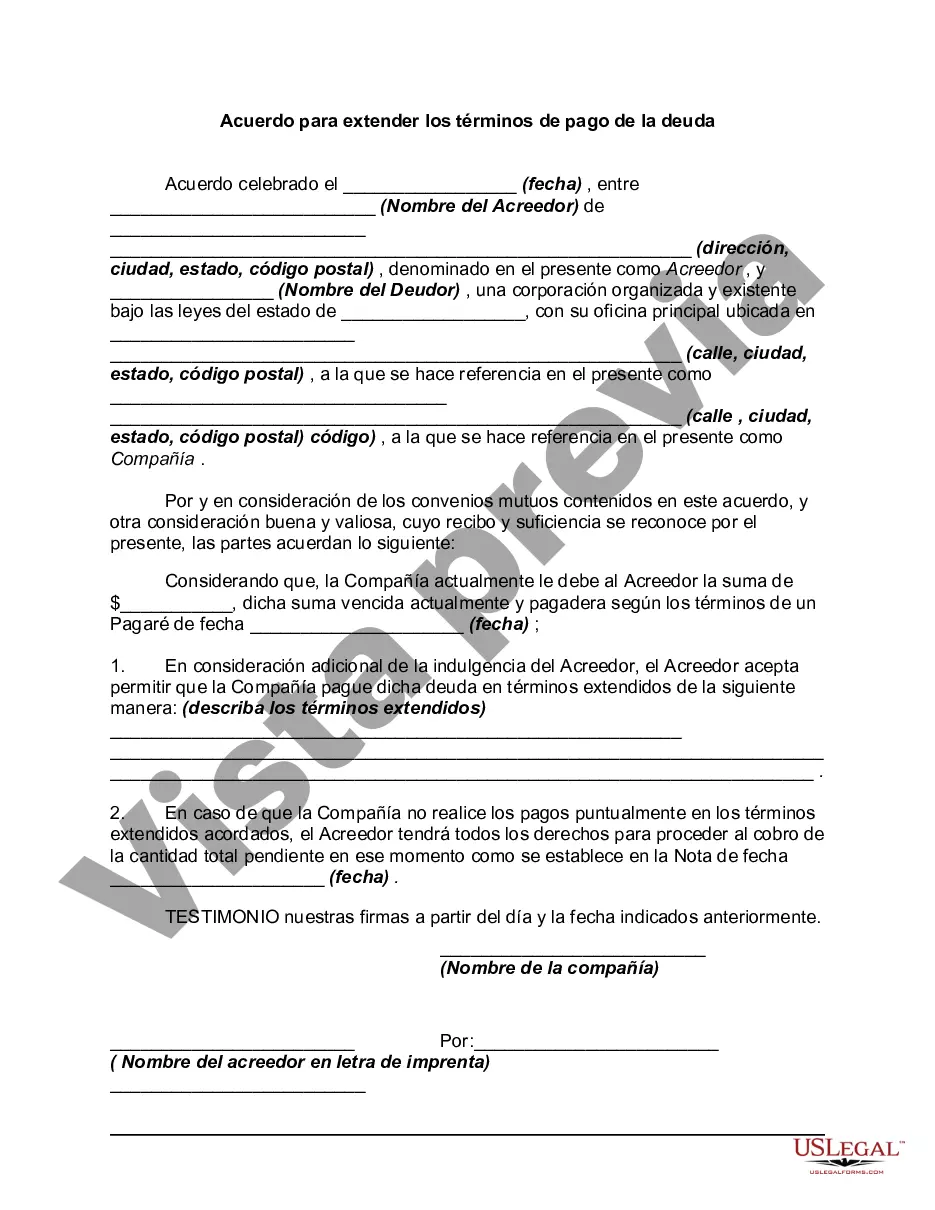

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mecklenburg North Carolina Agreement to Extend Debt Payment Terms is a legal document that allows individuals or organizations in Mecklenburg County to negotiate and establish new repayment terms for their outstanding debts. This agreement is designed to provide borrowers with temporary relief by extending the payment timeframe and potentially reducing or restructuring the debt obligations. The Mecklenburg North Carolina Agreement to Extend Debt Payment Terms is primarily used when borrowers encounter financial hardships and are unable to meet their existing debt obligations within the original timeline. By entering into this agreement, debtors can work with their creditors or lenders to create a new repayment plan that better suits their current financial situation. This agreement aims to alleviate the financial burden on both parties involved, providing a win-win situation. Debtors can avoid legal action, such as foreclosure or repossession, while creditors can ensure a higher chance of debt recovery. The terms of the agreement will vary based on the individual circumstances and creditor's discretion. Types of Mecklenburg North Carolina Agreement to Extend Debt Payment Terms may include: 1. Mortgage Extension Agreement: This agreement is specific to borrowers who are struggling to make mortgage payments. It allows for the extension of the repayment period or the adjustment of interest rates to ease the financial strain. 2. Student Loan Repayment Extension Agreement: Tailored for individuals burdened with student loan debt, this agreement offers extended repayment periods, reduced monthly installments, or alternative payment options to assist in managing the debt load. 3. Business Debt Restructuring Agreement: Designed for businesses facing financial challenges, this agreement enables companies to renegotiate their debt terms, including interest rates, repayment schedules, or monthly payments, providing them with the opportunity to stabilize their finances. 4. Personal Loan Refinancing Agreement: This type of agreement is utilized when individuals wish to refinance their personal loans, whether it be for credit cards, personal lines of credit, or other unsecured debts. It allows borrowers to negotiate new repayment terms that better align with their current financial capabilities. It is important to note that the terms and conditions of these agreements will depend on the specific circumstances and the willingness of creditors or lenders to accommodate the requests. Seeking the advice of a legal professional or financial advisor can help individuals or businesses navigate the process and ensure the best