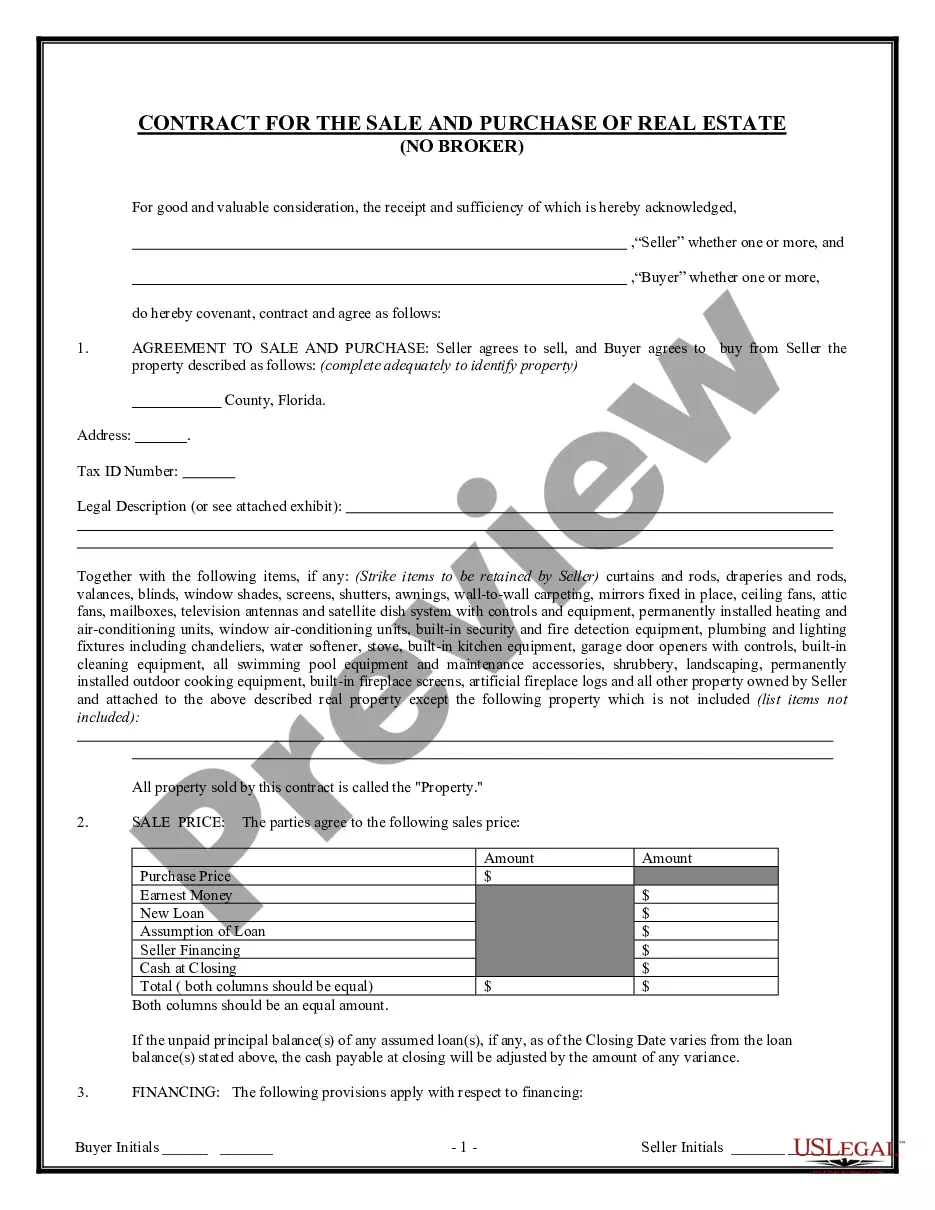

The Dallas Texas Convertible Note Agreement is a legal contract that outlines the terms and conditions under which a convertible note is issued and obtained in Dallas, Texas. This agreement is commonly used by startup companies to secure funding from investors. A Convertible Note Agreement is a financial instrument that offers investors the option to convert their debt investment into equity in the company at a later date. This allows the investor to initially lend money to the company and then convert this debt into ownership if certain conditions, typically a future equity financing round, are met. There are several types of Convertible Note Agreements used in Dallas, Texas: 1. pre-Roman valuation agreement: This type determines the value of the startup before the convertible note is issued. It influences the conversion price and the number of shares an investor will receive upon conversion. 2. Interest rate and maturity date agreement: This specifies the interest rate at which the convertible note will accrue interest and the maturity date at which the note becomes due and payable, if not converted. 3. Conversion discount agreement: This agreement provides investors with a discounted conversion price compared to the price paid by future investors in equity financing rounds. It rewards early investors for taking on the risk in the early stages of the startup. 4. Valuation cap agreement: This sets a maximum valuation at which the convertible note can convert into equity. It protects investors from potentially overpaying in a future funding round and ensures they receive a fair equity stake. 5. Non-disparagement clause: This clause prohibits the company and the investor from making negative statements or damaging the reputation of each other. It promotes a positive working relationship between the parties involved. 6. Non-disclosure agreement (NDA): This agreement ensures that sensitive information shared between the company and the investor remains confidential and is not disclosed to third parties. Overall, the Dallas Texas Convertible Note Agreement is a vital financial instrument that facilitates fundraising for startups in the Dallas area. It provides flexibility to both the company and the investor, offering an alternative to traditional equity investment, while protecting the interests of both parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Contrato de Nota Convertible - Convertible Note Agreement

