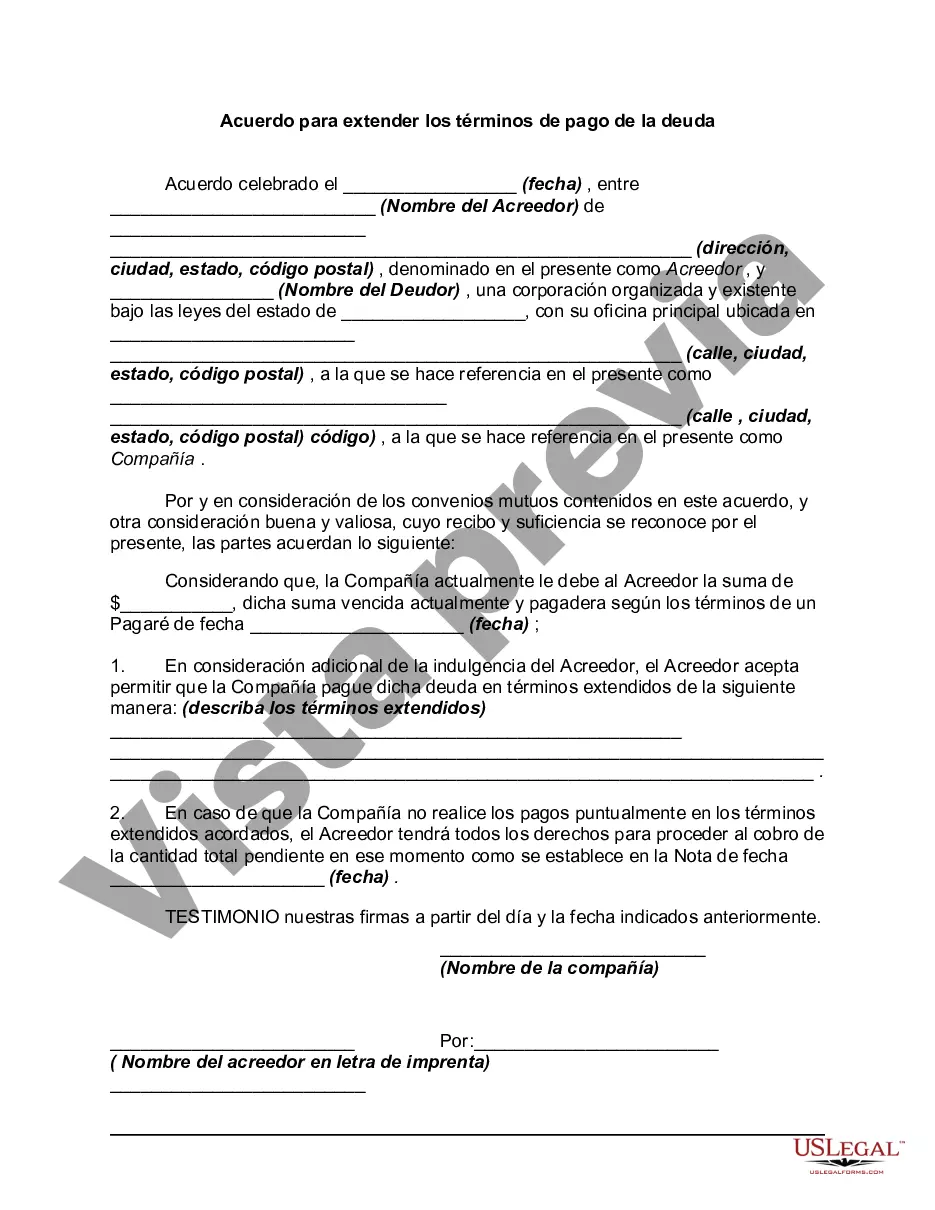

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Salt Lake Utah Agreement to Extend Debt Payment Terms: Exploring Different Types and Benefits Introduction: In Salt Lake Utah, an Agreement to Extend Debt Payment Terms provides a structured approach for borrowers to negotiate with creditors to extend the duration of debt payment. This detailed description delves into the concept, process, and potential benefits of these agreements while highlighting the different types available. 1. Understanding the Salt Lake Utah Agreement to Extend Debt Payment Terms: — The Salt Lake Utah Agreement to Extend Debt Payment Terms is a legally binding agreement between a borrower and creditor, granting extended payment terms for outstanding debts. — This agreement allows debtors to negotiate new repayment plans that are more manageable, enabling them to avoid defaulting on their obligations. — It is critical to note that this agreement must be willingly accepted and honored by both parties involved. 2. Exploring Different Types of Salt Lake Utah Agreement to Extend Debt Payment Terms: a) Debt Settlement Programs: — Debt settlement programs involve the negotiation of reduced outstanding balances with creditors, offering a one-time payment to resolve debts. — This type of agreement is often suitable for borrowers experiencing financial hardship or facing a significant debt burden. b) Debt Consolidation: — Debt consolidation agreements merge multiple debts into a single monthly payment. — By combining several debts, borrowers can streamline their finances and potentially secure lower interest rates, enabling faster debt repayment. c) Debt Restructuring: — Debt restructuring agreements involve modifying the terms of existing debts, such as reducing monthly payments or adjusting interest rates. — This type of agreement aims to alleviate short-term financial strain, providing borrowers with breathing room to repay their debts. d) Forbearance Agreements: — Forbearance agreements temporarily suspend or reduce loan payments for a specified period. — This type of agreement is often employed during times of financial hardship, such as job loss or medical emergencies. 3. Benefits of Salt Lake Utah Agreement to Extend Debt Payment Terms: a) Avoiding Default: — By extending debt payment terms, these agreements help borrowers avoid defaulting on their obligations, protecting their credit scores and minimizing legal consequences. b) Reduced Financial Stress: — The extended payment terms allow borrowers to allocate their financial resources effectively, reducing the burden of overwhelming debt payments and providing improved financial stability. c) Negotiated Repayment Plans: — Debtors are given the opportunity to negotiate more favorable repayment plans, potentially securing reduced interest rates, waived penalties, or lower monthly payments. d) Improved Credit Score: — Successfully honoring an agreement to extend debt payment terms helps borrowers rebuild their creditworthiness through consistent on-time payments. Conclusion: Salt Lake Utah Agreements to Extend Debt Payment Terms play a crucial role in aiding borrowers in managing their debts effectively. Whether through debt settlement, consolidation, restructuring, or forbearance, these agreements provide structured solutions and benefits such as avoiding default, reducing financial stress, negotiating repayment terms, and improving credit scores.Title: Understanding Salt Lake Utah Agreement to Extend Debt Payment Terms: Exploring Different Types and Benefits Introduction: In Salt Lake Utah, an Agreement to Extend Debt Payment Terms provides a structured approach for borrowers to negotiate with creditors to extend the duration of debt payment. This detailed description delves into the concept, process, and potential benefits of these agreements while highlighting the different types available. 