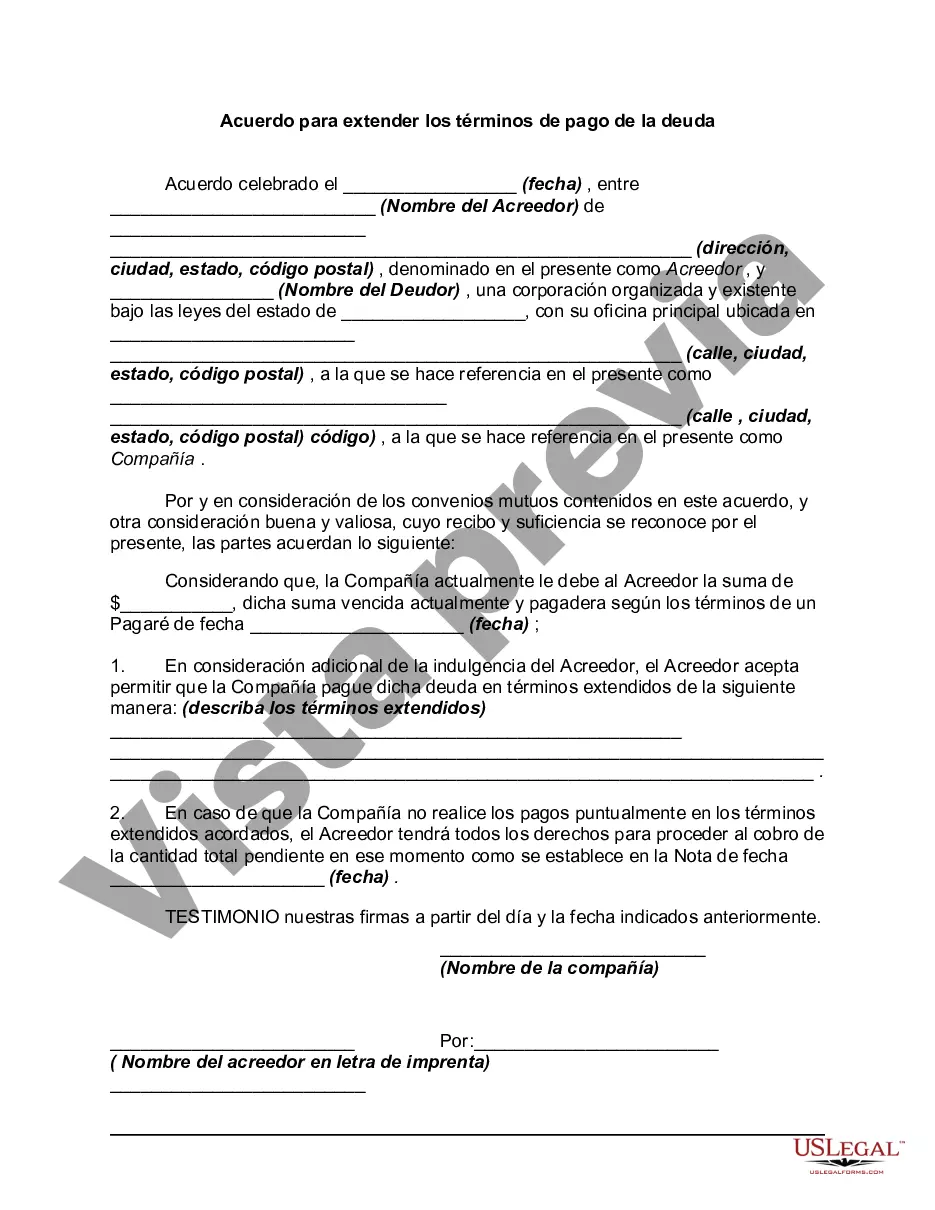

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Fairfax Virginia Agreement to Extend Debt Payment Terms is a legal agreement established between a debtor and a creditor to modify the terms of a debt repayment plan. It is specifically applicable to individuals or businesses residing in Fairfax, Virginia, seeking financial assistance to reschedule or prolong their debt repayment schedule. This agreement serves as a means to alleviate a debtor's financial burden by allowing them to extend the timeframe within which they must repay their outstanding debts. It is a proactive approach adopted by both parties involved in order to avoid default or bankruptcy, as it provides a feasible solution to meet their financial obligations. There are various types of Fairfax Virginia Agreement to Extend Debt Payment Terms, each designed to accommodate specific circumstances and needs. These may include: 1. Fairfax Virginia Personal Debt Extension Agreement: This agreement is tailored for individuals facing financial hardship and struggling to repay their personal debts such as credit card debts, medical bills, or student loans. It helps debtors negotiate with creditors for new payment terms, including extended duration or reduced interest rates. 2. Fairfax Virginia Business Debt Extension Agreement: This type of agreement is specifically designed for businesses in Fairfax, Virginia, facing financial strain and aiming to restructure their debt repayment plans. It enables the business owner to negotiate with creditors to modify payment terms and avoid severe consequences of foreclosure or insolvency. 3. Fairfax Virginia Mortgage Payment Extension Agreement: This form of agreement primarily addresses homeowners in Fairfax, Virginia, who may find it difficult to keep up with their mortgage payments. By extending the debt payment terms, homeowners can retain ownership while smoothing out temporary financial setbacks, preventing foreclosure, and maintaining their creditworthiness. 4. Fairfax Virginia Tax Debt Extension Agreement: This agreement caters specifically to taxpayers in Fairfax, Virginia, who have outstanding tax debts with the Internal Revenue Service (IRS). Through negotiations with the IRS, taxpayers can request an extension of debt payment terms, making it more manageable to clear their tax obligations without any adverse consequences. In order to initiate a Fairfax Virginia Agreement to Extend Debt Payment Terms, parties involved must seek legal counsel to discuss their financial situation and evaluate the best course of action. It is crucial to accurately analyze one's financial capabilities and present a persuasive case to the respective creditors, highlighting the intention to meet the payment obligations in due course, albeit with