure their payment plans, potentially reducing monthly installments or extending the repayment period. When entering into an Alameda California Agreement to Extend Debt Payment Terms, it is crucial for both parties to understand and agree upon the new terms, including the duration of the extension, any changes to interest rates or fees, and the provision of any additional collateral or guarantees if necessary. In conclusion, the Alameda California Agreement to Extend Debt Payment Terms is a vital tool for debtors facing financial challenges. By offering a way to renegotiate the terms of their debts, it provides an opportunity to alleviate their financial burden and work towards a more manageable repayment schedule.The Alameda California Agreement to Extend Debt Payment Terms is a legal document that outlines the specific terms and conditions under which a debtor can extend the repayment period for their outstanding debts. This agreement is typically entered into between a debtor, who may be an individual or a business entity, and a creditor, such as a financial institution or a lending company. The purpose of the Alameda California Agreement to Extend Debt Payment Terms is to provide a viable solution for debtors who are facing financial hardships and are unable to meet the original repayment schedule. It offers them a chance to renegotiate the terms of their debt, ensuring they can still repay the amount owed without going into default. There are several types of Alameda California Agreement to Extend Debt Payment Terms that can be tailored to suit the unique circumstances of each debtor. These variations may include: 1. Personal Debt Extension Agreement: This type of agreement applies to individuals who are struggling to meet their personal financial obligations, such as credit card debts, personal loans, or medical bills. It allows them to extend the repayment period, potentially reducing the monthly payment amount to make it more manageable. 2. Business Debt Extension Agreement: Designed specifically for businesses, this agreement focuses on addressing outstanding debts incurred by companies. It enables businesses to negotiate revised payment terms for loans, lines of credit, or outstanding invoices, providing them with much-needed flexibility during challenging economic times. 3. Mortgage Debt Extension Agreement: Homeowners who are facing difficulty in making their mortgage payments may enter into this type of agreement. It allows them to extend the repayment period of their mortgage loan, helping to prevent foreclosure and enabling them to retain ownership of their property. 4. Student Loan Debt Extension Agreement: With the rising costs of education, many individuals struggle to meet their student loan obligations. This type of agreement enables borrowers to restructure their payment plans, potentially reducing monthly installments or extending the repayment period. When entering into an Alameda California Agreement to Extend Debt Payment Terms, it is crucial for both parties to understand and agree upon the new terms, including the duration of the extension, any changes to interest rates or fees, and the provision of any additional collateral or guarantees if necessary. In conclusion, the Alameda California Agreement to Extend Debt Payment Terms is a vital tool for debtors facing financial challenges. By offering a way to renegotiate the terms of their debts, it provides an opportunity to alleviate their financial burden and work towards a more manageable repayment schedule.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.