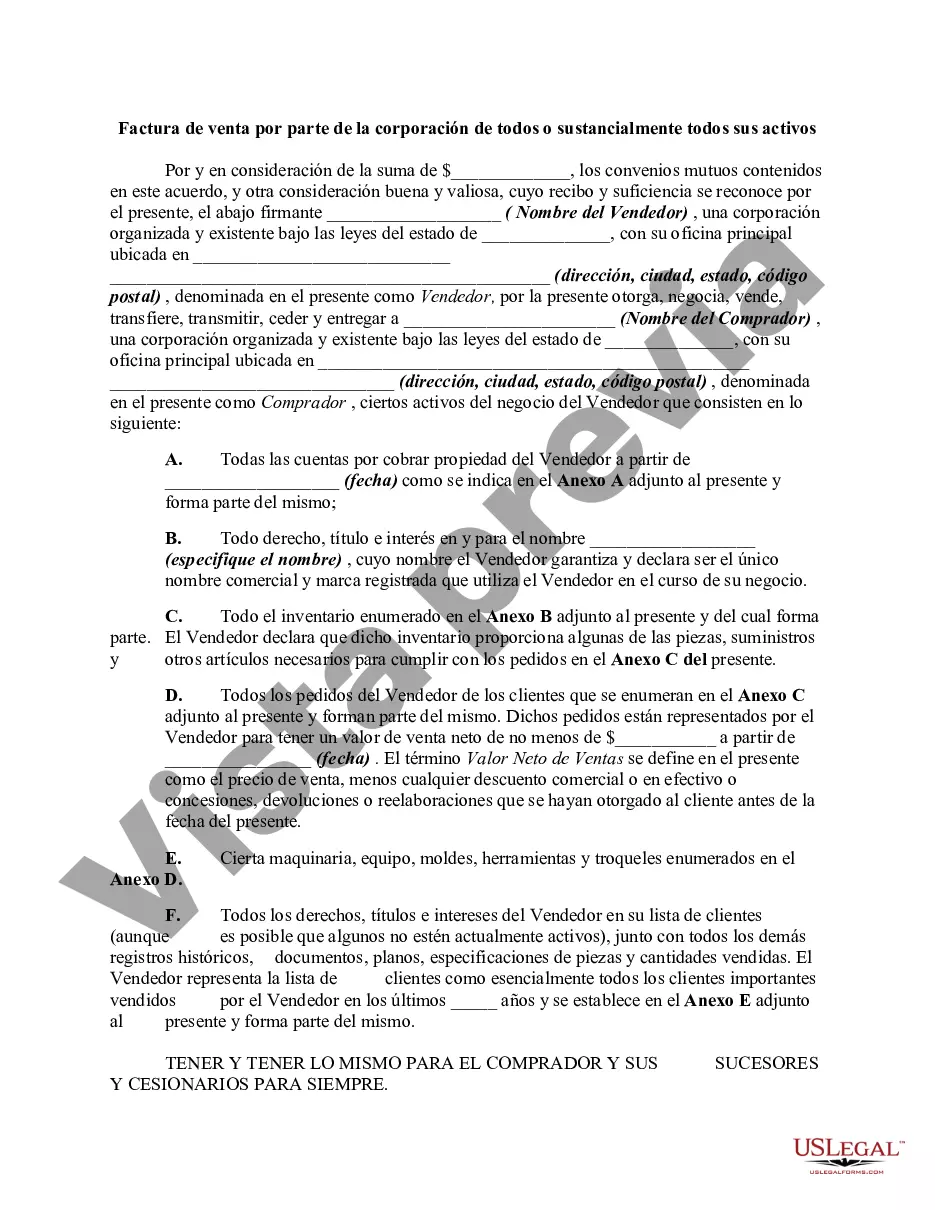

A San Diego California Bill of Sale by Corporation of all or Substantially all of its Assets is a legal document that serves as evidence of the transfer of ownership of a corporation's assets to another party. This type of bill of sale is commonly used in business transactions, mergers, acquisitions, or when a corporation is winding up its affairs. The key purpose of this document is to outline the terms and conditions of the asset sale, ensuring transparency and protection for both the corporation and the buyer. It provides a complete description of the assets being sold, including their identification, quantity, quality, condition, and any associated liabilities or encumbrances. The San Diego California Bill of Sale by Corporation of all or Substantially all of its Assets typically includes the following key elements: 1. Parties Involved: The document will identify the corporation, acting as the seller, and the buyer involved in the transaction. The legal names and addresses of both parties must be included for clarity. 2. Asset Description: A detailed description of the assets being sold is provided, including real estate, equipment, inventory, intellectual property, contracts, licenses, or any other tangible or intangible assets included in the sale. 3. Purchase Price: The agreed-upon purchase price for the assets is stated in the bill of sale. It may be a lump sum payment or broken down into installments, with specific payment terms and due dates. 4. Representations and Warranties: Both parties may include representations and warranties to protect their interests. The seller may warrant that they have clear title to the assets being sold and that they are free from any liens or encumbrances. The buyer may include provisions requiring the seller to disclose all known information about the assets that could impact their value or future performance. 5. Assumption of Liabilities: The bill of sale may clarify whether the buyer will assume any liabilities or debts associated with the assets. This may include outstanding loans, warranties, or legal claims. Alternatively, the agreement may specify that the seller will retain responsibility for any outstanding liabilities. 6. Governing Law: The bill of sale will mention the applicable law in San Diego, California, that governs the interpretation, validity, and enforcement of the agreement. Types of San Diego California Bill of Sale by Corporation of all or Substantially all of its Assets: 1. General Bill of Sale: This is the most common type of bill of sale and covers the transfer of all corporate assets to a buyer, including tangible and intangible assets. 2. Specialized Bill of Sale: In certain cases, when the corporation only intends to sell specific types of assets, such as intellectual property rights (patents, trademarks, copyrights), real estate, or equipment, a specialized bill of sale may be used. These specific types of bill of sale documents may include additional provisions and legal requirements. It is crucial to consult with an experienced corporate attorney to ensure that the San Diego California Bill of Sale by Corporation of all or Substantially all of its Assets accurately reflects the intentions and protects the rights of both parties involved in the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Factura de venta por parte de la corporación de todos o sustancialmente todos sus activos - Bill of Sale by Corporation of all or Substantially all of its Assets

Description

How to fill out San Diego California Factura De Venta Por Parte De La Corporación De Todos O Sustancialmente Todos Sus Activos?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the San Diego Bill of Sale by Corporation of all or Substantially all of its Assets, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Consequently, if you need the latest version of the San Diego Bill of Sale by Corporation of all or Substantially all of its Assets, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Diego Bill of Sale by Corporation of all or Substantially all of its Assets:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your San Diego Bill of Sale by Corporation of all or Substantially all of its Assets and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!