This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Nassau New York Agreement to Extend Debt Payment Terms is a legal arrangement that allows financial flexibility for individuals or organizations struggling with debt. In this agreement, the debtor and creditor come to a mutual understanding extending the payment terms, giving the debtor additional time to repay their debts. This agreement is particularly beneficial when the debtor is facing financial hardships and is unable to make the scheduled payments. The key objective of the Nassau New York Agreement to Extend Debt Payment Terms is to prevent defaults, bankruptcy filings, or legal actions that could result in further financial distress for the debtor. It provides an opportunity for the debtor to stabilize their financial situation and regain control over their monetary obligations. There are various types of Nassau New York Agreements to Extend Debt Payment Terms that can be tailored to suit the specific needs of the debtor and creditor. Some common variations include: 1. Mortgage Payment Extension Agreement: This type of agreement focuses on extending the payment terms for mortgage loans. Homeowners facing financial difficulties may opt for this agreement to avoid foreclosure by providing them with more time to catch up on missed payments. 2. Credit Card Debt Repayment Extension Agreement: Individuals struggling with high credit card debts can negotiate with their credit card companies for an extension of payment terms. This aids in reducing the burden and making the monthly payments more manageable. 3. Business Debt Restructuring Agreement: Companies facing financial distress, such as cash flow issues or declining profits, may enter into this agreement to restructure their existing debts. It allows them to renegotiate the terms, including interest rates, repayment periods, and installment amounts. 4. Student Loan Debt Payment Extension Agreement: Graduates or individuals with student loans often face difficulties in meeting their monthly payments after entering the job market. This agreement allows them to extend the repayment period or modify the terms to alleviate the financial strain. 5. Personal Loan Payment Extension Agreement: For individuals with various personal loans, such as auto loans or medical bills, a payment extension agreement can be negotiated. This provides them with relief by extending the repayment timeframe, enabling a more manageable financial situation. In summary, the Nassau New York Agreement to Extend Debt Payment Terms offers a lifeline to debtors facing financial hardships by providing them with extended payment options tailored to their specific circumstances. It serves as a financial tool to help individuals and organizations regain stability and avoid defaulting on their debts.The Nassau New York Agreement to Extend Debt Payment Terms is a legal arrangement that allows financial flexibility for individuals or organizations struggling with debt. In this agreement, the debtor and creditor come to a mutual understanding extending the payment terms, giving the debtor additional time to repay their debts. This agreement is particularly beneficial when the debtor is facing financial hardships and is unable to make the scheduled payments. The key objective of the Nassau New York Agreement to Extend Debt Payment Terms is to prevent defaults, bankruptcy filings, or legal actions that could result in further financial distress for the debtor. It provides an opportunity for the debtor to stabilize their financial situation and regain control over their monetary obligations. There are various types of Nassau New York Agreements to Extend Debt Payment Terms that can be tailored to suit the specific needs of the debtor and creditor. Some common variations include: 1. Mortgage Payment Extension Agreement: This type of agreement focuses on extending the payment terms for mortgage loans. Homeowners facing financial difficulties may opt for this agreement to avoid foreclosure by providing them with more time to catch up on missed payments. 2. Credit Card Debt Repayment Extension Agreement: Individuals struggling with high credit card debts can negotiate with their credit card companies for an extension of payment terms. This aids in reducing the burden and making the monthly payments more manageable. 3. Business Debt Restructuring Agreement: Companies facing financial distress, such as cash flow issues or declining profits, may enter into this agreement to restructure their existing debts. It allows them to renegotiate the terms, including interest rates, repayment periods, and installment amounts. 4. Student Loan Debt Payment Extension Agreement: Graduates or individuals with student loans often face difficulties in meeting their monthly payments after entering the job market. This agreement allows them to extend the repayment period or modify the terms to alleviate the financial strain. 5. Personal Loan Payment Extension Agreement: For individuals with various personal loans, such as auto loans or medical bills, a payment extension agreement can be negotiated. This provides them with relief by extending the repayment timeframe, enabling a more manageable financial situation. In summary, the Nassau New York Agreement to Extend Debt Payment Terms offers a lifeline to debtors facing financial hardships by providing them with extended payment options tailored to their specific circumstances. It serves as a financial tool to help individuals and organizations regain stability and avoid defaulting on their debts.

