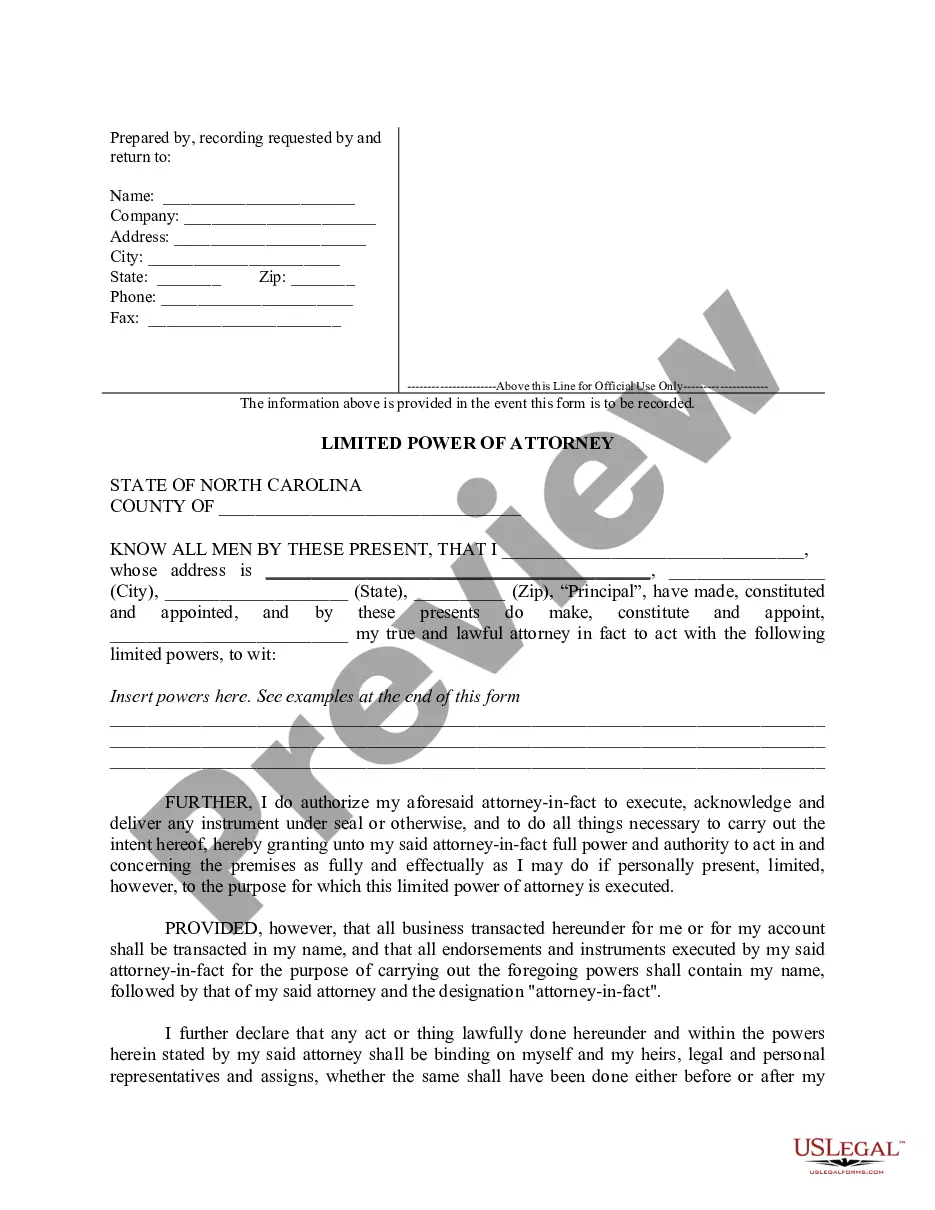

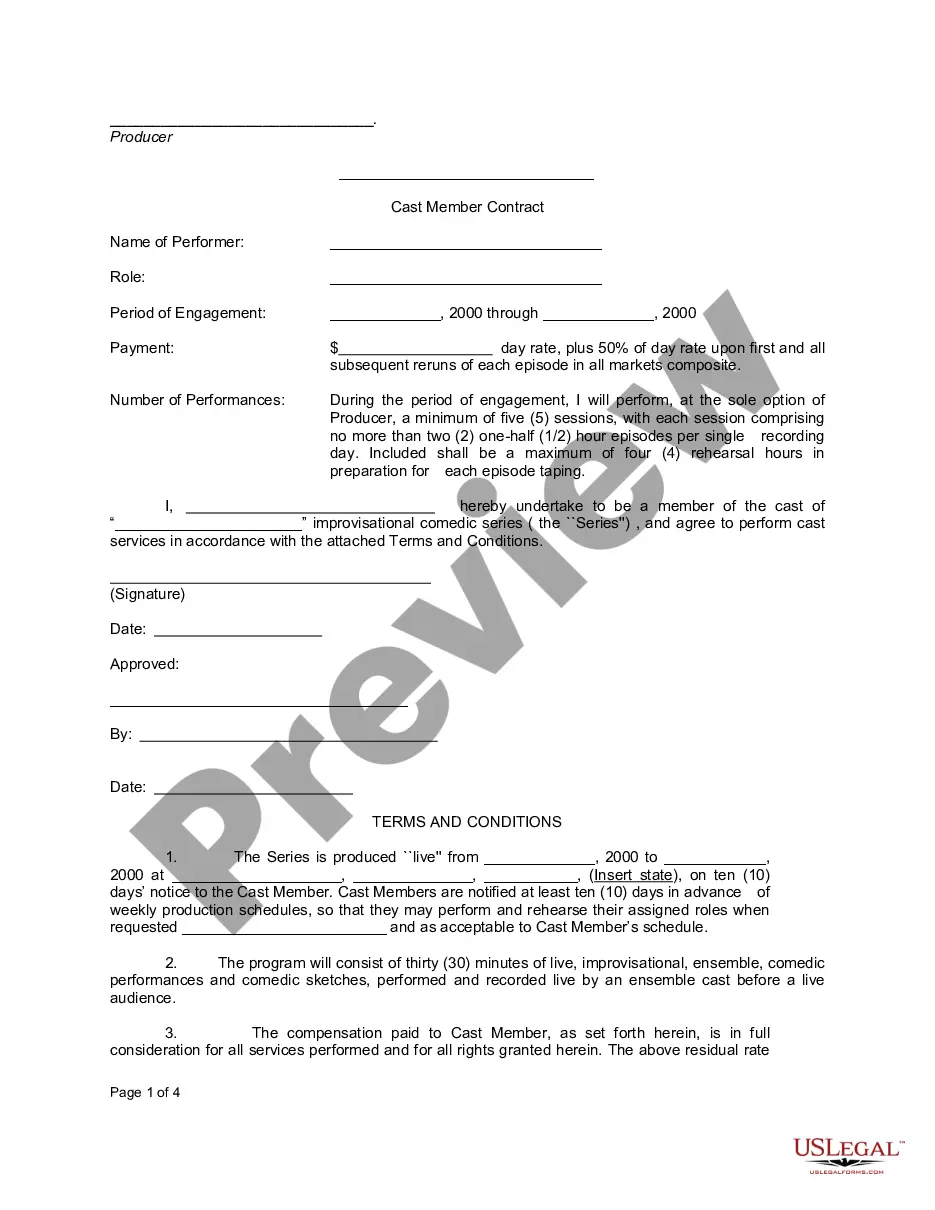

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

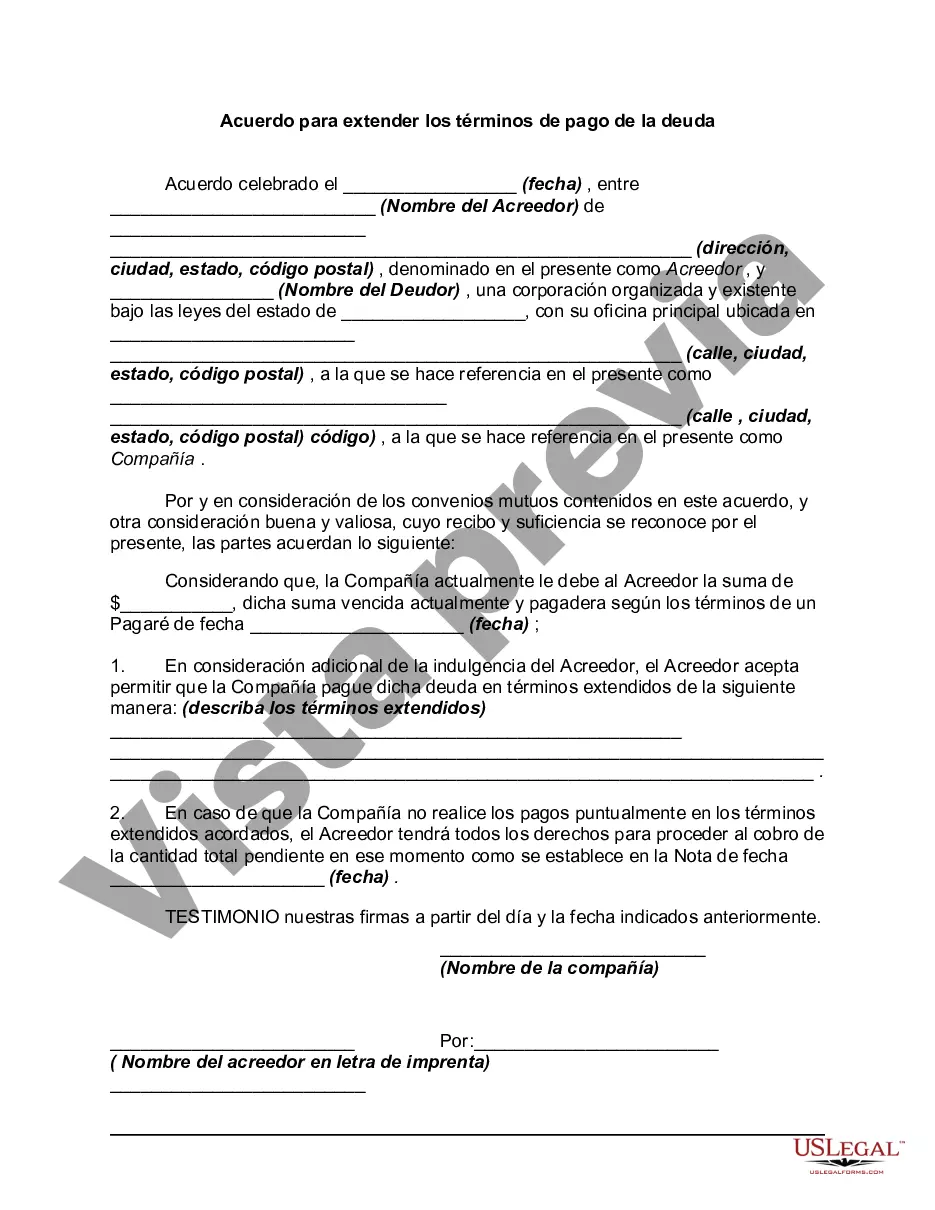

The Suffolk New York Agreement to Extend Debt Payment Terms refers to a legally binding contract made between a debtor and creditor based in Suffolk County, New York. This agreement allows the debtor to extend the payment terms for a debt, providing them with additional time to repay their outstanding obligations. It is often used as a means of reaching a mutually beneficial solution for both parties involved. The Suffolk New York Agreement to Extend Debt Payment Terms can be categorized into various types based on the specific terms and conditions agreed upon: 1. Installment Agreement: Under this type of agreement, the debtor can repay their debt through regular monthly installments over an extended period. The agreed-upon amount for each installment would be mentioned in the agreement. 2. Debt Restructuring Agreement: This agreement involves restructuring the debt by modifying its terms, such as reducing the interest rate, extending the repayment period, or renegotiating the principal amount owed. 3. Forbearance Agreement: In a forbearance agreement, the creditor agrees to temporarily suspend the debtor's obligation to make payments for a specified period. This provides the debtor with financial relief during a challenging period, with the understanding that regular payments will resume once the forbearance period ends. 4. Loan Modification Agreement: This type of agreement involves modifying the terms of a loan to help the debtor manage their debt more effectively. It may include changing the interest rate, payment schedule, or even the loan type. 5. Debt Settlement Agreement: When a debtor is unable to