This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

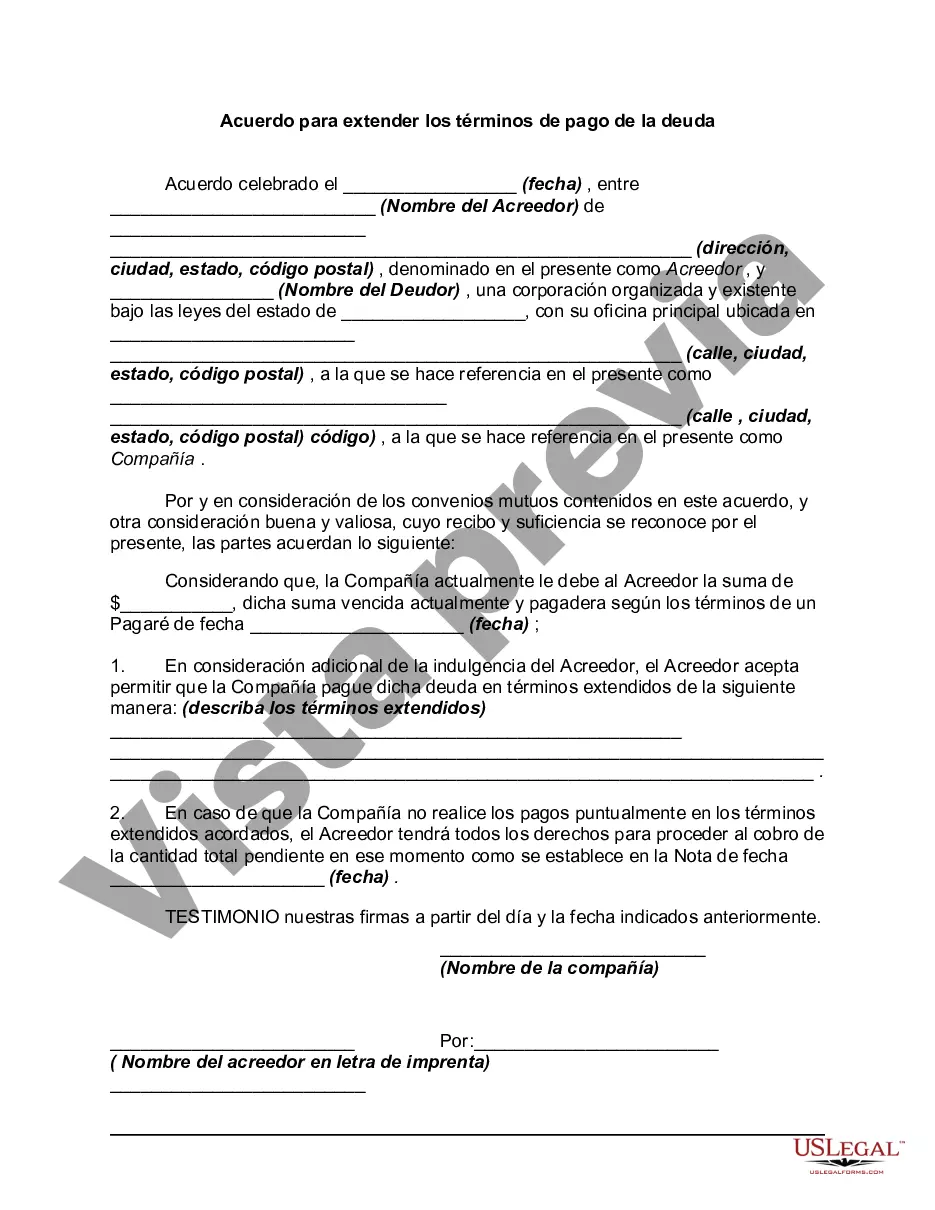

The Kings New York Agreement to Extend Debt Payment Terms is a legal agreement that provides a framework for restructuring and extending the payment terms of a debt. This type of agreement is often used when individuals, businesses, or governments are facing financial difficulties and are unable to repay their debts on time. The Agreement aims to alleviate the financial burden for debtors by negotiating new terms with their creditors. This typically involves extending the repayment period, reducing the interest rate, or adjusting the principal amount owed. The intention behind this Agreement is to provide debtors with a more manageable repayment schedule, allowing them to regain financial stability and avoid defaulting on their obligations. There are different types of Kings New York Agreements to Extend Debt Payment Terms, depending on the parties involved and the scope of the debt restructuring. Some key variations include: 1. Sovereign Debt Restructuring: This type of agreement is specifically tailored for governments facing economic crisis or severe financial distress. It involves negotiations between the debtor government and its creditors, such as international financial institutions or other countries, to reschedule debt payments and potentially reduce the overall debt burden. 2. Corporate Debt Restructuring: In cases where corporations or businesses are struggling with excessive debt, this Agreement can be utilized to renegotiate payment terms with their lenders. By extending the repayment period or modifying interest rates, the agreement aims to provide relief to the debtor while ensuring that creditors receive a reasonable return on their investment. 3. Consumer Debt Restructuring: Individuals burdened with overwhelming personal debt can benefit from this type of agreement. It involves working with creditors, such as banks or credit card companies, to negotiate new repayment terms that align with the individual's financial capacity. This may include reducing interest rates, waiving penalties, or extending the repayment period. In conclusion, the Kings New York Agreement to Extend Debt Payment Terms is a comprehensive framework utilized to restructure debts and provide debtors with more manageable repayment options. This agreement serves as a lifeline for individuals, businesses, and governments alike, allowing them to regain financial stability and avoid defaulting on their obligations.The Kings New York Agreement to Extend Debt Payment Terms is a legal agreement that provides a framework for restructuring and extending the payment terms of a debt. This type of agreement is often used when individuals, businesses, or governments are facing financial difficulties and are unable to repay their debts on time. The Agreement aims to alleviate the financial burden for debtors by negotiating new terms with their creditors. This typically involves extending the repayment period, reducing the interest rate, or adjusting the principal amount owed. The intention behind this Agreement is to provide debtors with a more manageable repayment schedule, allowing them to regain financial stability and avoid defaulting on their obligations. There are different types of Kings New York Agreements to Extend Debt Payment Terms, depending on the parties involved and the scope of the debt restructuring. Some key variations include: 1. Sovereign Debt Restructuring: This type of agreement is specifically tailored for governments facing economic crisis or severe financial distress. It involves negotiations between the debtor government and its creditors, such as international financial institutions or other countries, to reschedule debt payments and potentially reduce the overall debt burden. 2. Corporate Debt Restructuring: In cases where corporations or businesses are struggling with excessive debt, this Agreement can be utilized to renegotiate payment terms with their lenders. By extending the repayment period or modifying interest rates, the agreement aims to provide relief to the debtor while ensuring that creditors receive a reasonable return on their investment. 3. Consumer Debt Restructuring: Individuals burdened with overwhelming personal debt can benefit from this type of agreement. It involves working with creditors, such as banks or credit card companies, to negotiate new repayment terms that align with the individual's financial capacity. This may include reducing interest rates, waiving penalties, or extending the repayment period. In conclusion, the Kings New York Agreement to Extend Debt Payment Terms is a comprehensive framework utilized to restructure debts and provide debtors with more manageable repayment options. This agreement serves as a lifeline for individuals, businesses, and governments alike, allowing them to regain financial stability and avoid defaulting on their obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.