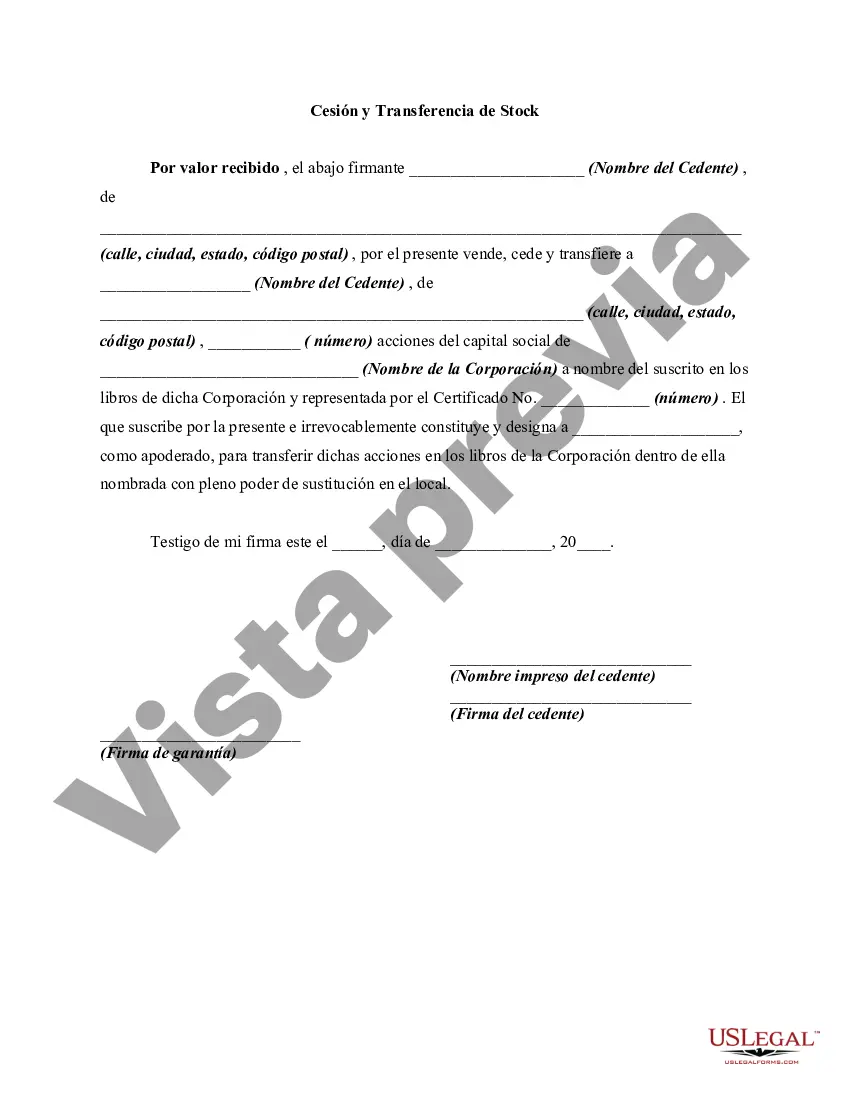

Allegheny Pennsylvania Assignment and Transfer of Stock is a legal document that outlines the process of transferring ownership of a stock or shares from one party to another within the jurisdiction of Allegheny, Pennsylvania. This type of agreement is common in business and investment transactions and plays a crucial role in ensuring a smooth transfer of ownership rights. The Assignment and Transfer of Stock document includes essential information such as the names and addresses of both the assignor (current stock owner) and assignee (the new stock owner). It also specifies the number of shares being transferred, the class of stock, and any restrictions or conditions associated with the transfer. These conditions may include compliance with applicable laws, obtaining necessary approvals, or adherence to any specific procedures set forth by the issuing company. In Allegheny Pennsylvania, there are several types of Assignment and Transfer of Stock agreements based on the purpose or circumstances of the transfer. Some notable types include: 1. General Assignment and Transfer of Stock: This is the most common type of transfer, which involves the straightforward sale or gift of stock without any specific restrictions or conditions. 2. Restricted Stock Transfer: In this type of transfer, the stock may be subject to certain restrictions imposed by the issuing company or governing regulations. Restrictions may include holding periods, limitations on resale, or mandatory compliance with company policies. 3. Inheritance or Estate Transfer: When an individual passes away, their stocks are transferred to their heirs or beneficiaries through an assignment and transfer agreement, which ensures a legal transfer of ownership. 4. Corporate Merger or Acquisition Transfer: During mergers or acquisitions, the Assignment and Transfer of Stock agreement plays a crucial role in transferring ownership rights from the acquired company's shareholders to the acquiring company or its shareholders. 5. Employee Stock Option Transfer: When an employee exercises their stock options, resulting in the transfer of shares from the company to the employee, an Assignment and Transfer of Stock agreement is utilized to document the transaction. In conclusion, an Allegheny Pennsylvania Assignment and Transfer of Stock document serves as a legal instrument for transferring ownership rights of stocks or shares. It is essential for both parties involved in the transfer to carefully draft and execute this document to ensure compliance with applicable laws and regulations and establish a clear record of the transfer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out Allegheny Pennsylvania Cesión Y Transferencia De Stock?

Creating paperwork, like Allegheny Assignment and Transfer of Stock, to manage your legal affairs is a difficult and time-consumming task. Many situations require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents created for a variety of cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Allegheny Assignment and Transfer of Stock form. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Allegheny Assignment and Transfer of Stock:

- Ensure that your template is specific to your state/county since the regulations for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Allegheny Assignment and Transfer of Stock isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to begin utilizing our website and get the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s easy to find and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!