repay the full amount owed, a debt settlement agreement can be reached. This agreement allows the debtor to repay a reduced lump sum or agree to a structured payment plan that satisfies both parties. The purpose of the Suffolk New York Agreement to Extend Debt Payment Terms is to provide a flexible solution for debtors who are struggling to fulfill their financial obligations. By extending the payment terms or restructuring the debt, both parties can avoid legal actions, such as bankruptcy or foreclosure, which can be detrimental to both the debtor and the creditor's financial interests. It is essential for debtors and creditors to carefully review and negotiate the terms of the agreement, ensuring that it facilitates a feasible repayment plan for the debtor while providing reasonable assurances to the creditor that the debt will be repaid. Seeking legal advice is recommended to ensure compliance with applicable laws and to protect the rights of both parties involved.The Suffolk New York Agreement to Extend Debt Payment Terms refers to a legally binding contract made between a debtor and creditor based in Suffolk County, New York. This agreement allows the debtor to extend the payment terms for a debt, providing them with additional time to repay their outstanding obligations. It is often used as a means of reaching a mutually beneficial solution for both parties involved. The Suffolk New York Agreement to Extend Debt Payment Terms can be categorized into various types based on the specific terms and conditions agreed upon: 1. Installment Agreement: Under this type of agreement, the debtor can repay their debt through regular monthly installments over an extended period. The agreed-upon amount for each installment would be mentioned in the agreement. 