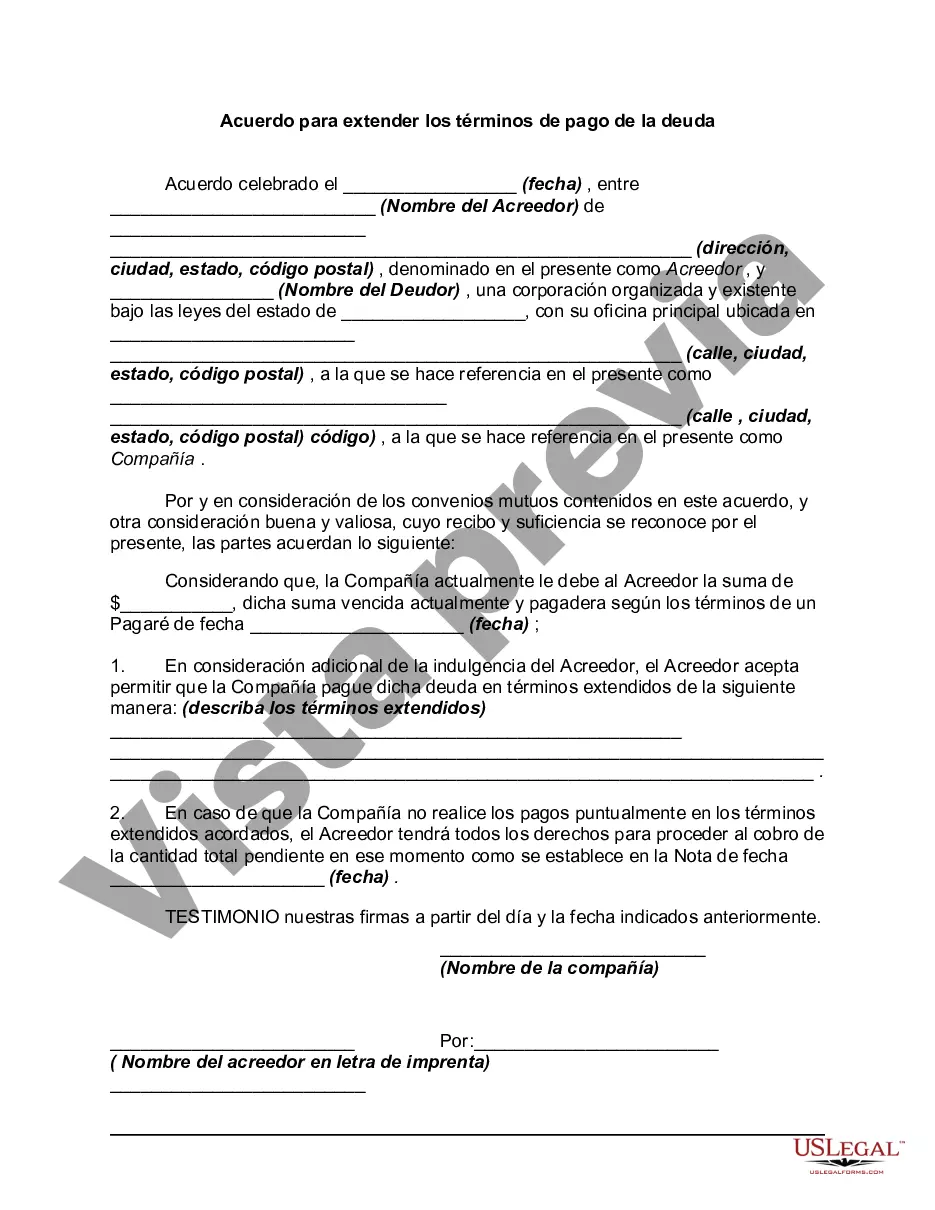

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Allegheny Pennsylvania Agreement to Extend Debt Payment Terms refers to a legal document that outlines the terms and conditions under which a debtor will extend the repayment period for an outstanding debt. This agreement is specific to the state of Pennsylvania and specifically the Allegheny County area. The Allegheny Pennsylvania Agreement to Extend Debt Payment Terms serves as a binding contract between the debtor and the creditor, ensuring that both parties are aware of their rights, responsibilities, and obligations regarding the extension of debt payment terms. This agreement is in place to provide a structured framework for debtors who are struggling to meet their financial obligations and need more time to repay their debts. There are various types of Allegheny Pennsylvania Agreement to Extend Debt Payment Terms, each designed to cater to different individual circumstances. These types may include: 1. Personal Debt Agreement: This type of agreement is commonly used for individuals who have accumulated personal debts, such as credit card debts, medical bills, or personal loans. It provides a structured plan for debtors to repay their outstanding debts over a longer period of time, often with reduced or suspended interest rates. 2. Business Debt Agreement: This type of agreement is specifically targeted towards businesses that face financial challenges and are unable to meet their debt obligations on time. It allows businesses to negotiate new payment terms with their creditors and potentially restructure their debts to avoid bankruptcy. 3. Mortgage Debt Agreement: For individuals or businesses struggling to make mortgage payments, this type of agreement provides a way to modify repayment terms, potentially reducing interest rates, extending the loan's duration, or reducing monthly payments to make them more affordable. 4. Student Loan Debt Agreement: With the rising cost of education, many graduates face difficulties repaying their student loans. This type of agreement allows borrowers in Allegheny Pennsylvania to modify their repayment terms based on their financial situation, potentially lowering their monthly payments or extending the loan duration. 5. Tax Debt Agreement: Individuals or businesses who owe taxes to the government can enter into an agreement to extend their debt payment terms through installments, allowing them to gradually repay their outstanding tax liabilities within a specified timeframe. In Allegheny Pennsylvania, these various types of agreements cater to different financial situations and provide a legal framework to address debt repayment challenges. It is important for debtors to consult with legal professionals or financial advisors to understand the specific terms and consequences of entering into an Allegheny Pennsylvania Agreement to Extend