San Bernardino, California, is a city located in the Inland Empire region of Southern California. It is the county seat of San Bernardino County and is known for its diverse population, vibrant culture, and strategic location. The Assignment of Accounts Receivable is a legal and financial term that encompasses the transfer of an entity's accounts receivable to another party. An Assignment of Accounts Receivable allows businesses to sell their unpaid invoices or outstanding debts to a third party, typically a financial institution or factoring company. This transaction enables businesses to convert their accounts receivable into immediate cash flow, which can be crucial for their operational and financial needs. By assigning their accounts receivable, businesses can accelerate their working capital and address liquidity concerns. Certain types of Assignment of Accounts Receivable in San Bernardino, California, include: 1. Recourse Assignment of Accounts Receivable: This type of assignment places the ultimate liability for payment on the business itself. If the debtor fails to fulfill their obligations, the assignor (business owner) remains responsible and must repurchase the account from the assignee (financial institution). 2. Non-Recourse Assignment of Accounts Receivable: In this type of assignment, the assignee takes on the risk of non-payment from the debtors. If the debtor fails to fulfill their obligations, the assignee will absorb the loss, without recourse to the assignor. 3. Notification Assignment of Accounts Receivable: This type of assignment requires notifying the debtors that their accounts have been assigned to a third party. The assignee collects payments directly from the debtors, removing the business owner's involvement in the process. 4. Factoring Assignment of Accounts Receivable: Factoring involves the outright purchase of accounts receivable at a discounted rate. The factoring company assumes control of collecting payments from the debtors and manages the entire accounts receivable process on behalf of the business. In San Bernardino, California, businesses can explore various options for assigning their accounts receivable to optimize cash flow, reduce financial risks, and maintain healthy working capital. It is essential for businesses to understand the specific terms and conditions associated with each type of assignment, ensuring they choose the most suitable option for their unique needs and circumstances.

