All jurisdictions have statutes enabling qualified persons to form corporations for certain purposes by following specified procedures. The proper form and necessary content of articles of incorporation depend largely on the requirements of the several state statutes, which in many instances designate the appropriate form and content. Thus, while the articles must stay within the limitations imposed by the various statutes and by the policies and interpretations of the responsible state officials and agencies, the articles may usually be drafted so as to fit the business needs of the proposed corporation. In many states, official forms are provided; in some of these jurisdictions, use of such forms is mandatory. Although in some jurisdictions, the secretary of state's printed forms are not required to be used, it is wise to use the language found in the forms since much of the language found in them is required.

This form is baser on the Revised Model Business Corporation Act.

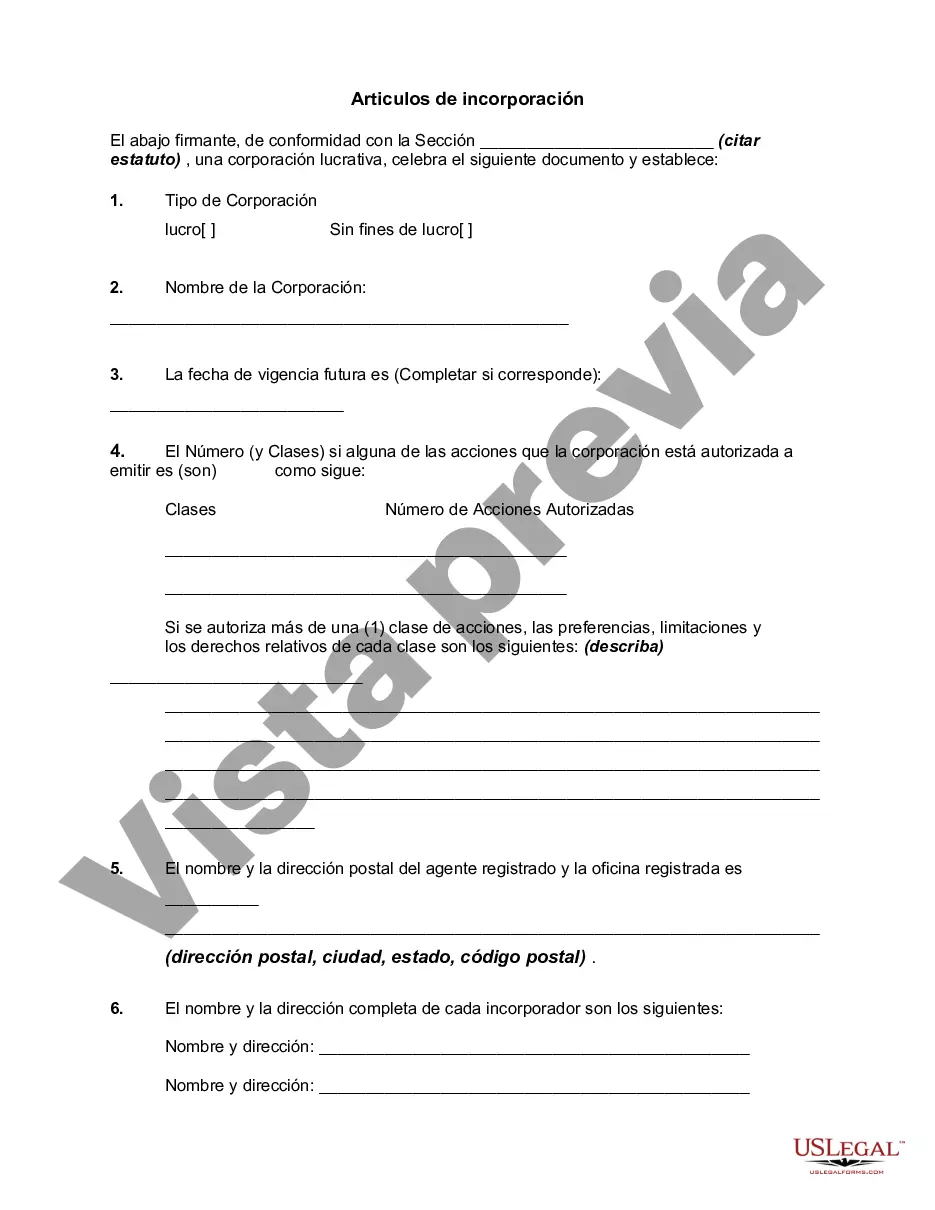

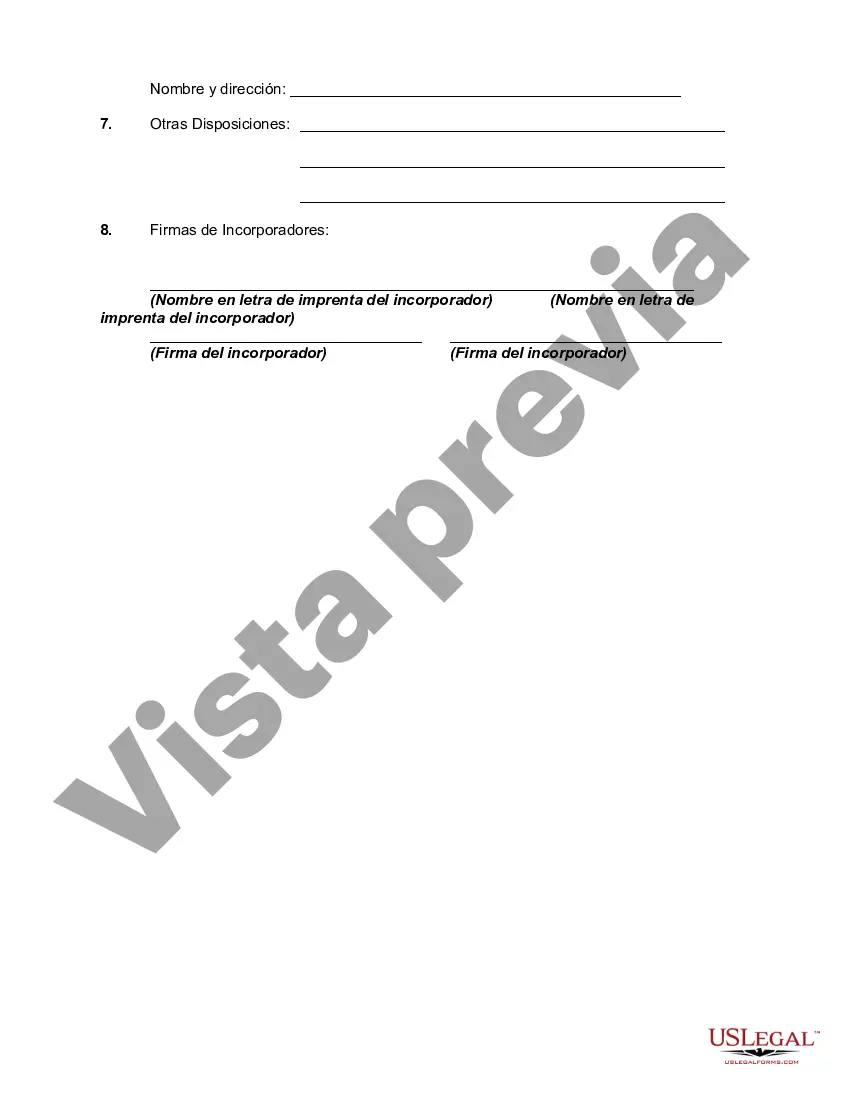

Dallas Texas Articles of Incorporation is a legal document that establishes a corporation in the state of Texas. These articles play a vital role in outlining the corporation's purpose, structure, and operations, as well as defining its relationships with shareholders, directors, and officers. Here, we delve into the different types of Dallas Texas Articles of Incorporation to provide an in-depth understanding of their significance. 1. General Articles of Incorporation: This standard document encompasses the fundamental information required by the Texas Secretary of State to form a corporation in Dallas. It typically includes the corporation's name, effective date, registered agent, principal office address, purpose, number of shares authorized, information about shareholders and directors, and other essential details. 2. Professional Corporation Articles: In certain industries, professionals like doctors, lawyers, or accountants may form corporations to provide their services. Professional Corporation Articles of Incorporation are specific to these professions and are subject to additional legal requirements and regulations. They often emphasize that the corporation's purpose is limited to the provision of professional services and may have restrictions on who can hold shares or serve as directors. 