a modified schedule.Fairfax Virginia Agreement to Extend Debt Payment Terms is a legal agreement established between a debtor and a creditor to modify the terms of a debt repayment plan. It is specifically applicable to individuals or businesses residing in Fairfax, Virginia, seeking financial assistance to reschedule or prolong their debt repayment schedule. This agreement serves as a means to alleviate a debtor's financial burden by allowing them to extend the timeframe within which they must repay their outstanding debts. It is a proactive approach adopted by both parties involved in order to avoid default or bankruptcy, as it provides a feasible solution to meet their financial obligations. There are various types of Fairfax Virginia Agreement to Extend Debt Payment Terms, each designed to accommodate specific circumstances and needs. These may include: 1. Fairfax Virginia Personal Debt Extension Agreement: This agreement is tailored for individuals facing financial hardship and struggling to repay their personal debts such as credit card debts, medical bills, or student loans. It helps debtors negotiate with creditors for new payment terms, including extended duration or reduced interest rates. 2. Fairfax Virginia Business Debt Extension Agreement: This type of agreement is specifically designed for businesses in Fairfax, Virginia, facing financial strain and aiming to restructure their debt repayment plans. It enables the business owner to negotiate with creditors to modify payment terms and avoid severe consequences of foreclosure or insolvency. 3. Fairfax Virginia Mortgage Payment Extension Agreement: This form of agreement primarily addresses homeowners in Fairfax, Virginia, who may find it difficult to keep up with their mortgage payments. By extending the debt payment terms, homeowners can retain ownership while smoothing out temporary financial setbacks, preventing foreclosure, and maintaining their creditworthiness. 4. Fairfax Virginia Tax Debt Extension Agreement: This agreement caters specifically to taxpayers in Fairfax, Virginia, who have outstanding tax debts with the Internal Revenue Service (IRS). Through negotiations with the IRS, taxpayers can request an extension of debt payment terms, making it more manageable to clear their tax obligations without any adverse consequences. In order to initiate a Fairfax Virginia Agreement to Extend Debt Payment Terms, parties involved must seek legal counsel to discuss their financial situation and evaluate the best course of action. It is crucial to accurately analyze one's financial capabilities and present a persuasive case to the respective creditors, highlighting the intention to meet the payment obligations in due course, albeit with a modified schedule.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.