Phoenix Arizona Assignment and Transfer of Stock is a legal document that facilitates the transfer of stock ownership from one party to another in the state of Arizona. It outlines the terms and conditions under which the transfer takes place, ensuring a smooth and legally binding transaction. This document is crucial in business dealings and is commonly used when individuals or entities want to buy or sell shares in a company based in Phoenix, Arizona. The Assignment and Transfer of Stock document typically includes important details such as the names and addresses of both the buyer and the seller, the stock identification number, the number of shares being transferred, and the purchase price or consideration for the transfer. It also contains specific representations and warranties made by both parties, ensuring that the stock is being transferred without any liens, encumbrances, or legal issues. There can be different types of Assignment and Transfer of Stock in Phoenix, Arizona, depending on the nature of the transaction or the parties involved. Some common types include: 1. Private Sale: This occurs when stockholders negotiate and transfer shares directly to another individual or entity. Both parties typically enter into a stock purchase agreement, which details the terms of the sale. 2. Public Offering: Also known as an Initial Public Offering (IPO), this type of transfer occurs when a private company goes public and issues shares to the public for the first time. The assignment and transfer of stock in an IPO requires compliance with various federal and state securities laws. 3. Merger or Acquisition: In cases where a company merges with or is acquired by another entity, the stockholders may need to assign and transfer their shares as part of the transaction. Such transfers usually require careful consideration and legal assistance. 4. Inheritance or Gift: Assignment and transfer of stock can also occur when shares are passed down through inheritance or given as a gift. Specific documentation, such as a will or gift deed, may be required to transfer ownership rights properly. It is important to note that the exact requirements and procedures for Assignment and Transfer of Stock in Phoenix, Arizona may vary depending on the specific circumstances and the company involved. Seeking legal guidance and advice is highly recommended ensuring compliance with all relevant laws and regulations.

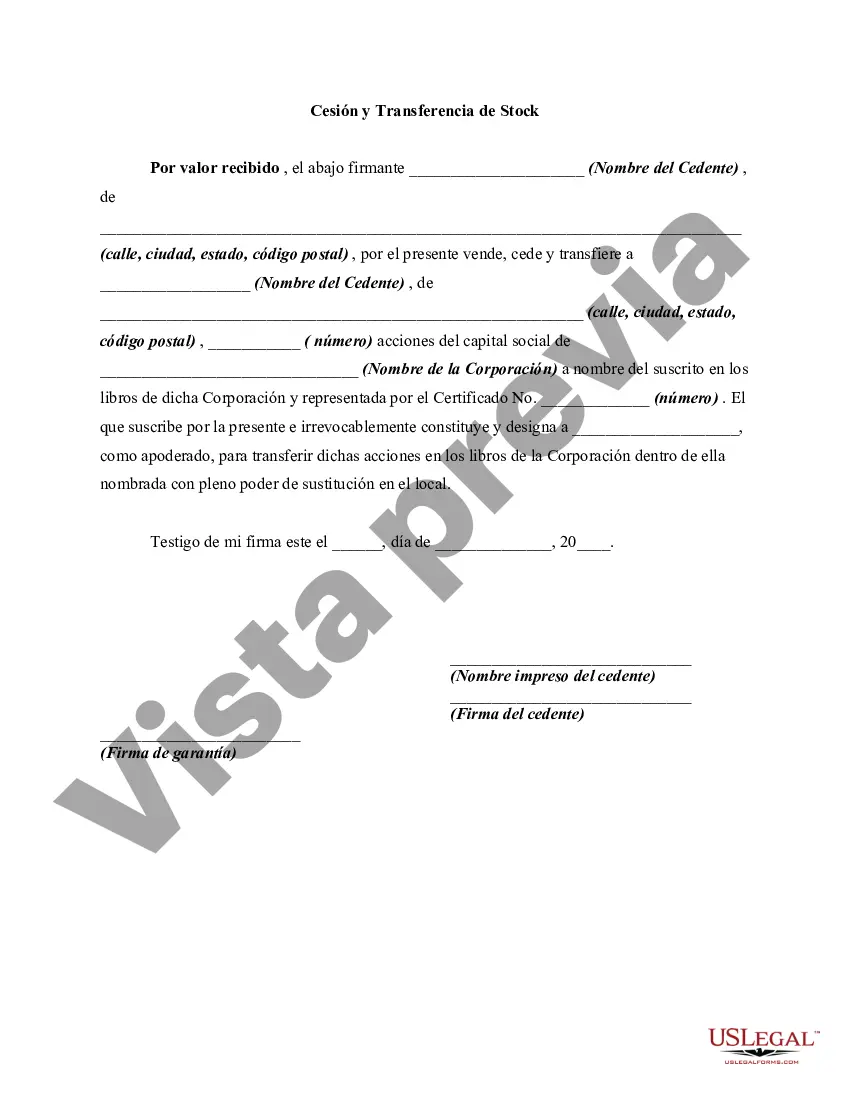

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out Phoenix Arizona Cesión Y Transferencia De Stock?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Phoenix Assignment and Transfer of Stock, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Phoenix Assignment and Transfer of Stock from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Phoenix Assignment and Transfer of Stock:

- Analyze the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!