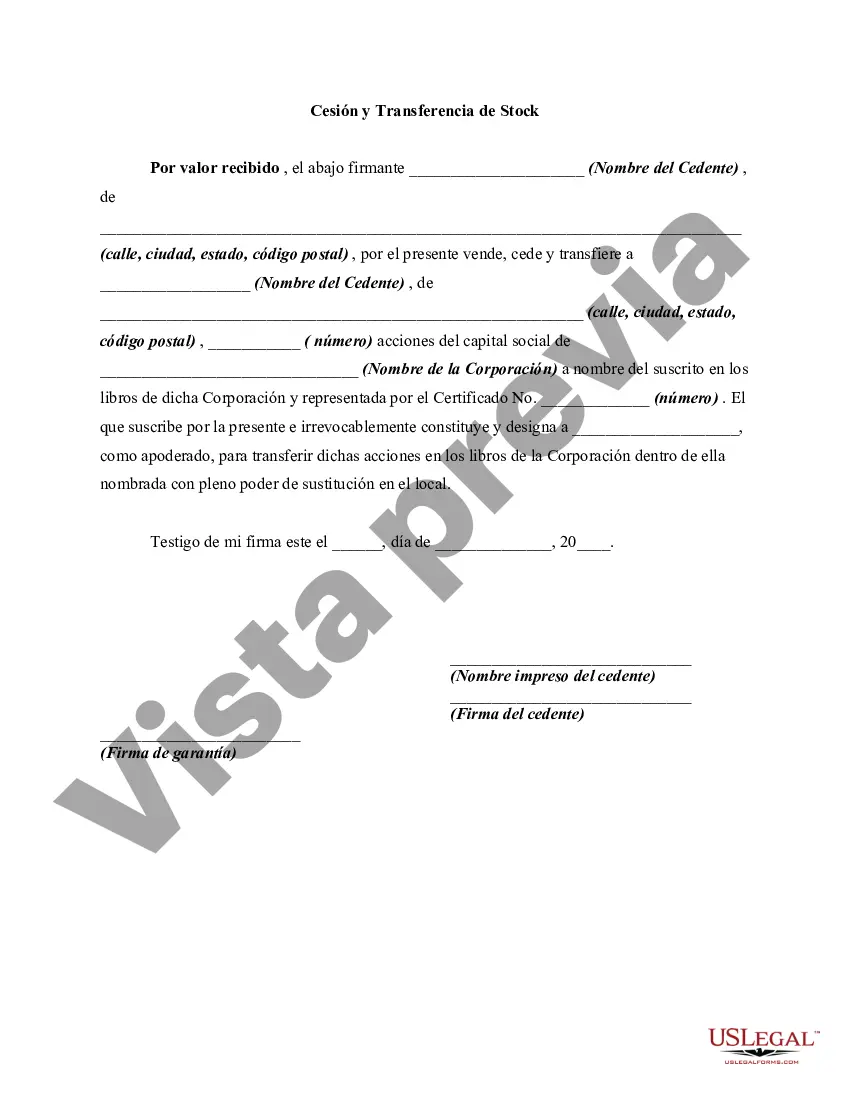

King Washington Assignment and Transfer of Stock is a legal process that involves the transfer of ownership and rights of shares in a company. This assignment and transfer of stock is commonly executed when an individual or entity wishes to sell, gift, or assign their stocks to another party. It acts as a legally binding agreement between the parties involved, ensuring a smooth and transparent transaction. The King Washington Assignment and Transfer of Stock can take various forms depending on the specific circumstances. Here are some different types of assignment and transfer of stock: 1. Direct Transfer: In this type, the owner directly transfers their ownership rights and shares to another party. This can occur through a simple agreement, where both parties agree to terms and conditions for the transfer. 2. Assignment for Consideration: This type of transfer involves a sale or exchange of shares for monetary consideration. The assignee pays a specific amount to acquire the stocks from the assignor. 3. Gift Assignment: Sometimes, an individual may choose to gift their stocks to someone without any monetary consideration. In this case, the assignor transfers the stocks as a gift, without any expectation of compensation. 4. Assignment with Restrictions: In certain cases, the assignment and transfer of stock may include specific restrictions or conditions. For example, the assignee may be restricted from selling or transferring the stocks for a specific period or may have limitations on voting rights. It is essential to follow the proper legal procedures and guidelines outlined by the company, as well as adhere to relevant securities laws and regulations during the King Washington Assignment and Transfer of Stock process. The assignment and transfer of stock typically involves several important elements, including the names and contact details of the assignor and assignee, the number and class of shares being transferred, the consideration or value involved, and any specific terms and conditions agreed upon. To execute the assignment and transfer of stock, various documents may be required, such as stock certificates, stock power, assignment agreements, and disclosure statements. These documents should be duly completed, signed, and witnessed to ensure their legal validity. In conclusion, King Washington Assignment and Transfer of Stock is a significant legal process for transferring ownership and rights of shares in a company. Whether it's a direct transfer, assignment for consideration, gift assignment, or assignment with restrictions, proper documentation and compliance with legal requirements are crucial to ensure a legally binding and transparent transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out King Washington Cesión Y Transferencia De Stock?

Are you looking to quickly create a legally-binding King Assignment and Transfer of Stock or maybe any other form to manage your own or corporate matters? You can go with two options: hire a professional to write a valid paper for you or create it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you get professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-compliant form templates, including King Assignment and Transfer of Stock and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, carefully verify if the King Assignment and Transfer of Stock is tailored to your state's or county's regulations.

- In case the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search again if the document isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the King Assignment and Transfer of Stock template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the templates we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!