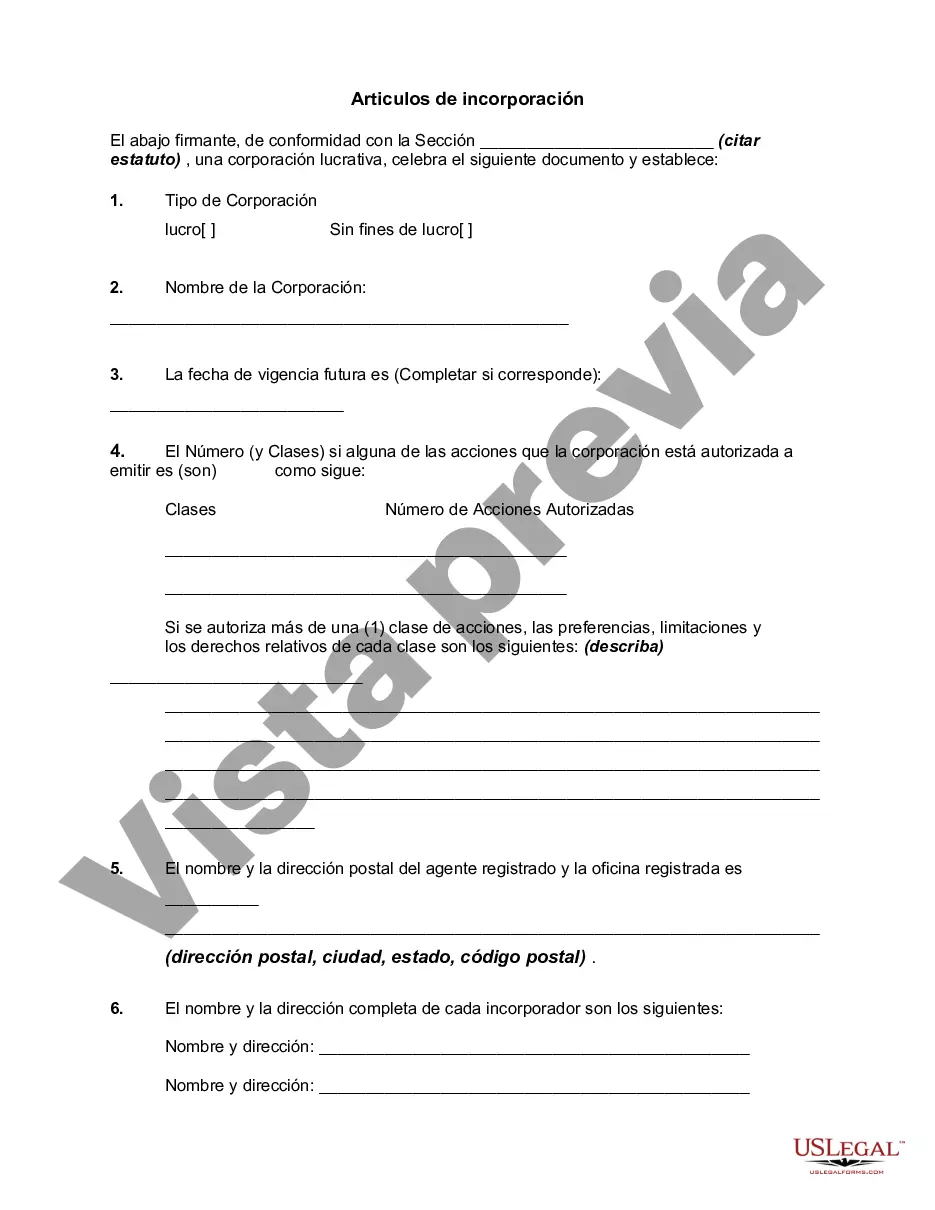

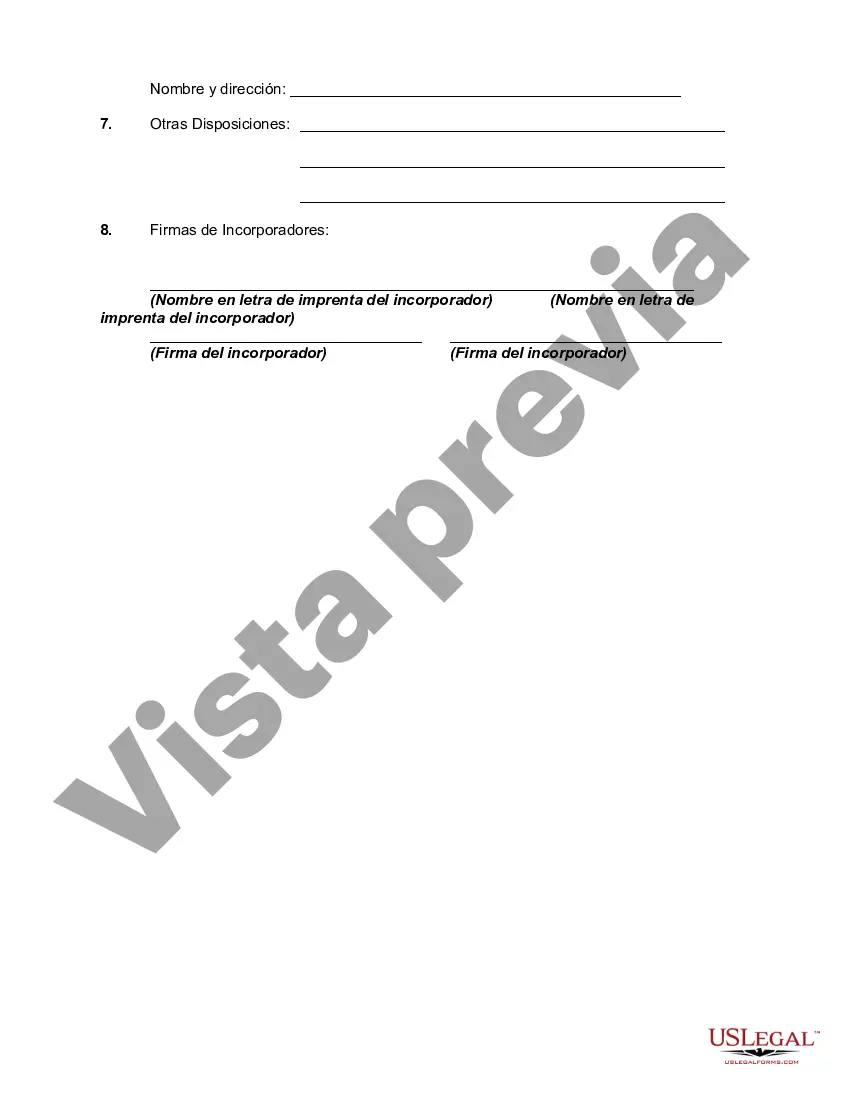

All jurisdictions have statutes enabling qualified persons to form corporations for certain purposes by following specified procedures. The proper form and necessary content of articles of incorporation depend largely on the requirements of the several state statutes, which in many instances designate the appropriate form and content. Thus, while the articles must stay within the limitations imposed by the various statutes and by the policies and interpretations of the responsible state officials and agencies, the articles may usually be drafted so as to fit the business needs of the proposed corporation. In many states, official forms are provided; in some of these jurisdictions, use of such forms is mandatory. Although in some jurisdictions, the secretary of state's printed forms are not required to be used, it is wise to use the language found in the forms since much of the language found in them is required.

This form is baser on the Revised Model Business Corporation Act.