3. Nonprofit Corporation Articles: Nonprofit organizations, such as charities, religious groups, or educational institutions, choose this type of Articles of Incorporation. These documents outline the nonprofit's mission, tax-exempt status, governance structure, and how they plan to serve the community. Nonprofit Corporation Articles typically contain specific clauses addressing dissolution and the usage of assets for charitable purposes. 4. Close Corporation Articles: Close corporations are smaller entities where a few individuals hold all or most of the shares. Close Corporation Articles of Incorporation provide flexibility to such corporations by allowing shareholders to manage the business directly without a separate board of directors. This type of Articles may include provisions related to shareholder agreements, restrictions on the transfer of shares, and the expectations of a close-knit business structure. Overall, Dallas Texas Articles of Incorporation are critical legal documents that create a corporation and define its operations. Whether it's a general corporation, professional corporation, nonprofit corporation, or close corporation, these articles establish the foundation for corporate governance, asset protection, and legal compliance. Entrepreneurs and business owners in Dallas have to adhere to these specific types of Articles of Incorporation based on their business model, industry, and goals when establishing and maintaining their corporations.Dallas Texas Articles of Incorporation is a legal document that establishes a corporation in the state of Texas. These articles play a vital role in outlining the corporation's purpose, structure, and operations, as well as defining its relationships with shareholders, directors, and officers. Here, we delve into the different types of Dallas Texas Articles of Incorporation to provide an in-depth understanding of their significance. 