outcome for all parties involved.Mecklenburg North Carolina Agreement to Extend Debt Payment Terms is a legal document that allows individuals or organizations in Mecklenburg County to negotiate and establish new repayment terms for their outstanding debts. This agreement is designed to provide borrowers with temporary relief by extending the payment timeframe and potentially reducing or restructuring the debt obligations. The Mecklenburg North Carolina Agreement to Extend Debt Payment Terms is primarily used when borrowers encounter financial hardships and are unable to meet their existing debt obligations within the original timeline. By entering into this agreement, debtors can work with their creditors or lenders to create a new repayment plan that better suits their current financial situation. This agreement aims to alleviate the financial burden on both parties involved, providing a win-win situation. Debtors can avoid legal action, such as foreclosure or repossession, while creditors can ensure a higher chance of debt recovery. The terms of the agreement will vary based on the individual circumstances and creditor's discretion. Types of Mecklenburg North Carolina Agreement to Extend Debt Payment Terms may include: 1. Mortgage Extension Agreement: This agreement is specific to borrowers who are struggling to make mortgage payments. It allows for the extension of the repayment period or the adjustment of interest rates to ease the financial strain. 2. Student Loan Repayment Extension Agreement: Tailored for individuals burdened with student loan debt, this agreement offers extended repayment periods, reduced monthly installments, or alternative payment options to assist in managing the debt load. 3. Business Debt Restructuring Agreement: Designed for businesses facing financial challenges, this agreement enables companies to renegotiate their debt terms, including interest rates, repayment schedules, or monthly payments, providing them with the opportunity to stabilize their finances. 4. Personal Loan Refinancing Agreement: This type of agreement is utilized when individuals wish to refinance their personal loans, whether it be for credit cards, personal lines of credit, or other unsecured debts. It allows borrowers to negotiate new repayment terms that better align with their current financial capabilities. It is important to note that the terms and conditions of these agreements will depend on the specific circumstances and the willingness of creditors or lenders to accommodate the requests. Seeking the advice of a legal professional or financial advisor can help individuals or businesses navigate the process and ensure the best outcome for all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.