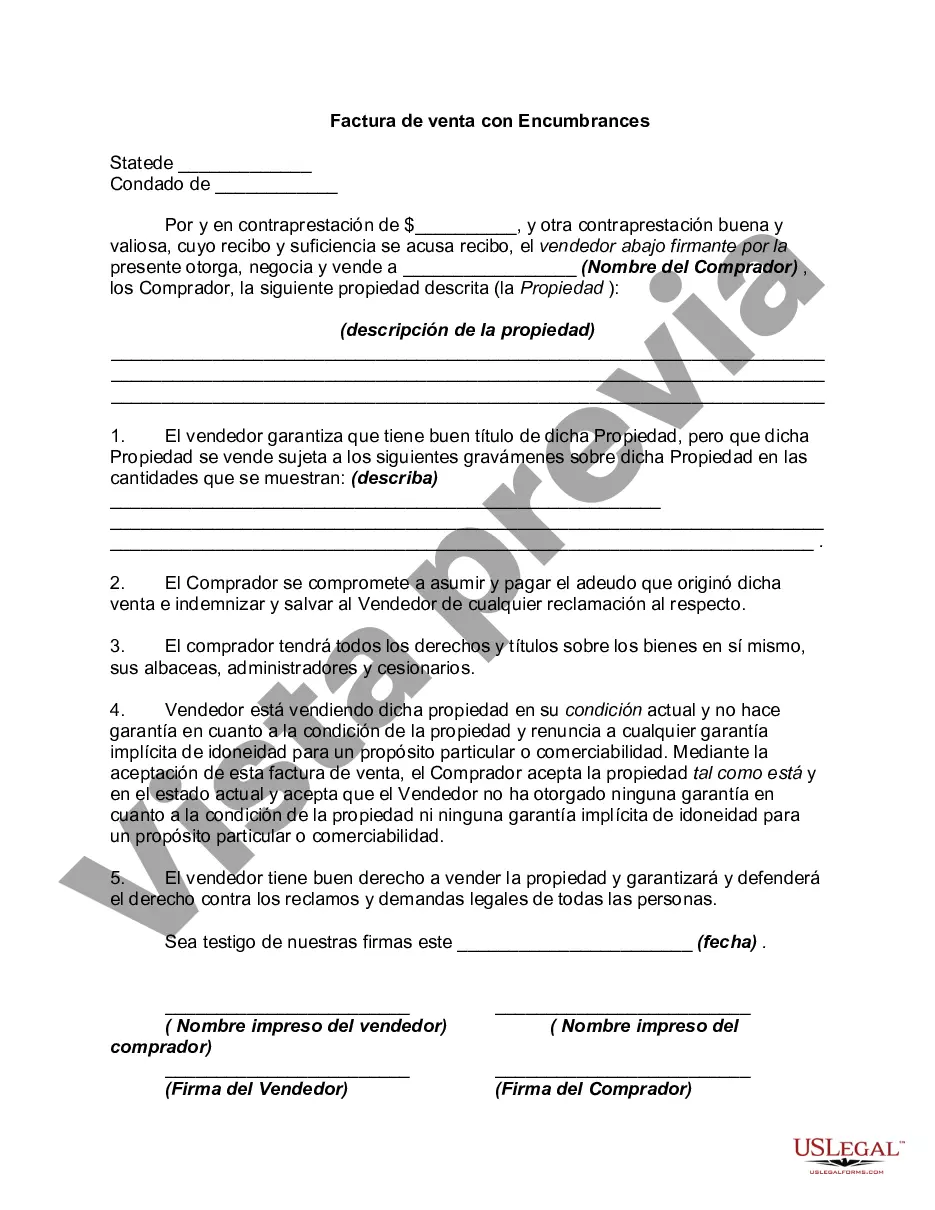

A Bill of Sale with encumbrances means that whatever product is being sold has some sort of lien, mortgage, or monies owing, and the Buyer is agreeing that they will take on these obligations upon purchase.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding the Houston Texas Bill of Sale with Encumbrances: Types and Detailed Description Introduction: The Houston Texas Bill of Sale with Encumbrances is a legal document used when transferring ownership of a property that has a lien or encumbrance attached to it. This article provides a comprehensive overview of this document, its purposes, the types available, and the key elements typically included. Key Terms/Keywords: Houston Texas Bill of Sale, Encumbrances, Lien, Property Ownership Transfer, Legal Document, Types. 1. Purpose of the Houston Texas Bill of Sale with Encumbrances: The Houston Texas Bill of Sale with Encumbrances serves as a safeguard for both the buyer and the seller during the transaction process. It outlines the conditions under which a property is being sold, ensuring that all parties involved have a clear understanding of any liens or encumbrances associated with the property. 2. Types of Houston Texas Bill of Sale with Encumbrances: a. General Bill of Sale with Encumbrances: This type of bill of sale is commonly used for various personal properties, such as vehicles or equipment, that have encumbrances, such as outstanding loans or leases. b. Real Estate Bill of Sale with Encumbrances: This type of bill of sale is specifically designed for the sale of real estate properties where there may be existing liens, mortgages, or other encumbrances affecting the title. 3. Detailed Description of the Houston Texas Bill of Sale with Encumbrances: a. Identification of Parties: The bill of sale includes the legal names and contact information of both the buyer and seller, identifying their roles in the transaction. b. Property Description: A detailed description of the property being sold, including its address, legal description, and unique identifiers if applicable. c. Disclosure of Encumbrances: It explicitly highlights any existing encumbrances, such as mortgages, liens, or claims against the property's title, ensuring the buyer is fully aware of them before completing the purchase. d. Terms and Conditions: The document includes terms and conditions regarding the sale, such as the purchase price, payment method, and any other relevant agreements negotiated between the parties. e. Seller's Representations and Warranties: The seller provides assurances regarding their ownership rights to the property, guaranteeing that there are no additional undisclosed encumbrances apart from those explicitly stated in the bill of sale. f. Signatures and Notarization: The bill of sale requires both buyer and seller signatures, indicating their agreement to the terms outlined. Additionally, notarization may be required to authenticate the document as a legally binding agreement. Conclusion: Understanding the Houston Texas Bill of Sale with Encumbrances is crucial for anyone involved in property transactions affected by liens or encumbrances. By utilizing this legal document, both the buyer and seller can ensure a transparent and secure transfer of ownership. Whether it is a General Bill of Sale or a Real