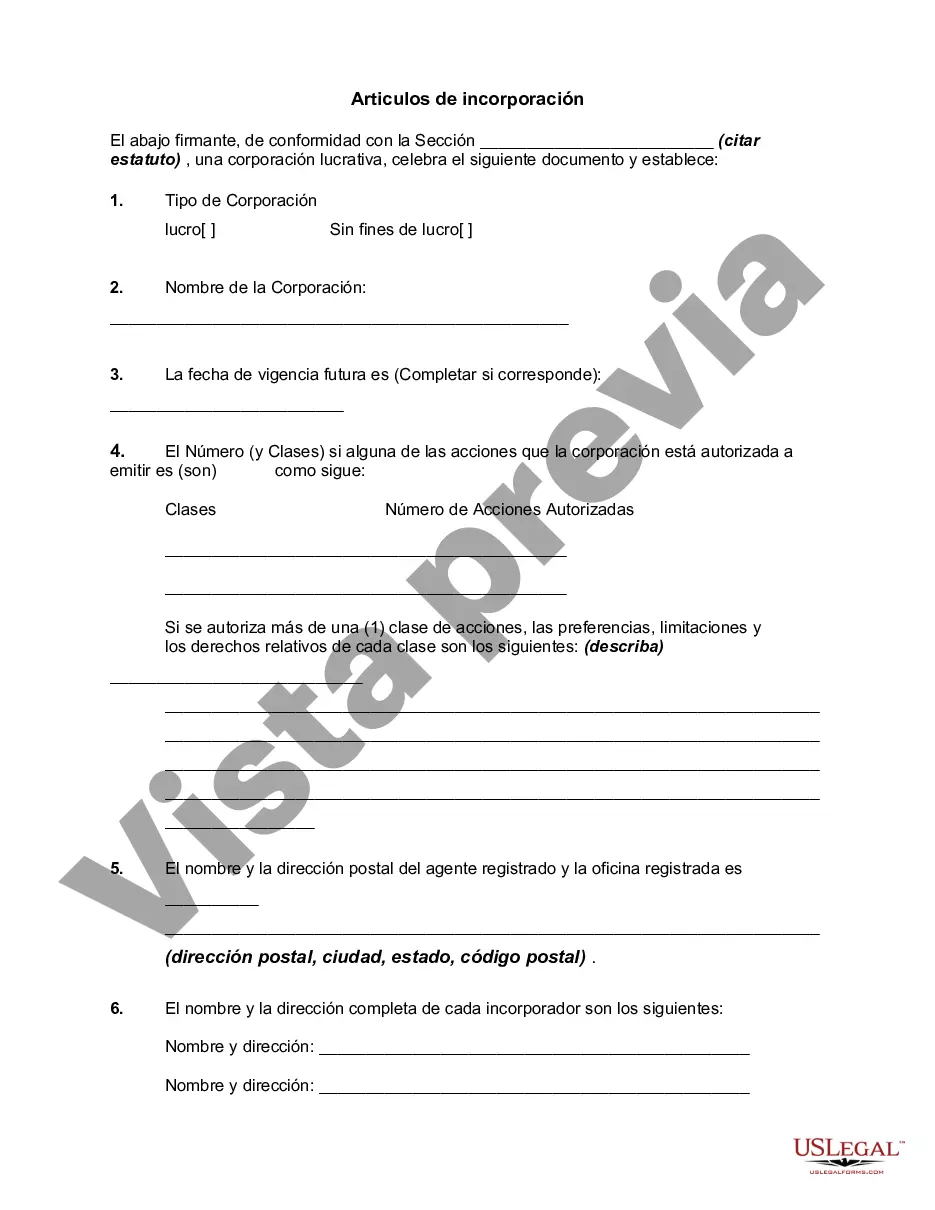

All jurisdictions have statutes enabling qualified persons to form corporations for certain purposes by following specified procedures. The proper form and necessary content of articles of incorporation depend largely on the requirements of the several state statutes, which in many instances designate the appropriate form and content. Thus, while the articles must stay within the limitations imposed by the various statutes and by the policies and interpretations of the responsible state officials and agencies, the articles may usually be drafted so as to fit the business needs of the proposed corporation. In many states, official forms are provided; in some of these jurisdictions, use of such forms is mandatory. Although in some jurisdictions, the secretary of state's printed forms are not required to be used, it is wise to use the language found in the forms since much of the language found in them is required.