Debt Payment Terms.The Allegheny Pennsylvania Agreement to Extend Debt Payment Terms refers to a legal document that outlines the terms and conditions under which a debtor will extend the repayment period for an outstanding debt. This agreement is specific to the state of Pennsylvania and specifically the Allegheny County area. The Allegheny Pennsylvania Agreement to Extend Debt Payment Terms serves as a binding contract between the debtor and the creditor, ensuring that both parties are aware of their rights, responsibilities, and obligations regarding the extension of debt payment terms. This agreement is in place to provide a structured framework for debtors who are struggling to meet their financial obligations and need more time to repay their debts. There are various types of Allegheny Pennsylvania Agreement to Extend Debt Payment Terms, each designed to cater to different individual circumstances. These types may include: 1. Personal Debt Agreement: This type of agreement is commonly used for individuals who have accumulated personal debts, such as credit card debts, medical bills, or personal loans. It provides a structured plan for debtors to repay their outstanding debts over a longer period of time, often with reduced or suspended interest rates. 2. Business Debt Agreement: This type of agreement is specifically targeted towards businesses that face financial challenges and are unable to meet their debt obligations on time. It allows businesses to negotiate new payment terms with their creditors and potentially restructure their debts to avoid bankruptcy. 3. Mortgage Debt Agreement: For individuals or businesses struggling to make mortgage payments, this type of agreement provides a way to modify repayment terms, potentially reducing interest rates, extending the loan's duration, or reducing monthly payments to make them more affordable. 4. Student Loan Debt Agreement: With the rising cost of education, many graduates face difficulties repaying their student loans. This type of agreement allows borrowers in Allegheny Pennsylvania to modify their repayment terms based on their financial situation, potentially lowering their monthly payments or extending the loan duration. 5. Tax Debt Agreement: Individuals or businesses who owe taxes to the government can enter into an agreement to extend their debt payment terms through installments, allowing them to gradually repay their outstanding tax liabilities within a specified timeframe. In Allegheny Pennsylvania, these various types of agreements cater to different financial situations and provide a legal framework to address debt repayment challenges. It is important for debtors to consult with legal professionals or financial advisors to understand the specific terms and consequences of entering into an Allegheny Pennsylvania Agreement to Extend Debt Payment Terms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.