Bronx New York Assignment and Transfer of Stock refers to the process of transferring ownership of stocks from one party to another within the Bronx, New York region. It involves the legal transfer of shares of stock from the current shareholder, known as the assignor, to another individual or entity, referred to as the assignee. This assignment and transfer of stock is facilitated through various legal procedures and documentation required by both parties involved. The stated procedures ensure that the transfer is completed accurately and in compliance with applicable securities laws and regulations. The Bronx, New York area witnesses a significant volume of stock trading and investment activities due to its robust financial sector. The stock market plays a vital role in the local economy, attracting numerous investors, businesses, and financial institutions. As a result, the need for assignment and transfer of stock arises frequently. There are different types of Bronx New York Assignment and Transfer of Stock methods, including: 1. Direct Transfer: This is the most common type of stock transfer, where the assignor directly assigns their shares to the assignee through a written agreement. 2. In-Trust Transfer: In certain scenarios, an assignor may transfer their shares to a trustee, typically a company or an individual, who holds and manages the shares on behalf of the assignee. 3. Gift Transfer: Stock ownership can be gifted to another individual or entity without any exchange of consideration. This type of transfer usually requires a written gift document and compliance with gift tax regulations. 4. Inheritance Transfer: When the original shareholder passes away, their shares can be transferred to their designated heirs or beneficiaries through a legally documented inheritance process. This often involves probate and estate administration procedures. Regardless of the type of assignment and transfer, all parties involved must comply with relevant laws and regulations set forth by the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and other governing bodies. In conclusion, Bronx New York Assignment and Transfer of Stock is a crucial process in the financial landscape of the region. It involves the legal transfer of ownership of stocks from one party to another and requires adherence to specific procedures and documentation. The various types of transfers, such as direct transfer, in-trust transfer, gift transfer, and inheritance transfer, cater to different circumstances and preferences of the stakeholders involved.

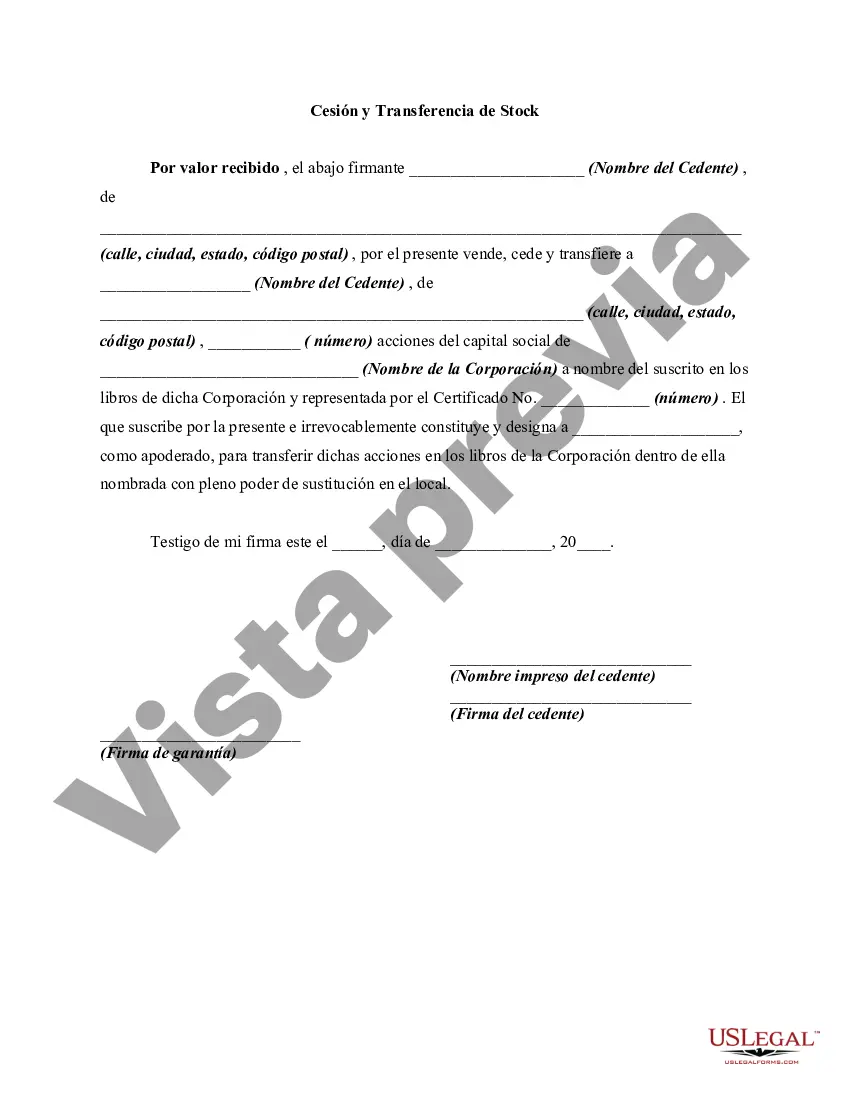

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out Bronx New York Cesión Y Transferencia De Stock?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Bronx Assignment and Transfer of Stock meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Bronx Assignment and Transfer of Stock, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Professionals check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Bronx Assignment and Transfer of Stock:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Bronx Assignment and Transfer of Stock.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!