This form is baser on the Revised Model Business Corporation Act.

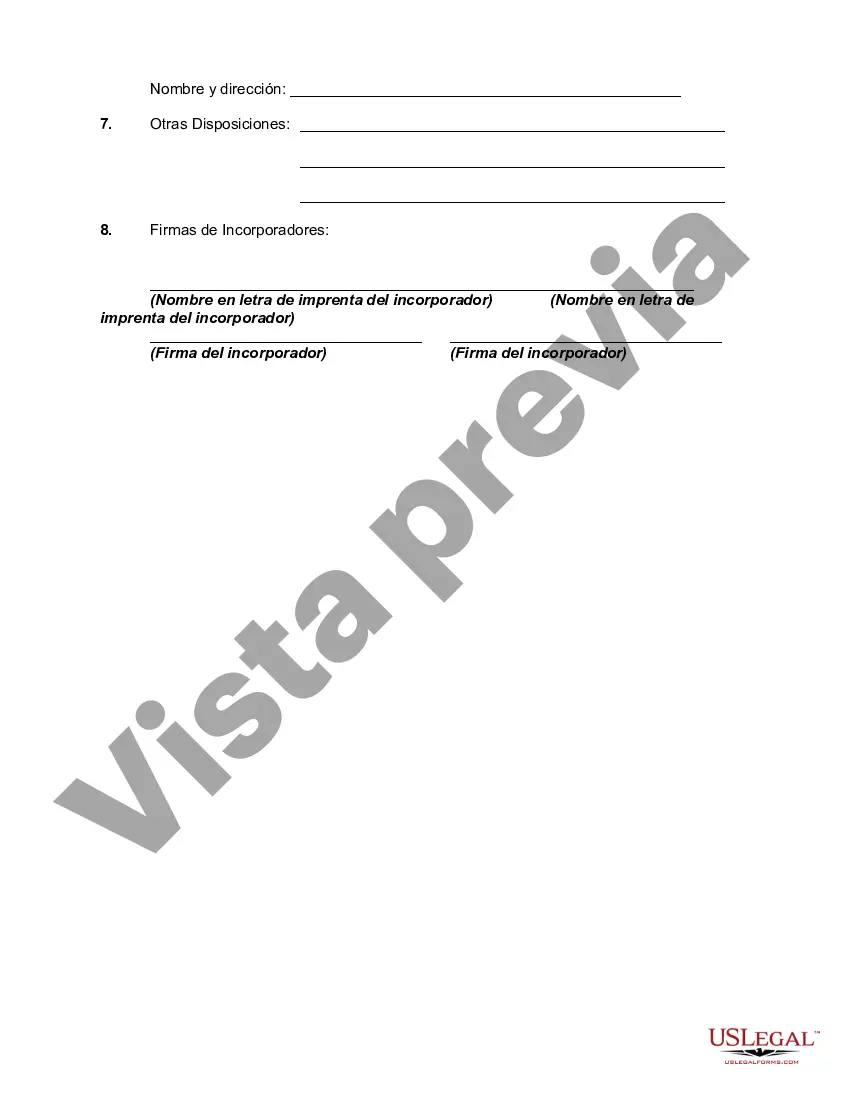

Keywords: Harris Texas, Articles of Incorporation, types Title: Exploring Harris Texas Articles of Incorporation: Types and Detailed Description Introduction: The Articles of Incorporation play a crucial role in establishing a business entity in Harris County, Texas. This article aims to delve into the details of what Harris Texas Articles of Incorporation entail, their significance, and explore any different types that exist. 1. Definition of Harris Texas Articles of Incorporation: The Harris Texas Articles of Incorporation refer to the legal document required for formally creating a corporation within the boundaries of Harris County, Texas. It provides vital information about the company, its purpose, structure, and other essential details. 2. Key Components: The Articles of Incorporation typically include: a) Corporate Name: The chosen name must comply with the naming guidelines set by the Secretary of State of Texas and should end with a corporate designator such as "Incorporated," "Company," or "Corporation." b) Purpose: This section outlines the primary objectives and activities that the company intends to pursue. c) Registered Agent: The document designates an individual or entity responsible for receiving legal notifications on behalf of the corporation. d) Stock Details: If the company issues stock, this section outlines the types, classes, and details of shares authorized. e) Directors and Officers: The names and addresses of initial directors and officers are typically mentioned. f) Initial Registered Office and Principal Office: The physical address of the principal place of business and registered office is provided. g) Incorporated Information: Details of the person(s) responsible for filing the Articles of Incorporation are included. 3. Different Types of Harris Texas Articles of Incorporation: While the core elements remain fairly consistent, different types of articles may apply depending on the nature and purpose of the corporation. Some common variations include: a) Non-Profit Articles of Incorporation: These articles are used when establishing a non-profit corporation, where the primary goal is charitable, religious, educational, or public service-oriented. b) Professional Association Articles of Incorporation: If professionals, such as lawyers, doctors, or accountants, wish to form a corporation together, specific articles cater to the unique requirements of professional associations. c) For-Profit Articles of Incorporation: This category covers general businesses aiming to generate profits, which encompass a wide range of industries and sectors. d) Close Corporation Articles of Incorporation: Close corporations are specifically intended for businesses with a smaller number of shareholders, providing flexibility in operation and governance. Conclusion: Understanding the significance and intricacies of Harris Texas Articles of Incorporation is crucial when forming a corporation in Harris County, Texas. Whether establishing a non-profit, professional association, for-profit, or close corporation, adherence to the specific requirements outlined in the relevant articles is essential. By carefully filling out the Articles of Incorporation, businesses can lay a strong foundation for their operations in Harris Texas.Keywords: Harris Texas, Articles of Incorporation, types Title: Exploring Harris Texas Articles of Incorporation: Types and Detailed Description Introduction: The Articles of Incorporation play a crucial role in establishing a business entity in Harris County, Texas. This article aims to delve into the details of what Harris Texas Articles of Incorporation entail, their significance, and explore any different types that exist. 