Estate Bill of Sale, comprehending the intricacies of these documents is essential for a smooth transaction process.Title: Understanding the Houston Texas Bill of Sale with Encumbrances: Types and Detailed Description Introduction: The Houston Texas Bill of Sale with Encumbrances is a legal document used when transferring ownership of a property that has a lien or encumbrance attached to it. This article provides a comprehensive overview of this document, its purposes, the types available, and the key elements typically included. Key Terms/Keywords: Houston Texas Bill of Sale, Encumbrances, Lien, Property Ownership Transfer, Legal Document, Types. 1. Purpose of the Houston Texas Bill of Sale with Encumbrances: The Houston Texas Bill of Sale with Encumbrances serves as a safeguard for both the buyer and the seller during the transaction process. It outlines the conditions under which a property is being sold, ensuring that all parties involved have a clear understanding of any liens or encumbrances associated with the property. 2. Types of Houston Texas Bill of Sale with Encumbrances: a. General Bill of Sale with Encumbrances: This type of bill of sale is commonly used for various personal properties, such as vehicles or equipment, that have encumbrances, such as outstanding loans or leases. b. Real Estate Bill of Sale with Encumbrances: This type of bill of sale is specifically designed for the sale of real estate properties where there may be existing liens, mortgages, or other encumbrances affecting the title. 3. Detailed Description of the Houston Texas Bill of Sale with Encumbrances: a. Identification of Parties: The bill of sale includes the legal names and contact information of both the buyer and seller, identifying their roles in the transaction. b. Property Description: A detailed description of the property being sold, including its address, legal description, and unique identifiers if applicable. c. Disclosure of Encumbrances: It explicitly highlights any existing encumbrances, such as mortgages, liens, or claims against the property's title, ensuring the buyer is fully aware of them before completing the purchase. d. Terms and Conditions: The document includes terms and conditions regarding the sale, such as the purchase price, payment method, and any other relevant agreements negotiated between the parties. e. Seller's Representations and Warranties: The seller provides assurances regarding their ownership rights to the property, guaranteeing that there are no additional undisclosed encumbrances apart from those explicitly stated in the bill of sale. f. Signatures and Notarization: The bill of sale requires both buyer and seller signatures, indicating their agreement to the terms outlined. Additionally, notarization may be required to authenticate the document as a legally binding agreement. Conclusion: Understanding the Houston Texas Bill of Sale with Encumbrances is crucial for anyone involved in property transactions affected by liens or encumbrances. By utilizing this legal document, both the buyer and seller can ensure a transparent and secure transfer of ownership. Whether it is a General Bill of Sale or a Real Estate Bill of Sale, comprehending the intricacies of these documents is essential for a smooth transaction process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.