1. Understanding the Salt Lake Utah Agreement to Extend Debt Payment Terms: — The Salt Lake Utah Agreement to Extend Debt Payment Terms is a legally binding agreement between a borrower and creditor, granting extended payment terms for outstanding debts. — This agreement allows debtors to negotiate new repayment plans that are more manageable, enabling them to avoid defaulting on their obligations. — It is critical to note that this agreement must be willingly accepted and honored by both parties involved. 2. Exploring Different Types of Salt Lake Utah Agreement to Extend Debt Payment Terms: a) Debt Settlement Programs: — Debt settlement programs involve the negotiation of reduced outstanding balances with creditors, offering a one-time payment to resolve debts. — This type of agreement is often suitable for borrowers experiencing financial hardship or facing a significant debt burden. b) Debt Consolidation: — Debt consolidation agreements merge multiple debts into a single monthly payment. — By combining several debts, borrowers can streamline their finances and potentially secure lower interest rates, enabling faster debt repayment. c) Debt Restructuring: — Debt restructuring agreements involve modifying the terms of existing debts, such as reducing monthly payments or adjusting interest rates. — This type of agreement aims to alleviate short-term financial strain, providing borrowers with breathing room to repay their debts. d) Forbearance Agreements: — Forbearance agreements temporarily suspend or reduce loan payments for a specified period. — This type of agreement is often employed during times of financial hardship, such as job loss or medical emergencies. 3. Benefits of Salt Lake Utah Agreement to Extend Debt Payment Terms: a) Avoiding Default: — By extending debt payment terms, these agreements help borrowers avoid defaulting on their obligations, protecting their credit scores and minimizing legal consequences. b) Reduced Financial Stress: — The extended payment terms allow borrowers to allocate their financial resources effectively, reducing the burden of overwhelming debt payments and providing improved financial stability. c) Negotiated Repayment Plans: — Debtors are given the opportunity to negotiate more favorable repayment plans, potentially securing reduced interest rates, waived penalties, or lower monthly payments. d) Improved Credit Score: — Successfully honoring an agreement to extend debt payment terms helps borrowers rebuild their creditworthiness through consistent on-time payments. Conclusion: Salt Lake Utah Agreements to Extend Debt Payment Terms play a crucial role in aiding borrowers in managing their debts effectively. Whether through debt settlement, consolidation, restructuring, or forbearance, these agreements provide structured solutions and benefits such as avoiding default, reducing financial stress, negotiating repayment terms, and improving credit scores.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.