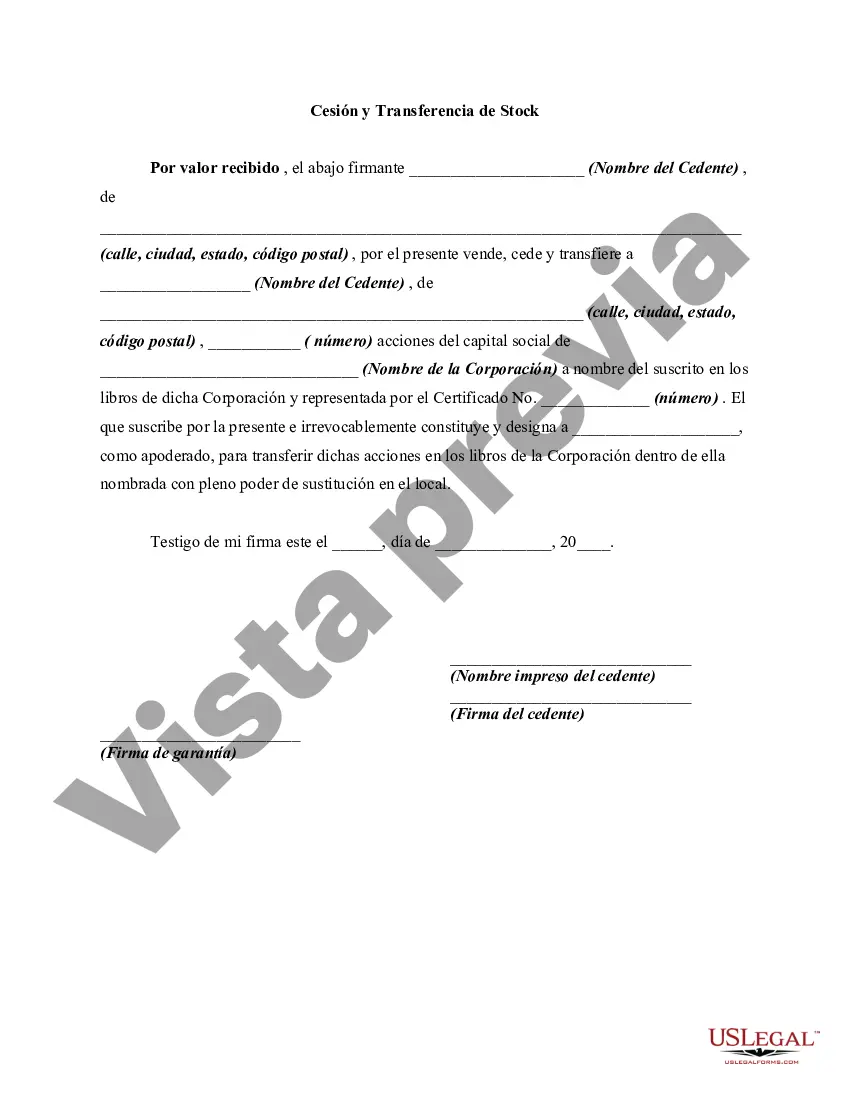

Maricopa, Arizona Assignment and Transfer of Stock: A Comprehensive Overview In the realm of business and finance, Maricopa, Arizona Assignment and Transfer of Stock refer to the legal processes involved in transferring ownership or assigning shares of a company to another individual or entity. This detailed description aims to shed light on the various aspects, procedures, and types of assignment and transfer of stock that exist in Maricopa, Arizona. 1. Definition of Maricopa, Arizona Assignment and Transfer of Stock: The assignment and transfer of stock in Maricopa, Arizona, entail the formal transfer of ownership rights and responsibilities regarding shares of a corporation or company from one party (assignor) to another (assignee). It signifies a pivotal event in the life of an enterprise and is governed by both state and federal laws. 2. Key Players Involved: a. Assignor: The current owner of the stock who intends to transfer or assign ownership rights to another party. b. Assignee: The prospective buyer or recipient of the assigned or transferred stock. c. Corporation or Company: The legal entity issuing the stock and overseeing the transfer process. d. Transfer Agent: A financial institution or individual responsible for facilitating the stock transfer by updating ownership records and issuing new stock certificates. 3. Processes Involved: a. Stock Assignment: The process of assigning ownership rights of stock to another party, either voluntarily or involuntarily. This assignment must comply with the corporation's articles of incorporation, bylaws, and applicable state and federal laws. b. Stock Transfer: The act of transferring ownership of stock from one party to another. This usually involves the physical or electronic transfer of stock certificates and updating the ownership records with the corporation's transfer agent. 4. Types of Maricopa, Arizona Assignment and Transfer of Stock: a. Voluntary Assignment: This occurs when the stockholder willingly transfers their shares to another party, possibly due to personal or financial reasons. b. Involuntary Assignment: In certain cases, stock may be involuntarily assigned, typically due to legal actions such as bankruptcy, foreclosure, or court-ordered transfers. c. Gift Transfer: Stock can be transferred as a gift from one party to another. This usually requires completion of relevant gift tax documentation according to federal and state regulations. d. Inheritance and Estate Transfers: Upon the demise of a stockholder, their shares may be inherited by beneficiaries as part of an estate distribution process. 5. Legal and Documentation Requirements: a. Stock Assignment Agreement: A legally binding contract between the assignor and assignee, outlining the terms and conditions of the stock assignment. b. Stock Power Form: A legal document signed by the assignor, transferring the ownership rights to the assignee. c. Stock Transfer Form: A document used to record the transfer of stock and update ownership records with the corporation's transfer agent. d. Relevant State and Federal Forms: Depending on the nature of the transfer, additional documentation may be required to comply with tax laws, such as federal gift tax forms or estate tax forms. In conclusion, Maricopa, Arizona Assignment and Transfer of Stock involve the intricate processes of transferring ownership rights and responsibilities for shares of a corporation. This detailed description provides an overview of the concept, including the key players involved, processes, and various types of assignments and transfers that can occur in Maricopa, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