2. Debt Restructuring Agreement: This agreement involves restructuring the debt by modifying its terms, such as reducing the interest rate, extending the repayment period, or renegotiating the principal amount owed. 3. Forbearance Agreement: In a forbearance agreement, the creditor agrees to temporarily suspend the debtor's obligation to make payments for a specified period. This provides the debtor with financial relief during a challenging period, with the understanding that regular payments will resume once the forbearance period ends. 4. Loan Modification Agreement: This type of agreement involves modifying the terms of a loan to help the debtor manage their debt more effectively. It may include changing the interest rate, payment schedule, or even the loan type. 5. Debt Settlement Agreement: When a debtor is unable to repay the full amount owed, a debt settlement agreement can be reached. This agreement allows the debtor to repay a reduced lump sum or agree to a structured payment plan that satisfies both parties. The purpose of the Suffolk New York Agreement to Extend Debt Payment Terms is to provide a flexible solution for debtors who are struggling to fulfill their financial obligations. By extending the payment terms or restructuring the debt, both parties can avoid legal actions, such as bankruptcy or foreclosure, which can be detrimental to both the debtor and the creditor's financial interests. It is essential for debtors and creditors to carefully review and negotiate the terms of the agreement, ensuring that it facilitates a feasible repayment plan for the debtor while providing reasonable assurances to the creditor that the debt will be repaid. Seeking legal advice is recommended to ensure compliance with applicable laws and to protect the rights of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.