San Jose California Articles of Incorporation serve as legally binding documents that establish and outline the formation and operation of a corporation within the city of San Jose, California. This crucial step is necessary for individuals or entities seeking to start a corporation in San Jose. By filing Articles of Incorporation with the California Secretary of State, aspiring business owners legally cement their company's existence. The process for preparing Articles of Incorporation involves providing specific information about the corporation, such as its name, purpose, duration, address, registered agent details, and the number of authorized shares. These details help create a formal structure and identity for the corporation. In San Jose, there are various types of Articles of Incorporation that can be filed, depending on the nature and purpose of the corporation. Some of these types include: 1. General Business Corporation: This is the most common type of corporation that encompasses a broad range of commercial activities. It allows individuals or groups to conduct business in San Jose while providing limited liability protection to its shareholders. 2. Nonprofit Corporation: This type of corporation is formed for charitable, educational, religious, or scientific purposes that benefit the public. Nonprofit corporations in San Jose enjoy tax-exempt status and must fulfill specific criteria to maintain their nonprofit status. 3. Professional Corporation: Professionals, such as doctors, lawyers, accountants, and architects, who wish to practice their respective professions as a corporation in San Jose, must file Articles of Incorporation as a professional corporation. This structure provides limited liability protection to its shareholders while ensuring compliance with professional regulations. 4. Close Corporation: A close corporation is an option for smaller businesses with a limited number of shareholders, typically family members or close associates. This type of corporation allows for flexible management and fewer legal formalities, making it an attractive choice for closely held businesses in San Jose. 5. Benefit Corporation: Benefit corporations are a relatively recent addition to corporate structures. They are formed to pursue both profit-making activities and public benefits. By incorporating elements of social and environmental responsibility into their mission statements, benefit corporations aim to achieve positive impacts on society while still generating profits. In conclusion, San Jose California Articles of Incorporation delineate the essential details required to establish and operate a corporation in San Jose. From general business corporations to nonprofit, professional, close, and benefit corporations, the specific type of Articles of Incorporation depends on the nature and purpose of the corporation being formed. By adhering to legal requirements and choosing the appropriate structure, aspiring business owners can confidently navigate the process of forming a corporation in San Jose, California.San Jose California Articles of Incorporation serve as legally binding documents that establish and outline the formation and operation of a corporation within the city of San Jose, California. This crucial step is necessary for individuals or entities seeking to start a corporation in San Jose. By filing Articles of Incorporation with the California Secretary of State, aspiring business owners legally cement their company's existence. The process for preparing Articles of Incorporation involves providing specific information about the corporation, such as its name, purpose, duration, address, registered agent details, and the number of authorized shares. These details help create a formal structure and identity for the corporation. In San Jose, there are various types of Articles of Incorporation that can be filed, depending on the nature and purpose of the corporation. Some of these types include: 1. General Business Corporation: This is the most common type of corporation that encompasses a broad range of commercial activities. It allows individuals or groups to conduct business in San Jose while providing limited liability protection to its shareholders. 2. Nonprofit Corporation: This type of corporation is formed for charitable, educational, religious, or scientific purposes that benefit the public. Nonprofit corporations in San Jose enjoy tax-exempt status and must fulfill specific criteria to maintain their nonprofit status. 3. Professional Corporation: Professionals, such as doctors, lawyers, accountants, and architects, who wish to practice their respective professions as a corporation in San Jose, must file Articles of Incorporation as a professional corporation. This structure provides limited liability protection to its shareholders while ensuring compliance with professional regulations. 4. Close Corporation: A close corporation is an option for smaller businesses with a limited number of shareholders, typically family members or close associates. This type of corporation allows for flexible management and fewer legal formalities, making it an attractive choice for closely held businesses in San Jose. 5. Benefit Corporation: Benefit corporations are a relatively recent addition to corporate structures. They are formed to pursue both profit-making activities and public benefits. By incorporating elements of social and environmental responsibility into their mission statements, benefit corporations aim to achieve positive impacts on society while still generating profits. In conclusion, San Jose California Articles of Incorporation delineate the essential details required to establish and operate a corporation in San Jose. From general business corporations to nonprofit, professional, close, and benefit corporations, the specific type of Articles of Incorporation depends on the nature and purpose of the corporation being formed. By adhering to legal requirements and choosing the appropriate structure, aspiring business owners can confidently navigate the process of forming a corporation in San Jose, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.