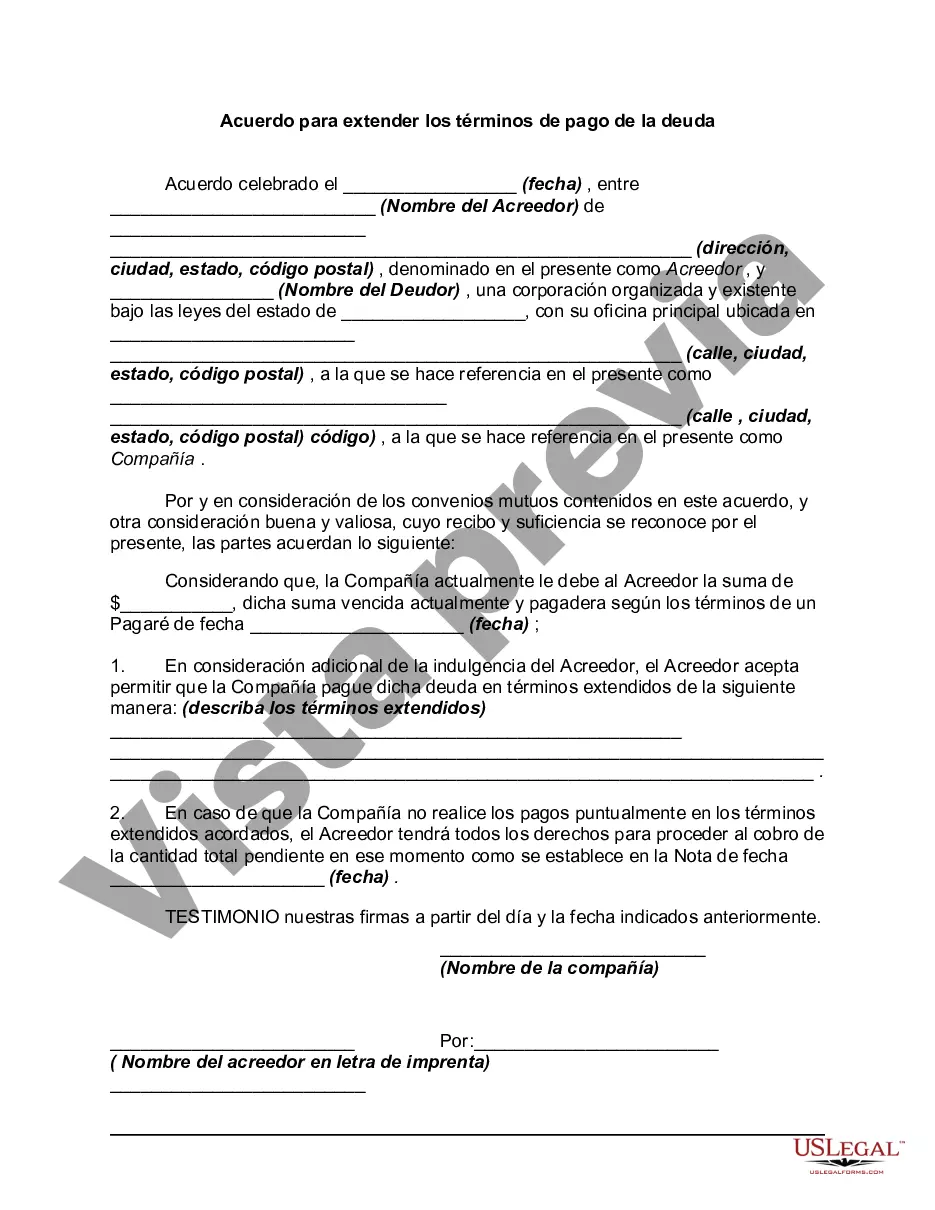

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.