1. Definition of Harris Texas Articles of Incorporation: The Harris Texas Articles of Incorporation refer to the legal document required for formally creating a corporation within the boundaries of Harris County, Texas. It provides vital information about the company, its purpose, structure, and other essential details. 2. Key Components: The Articles of Incorporation typically include: a) Corporate Name: The chosen name must comply with the naming guidelines set by the Secretary of State of Texas and should end with a corporate designator such as "Incorporated," "Company," or "Corporation." b) Purpose: This section outlines the primary objectives and activities that the company intends to pursue. c) Registered Agent: The document designates an individual or entity responsible for receiving legal notifications on behalf of the corporation. d) Stock Details: If the company issues stock, this section outlines the types, classes, and details of shares authorized. e) Directors and Officers: The names and addresses of initial directors and officers are typically mentioned. f) Initial Registered Office and Principal Office: The physical address of the principal place of business and registered office is provided. g) Incorporated Information: Details of the person(s) responsible for filing the Articles of Incorporation are included. 3. Different Types of Harris Texas Articles of Incorporation: While the core elements remain fairly consistent, different types of articles may apply depending on the nature and purpose of the corporation. Some common variations include: a) Non-Profit Articles of Incorporation: These articles are used when establishing a non-profit corporation, where the primary goal is charitable, religious, educational, or public service-oriented. b) Professional Association Articles of Incorporation: If professionals, such as lawyers, doctors, or accountants, wish to form a corporation together, specific articles cater to the unique requirements of professional associations. c) For-Profit Articles of Incorporation: This category covers general businesses aiming to generate profits, which encompass a wide range of industries and sectors. d) Close Corporation Articles of Incorporation: Close corporations are specifically intended for businesses with a smaller number of shareholders, providing flexibility in operation and governance. Conclusion: Understanding the significance and intricacies of Harris Texas Articles of Incorporation is crucial when forming a corporation in Harris County, Texas. Whether establishing a non-profit, professional association, for-profit, or close corporation, adherence to the specific requirements outlined in the relevant articles is essential. By carefully filling out the Articles of Incorporation, businesses can lay a strong foundation for their operations in Harris Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.