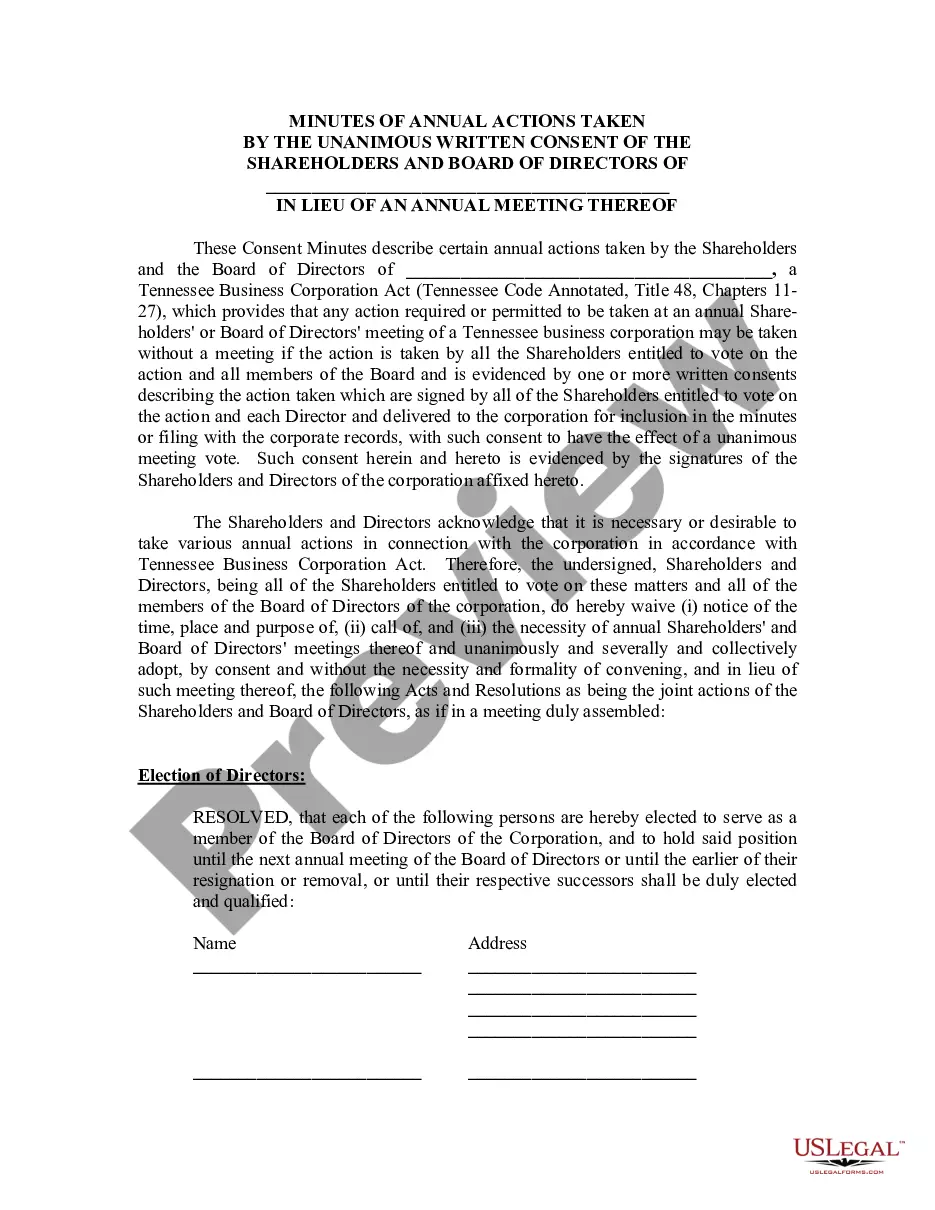

How to fill out Maricopa Arizona Cesión Y Transferencia De Stock?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Maricopa Assignment and Transfer of Stock meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. In addition to the Maricopa Assignment and Transfer of Stock, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Maricopa Assignment and Transfer of Stock:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Maricopa Assignment and Transfer of Stock.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!