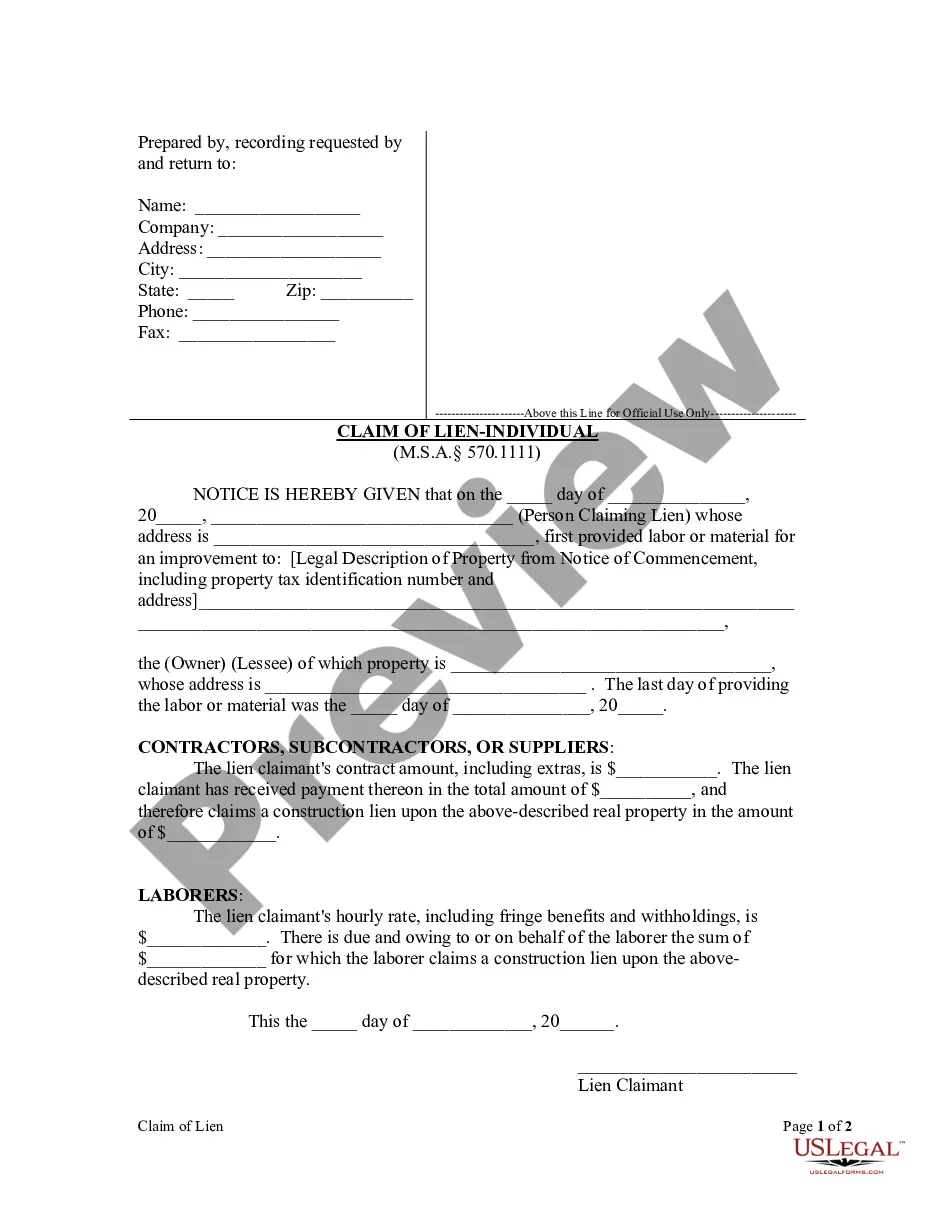

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

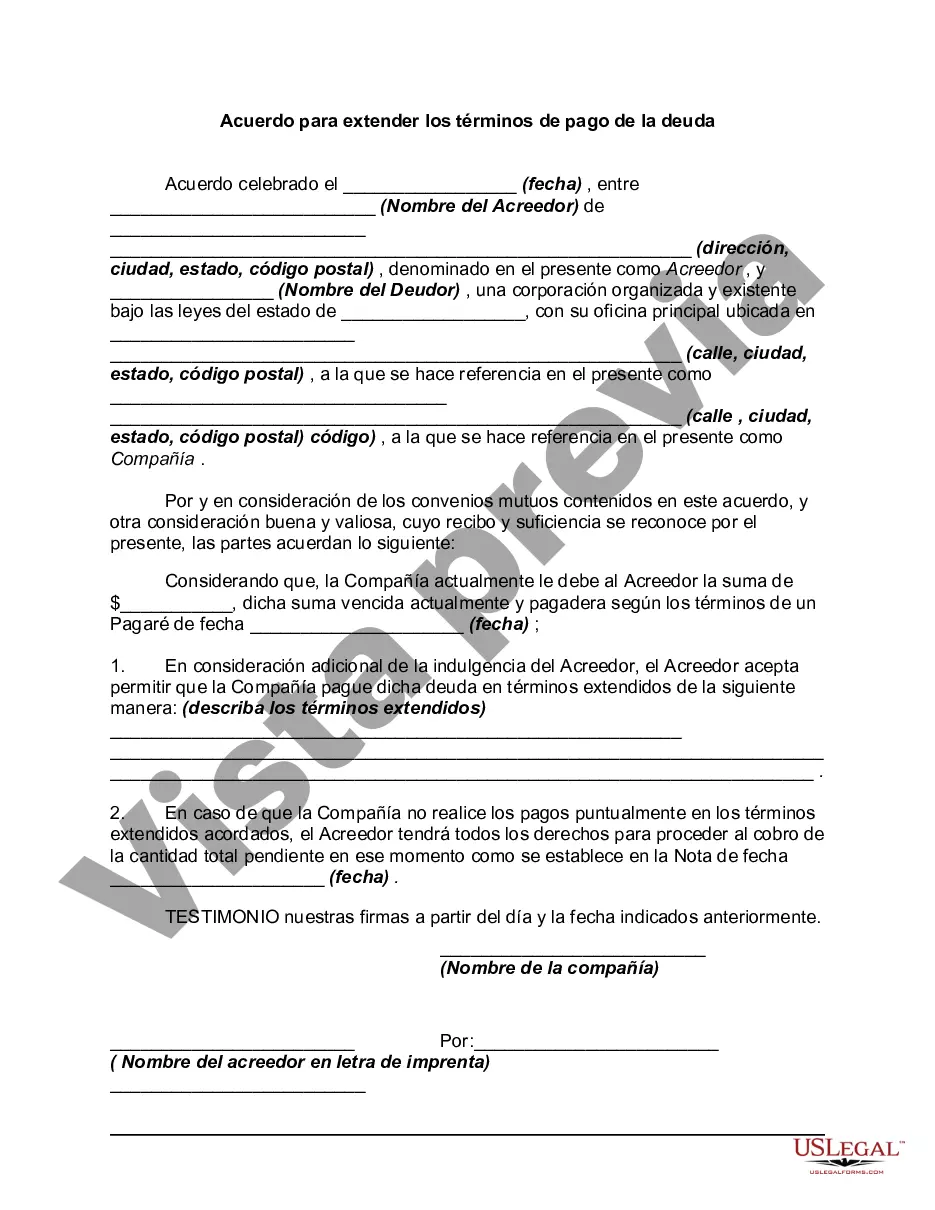

The King Washington Agreement to Extend Debt Payment Terms is a crucial legal agreement designed to address the resolution of debt issues between parties involved. This agreement allows for the extension of debt payment terms, ensuring a more flexible approach to debt repayment. The King Washington Agreement serves as a formal contract that outlines the terms and conditions agreed upon by both the debtor and the creditor. By extending the debt payment terms, the agreement aims to alleviate financial burdens on the debtor, enabling them to meet their obligations in a more manageable way. This agreement acts as a lifeline for individuals or entities struggling with heavy debt loads, providing them with much-needed relief. In various circumstances, different types of King Washington Agreements to Extend Debt Payment Terms can be established: 1. Individual Debt Agreement: This refers to an agreement tailored for individuals who are facing insurmountable debts, offering them an opportunity to reorganize their finances and develop a realistic repayment plan. 2. Corporate Debt Agreement: This type of agreement is specifically designed for businesses burdened with considerable debt. It allows them to modify payment terms and restructure their financial obligations to ensure sustainable growth and avoid bankruptcy. 3. Sovereign Debt Agreement: This agreement involves negotiations between a sovereign nation and its creditors, often international financial institutions. It assists countries in overcoming crippling debt burdens, providing them with a chance to stabilize their economies and regain financial solvency. 4. Debt Restructuring Agreement: This type of agreement is characterized by a comprehensive reassessment and modification of the debt structure. Creditors and debtors collaborate to adjust interest rates, repayment schedules, or even principal amounts to facilitate successful debt resolution. The King Washington Agreement to Extend Debt Payment Terms safeguards the interests of both parties involved. It typically outlines the modified payment schedule, the agreed-upon interest rates, any necessary collateral arrangements, and contingency plans in case of default. To ensure fairness and transparency, the agreement may require legal documentation and approval from relevant authorities. Moreover, it is critical to engage professional advisors specialized in debt negotiations to facilitate the process and find the best possible solution for all parties involved. In conclusion, the King Washington Agreement to Extend Debt Payment Terms is a significant legal instrument that provides a framework for debtors and creditors to negotiate and adapt debt repayment terms. Its various forms cater to the needs of individuals, corporations, and even sovereign nations, fostering financial stability, and enabling a fresh start towards a debt-free future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.