1. General Articles of Incorporation: This standard document encompasses the fundamental information required by the Texas Secretary of State to form a corporation in Dallas. It typically includes the corporation's name, effective date, registered agent, principal office address, purpose, number of shares authorized, information about shareholders and directors, and other essential details. 2. Professional Corporation Articles: In certain industries, professionals like doctors, lawyers, or accountants may form corporations to provide their services. Professional Corporation Articles of Incorporation are specific to these professions and are subject to additional legal requirements and regulations. They often emphasize that the corporation's purpose is limited to the provision of professional services and may have restrictions on who can hold shares or serve as directors. 3. Nonprofit Corporation Articles: Nonprofit organizations, such as charities, religious groups, or educational institutions, choose this type of Articles of Incorporation. These documents outline the nonprofit's mission, tax-exempt status, governance structure, and how they plan to serve the community. Nonprofit Corporation Articles typically contain specific clauses addressing dissolution and the usage of assets for charitable purposes. 4. Close Corporation Articles: Close corporations are smaller entities where a few individuals hold all or most of the shares. Close Corporation Articles of Incorporation provide flexibility to such corporations by allowing shareholders to manage the business directly without a separate board of directors. This type of Articles may include provisions related to shareholder agreements, restrictions on the transfer of shares, and the expectations of a close-knit business structure. Overall, Dallas Texas Articles of Incorporation are critical legal documents that create a corporation and define its operations. Whether it's a general corporation, professional corporation, nonprofit corporation, or close corporation, these articles establish the foundation for corporate governance, asset protection, and legal compliance. Entrepreneurs and business owners in Dallas have to adhere to these specific types of Articles of Incorporation based on their business model, industry, and goals when establishing and maintaining their corporations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.