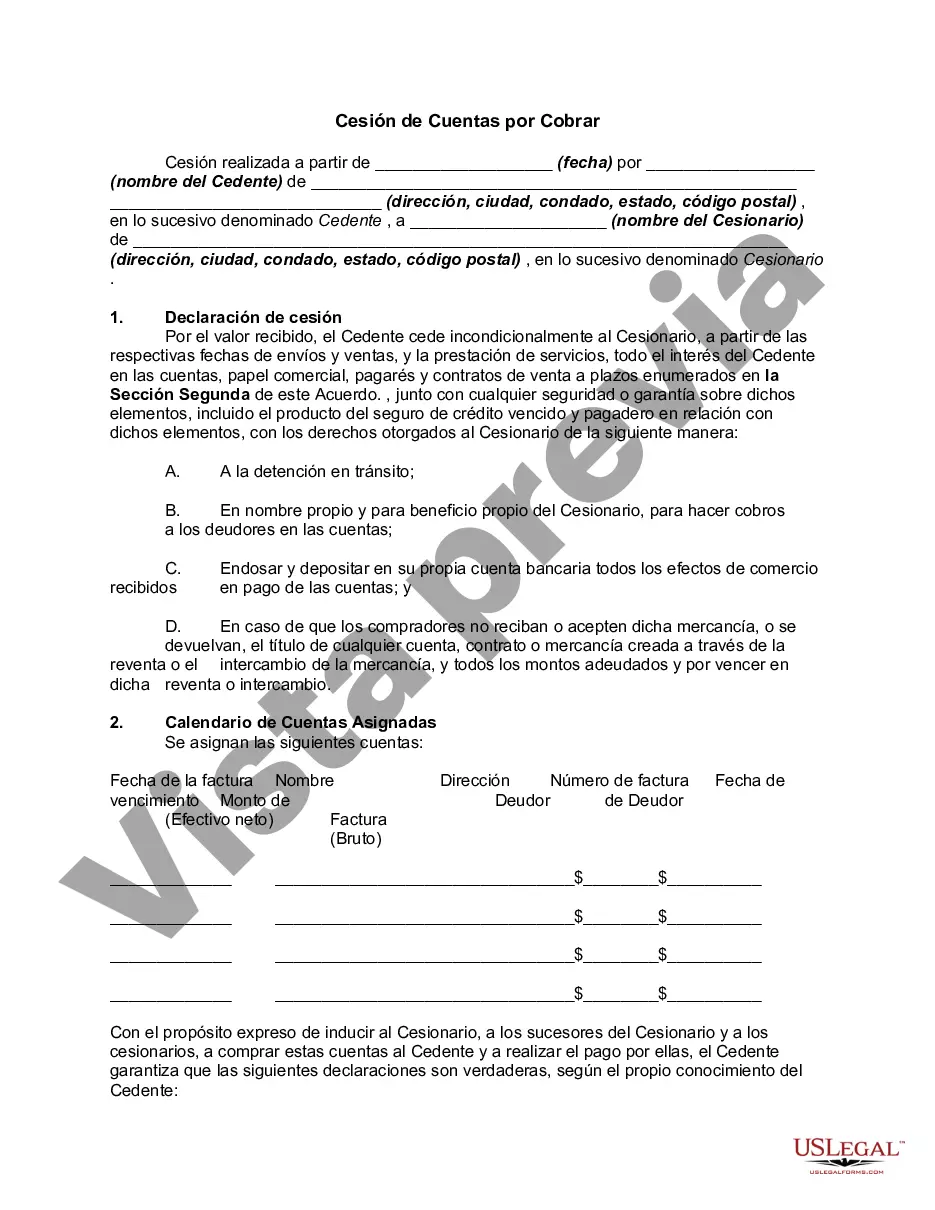

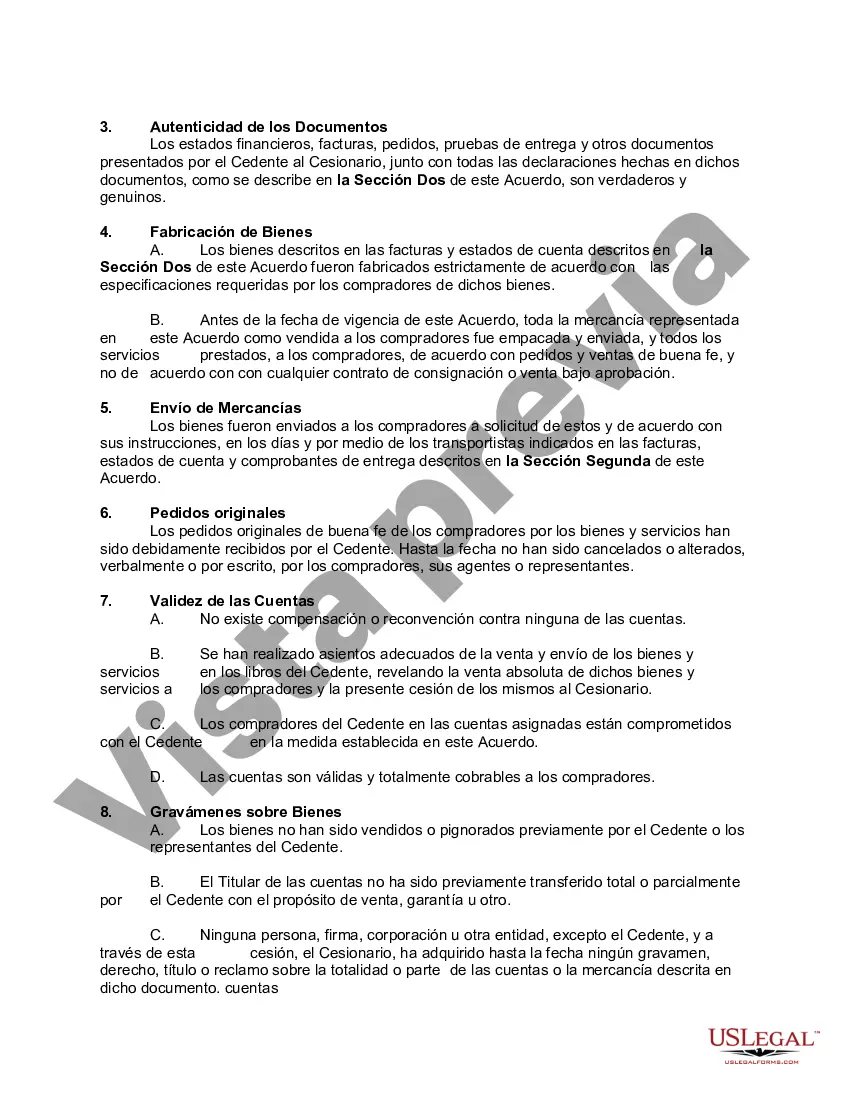

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Bernardino California Cesión de Cuentas por Cobrar - Assignment of Accounts Receivable

Description

How to fill out San Bernardino California Cesión De Cuentas Por Cobrar?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business purpose utilized in your county, including the San Bernardino Assignment of Accounts Receivable.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the San Bernardino Assignment of Accounts Receivable will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the San Bernardino Assignment of Accounts Receivable:

- Ensure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the San Bernardino Assignment of Accounts Receivable on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!