Houston Texas Assignment and Transfer of Stock: A Comprehensive Guide Introduction: Houston, Texas is home to a dynamic and thriving business environment, attracting numerous investors and companies. As with any business transaction, the Assignment and Transfer of Stock plays a crucial role in facilitating ownership changes within corporations. In this guide, we will provide a detailed description of what Houston Texas Assignment and Transfer of Stock entails, covering essential aspects and relevant keywords. Additionally, we will explore different types of stock transfer in Houston, Texas. Definition: Assignment and Transfer of Stock refers to the legal process through which ownership rights of shares in a corporation are transferred from one entity to another. This transfer is facilitated by executing necessary agreements, such as stock transfer forms or stock assignment agreements, and complying with applicable laws and regulations. Keywords: Houston Texas Assignment and Transfer of Stock, stock transfer, ownership change, corporation, legal process, stock transfer forms, stock assignment agreements, applicable laws, regulations. Key Components of Houston Texas Assignment and Transfer of Stock: 1. Stock Transfer Forms: When transferring stock in Houston, Texas, one of the fundamental elements is executing stock transfer forms. These forms document the transfer details such as the names of both the transferor (seller) and the transferee (buyer), the number of shares being transferred, and any relevant considerations or prices involved. Keywords: stock transfer forms, transfer details, transferor, transferee, number of shares, considerations, prices. 2. Stock Assignment Agreements: In some cases, especially for larger corporations or complex stock transactions, a stock assignment agreement may be utilized. This is a legally binding contract that outlines the terms and conditions of the stock transfer, including any warranties or representations made by the transferor. Keywords: stock assignment agreements, contract, terms, conditions, warranties, representations. 3. Compliance with Laws and Regulations: Houston, Texas has specific laws and regulations governing the Assignment and Transfer of Stock. It is crucial for all parties involved to ensure compliance with these legal requirements. For example, certain transfers may require approvals from regulatory bodies or adherence to specific corporate bylaws. Keywords: compliance, laws, regulations, legal requirements, approvals, regulatory bodies, corporate bylaws. Different Types of Assignment and Transfer of Stock in Houston, Texas: 1. Internal Stock Transfer: This type of transfer occurs within a corporation, typically when transferring shares between existing shareholders or within a family-owned business. It may involve the transfer of stock from one shareholder to another or a change in the ownership structure due to corporate reorganization. Keywords: internal stock transfer, existing shareholders, family-owned business, ownership structure, corporate reorganization. 2. External Stock Transfer: External stock transfers involve the sale or transfer of shares to external individuals, entities, or investors outside the existing shareholder base. This often occurs during mergers, acquisitions, or when founders/owners decide to sell a portion of their shares to raise capital or exit the business. Keywords: external stock transfer, sale, transfer, external individuals, entities, investors, mergers, acquisitions, founders, owners, raise capital, exit the business. 3. Restricted Stock Transfer: Restricted stock transfers refer to the transfer of stocks that are subject to certain restrictions imposed by the corporation or regulatory bodies. These restrictions may include holding periods, limitations on transferability, or rights of first refusal. Keywords: restricted stock transfer, restrictions, holding periods, limitations, transferability, rights of first refusal. Conclusion: The Assignment and Transfer of Stock in Houston, Texas is a vital process that facilitates ownership changes in corporations. Understanding the key components and different types of stock transfer can help individuals and businesses navigate this process successfully. Compliance with applicable laws and regulations is crucial for a secure and legally valid transfer. It is advisable to consult legal professionals or experienced advisors familiar with Texas corporate laws for guidance throughout the stock transfer process.

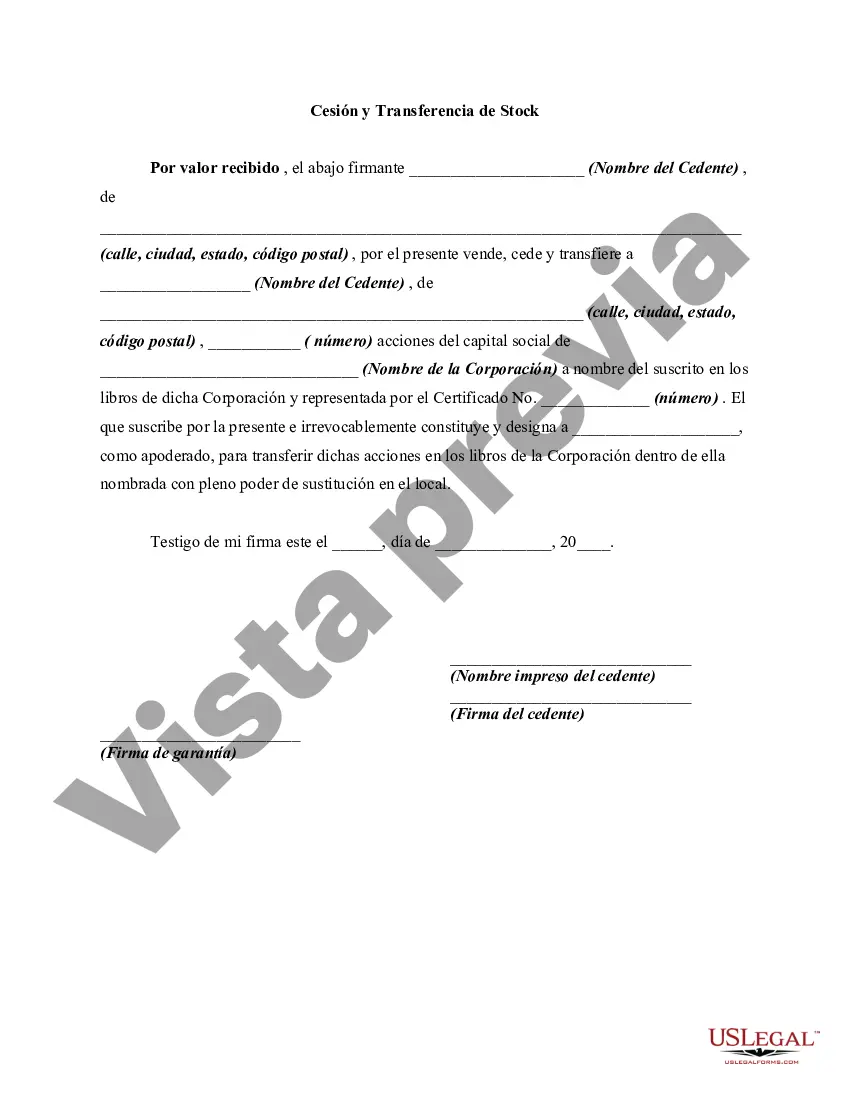

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out Houston Texas Cesión Y Transferencia De Stock?

Preparing documents for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Houston Assignment and Transfer of Stock without professional help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Houston Assignment and Transfer of Stock by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Houston Assignment and Transfer of Stock:

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!