Harris Texas Assignment and Transfer of Stock is a legal process that involves the transfer of ownership of stocks or shares from one party to another. It is a crucial element in any business acquisition, merger, or change of ownership scenario. The assignment and transfer of stock typically occurs when an individual or entity wants to either buy or sell stocks in a Texas-based company located in Harris County. This stock transfer process involves various steps and legal formalities to ensure the smooth and lawful transfer of ownership. The first step is the negotiation and agreement between the buyer and seller regarding the terms and conditions of the stock transfer. This includes determining the stock price, quantity, payment terms, and any specific agreements between the parties involved. Once the agreement is in place, the stock transfer documentation must be prepared. This includes drafting and executing a legally binding agreement, often referred to as the Stock Purchase Agreement or Stock Transfer Agreement. This agreement outlines the details of the transaction, including the names and addresses of the buyer and seller, stock information, purchase price, and any warranties or representations. In Harris Texas, there are several specific types of assignment and transfer of stock, including: 1. Private Stock Transfer: This type of transfer occurs when the stocks are being sold or transferred between private individuals or entities, typically outside a public stock exchange. It is usually subject to less regulatory scrutiny compared to public stock transfers. 2. Public Stock Transfer: Publicly traded companies allow the transfer of their stocks through public stock exchanges such as the New York Stock Exchange or NASDAQ. Public stock transfers involve compliance with various securities and exchange regulations to ensure transparency and fairness. 3. Interfamily Stock Transfer: This involves the transfer of stocks within a family, such as from a parent to a child, or between siblings. Interfamily transfers may have certain tax implications but are generally facilitated with less complexity and lower costs compared to transfers between unrelated parties. 4. Corporate Stock Transfer: When a company undergoes internal changes, such as reorganization, merger, or acquisition, the transfer of stocks between different entities within the corporate structure occurs. These transfers may require additional legal formalities and regulatory approvals. In conclusion, the Harris Texas Assignment and Transfer of Stock process involves the legal transfer of ownership of stocks from one party to another. It is an integral part of business transactions and corporate changes in Harris County, Texas. Whether it be private or public stock transfers, or those occurring within families or corporate entities, the assignment and transfer of stocks require comprehensive documentation and adherence to relevant laws and regulations.

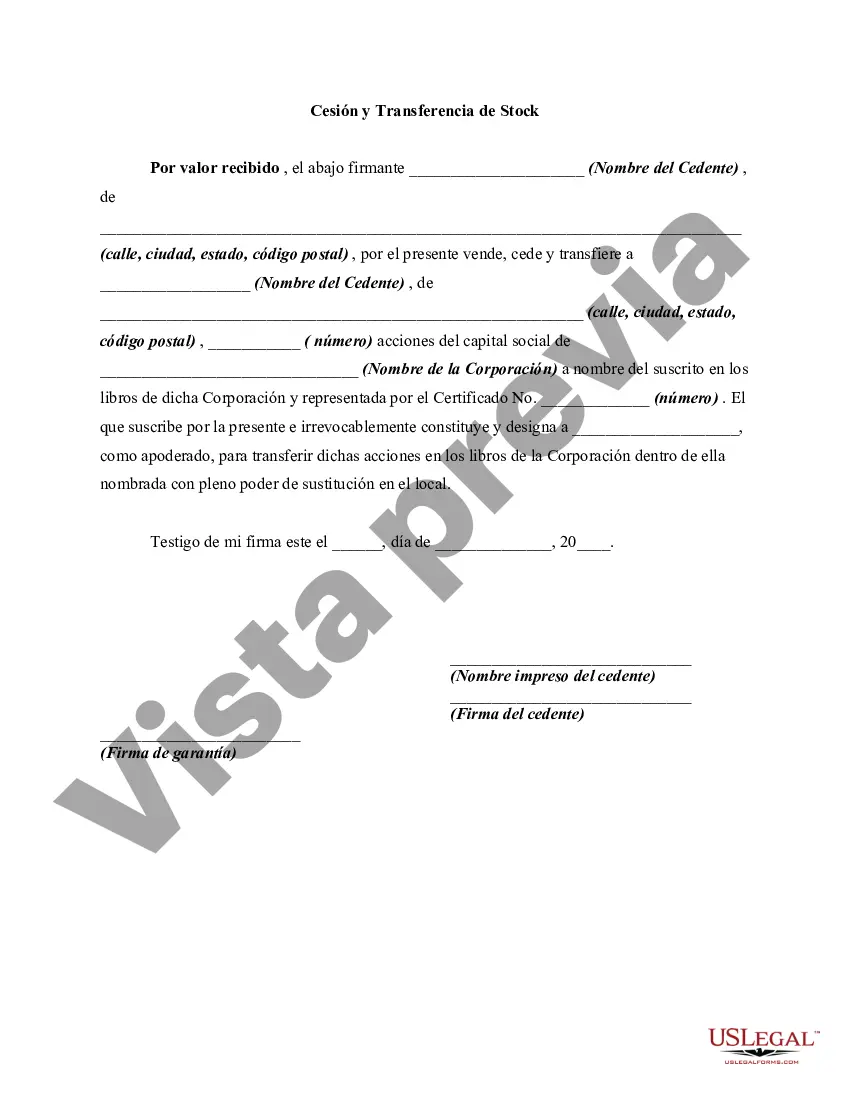

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out Harris Texas Cesión Y Transferencia De Stock?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a Harris Assignment and Transfer of Stock suiting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. In addition to the Harris Assignment and Transfer of Stock, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Harris Assignment and Transfer of Stock:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Harris Assignment and Transfer of Stock.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!