Description

How to fill out Dallas Texas Contrato De Nota Convertible?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Dallas Convertible Note Agreement, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types ranging from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find detailed materials and tutorials on the website to make any tasks related to paperwork execution simple.

Here's how to find and download Dallas Convertible Note Agreement.

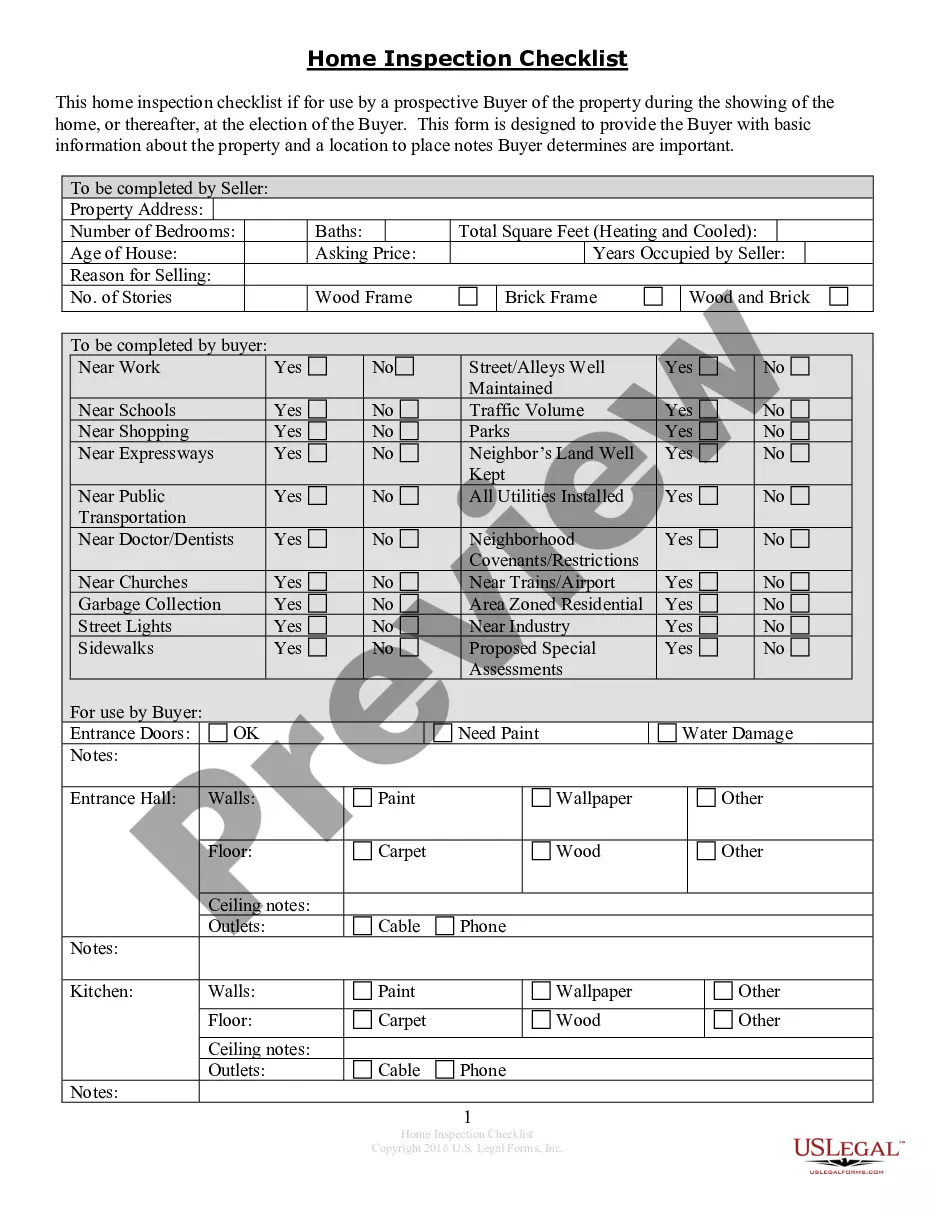

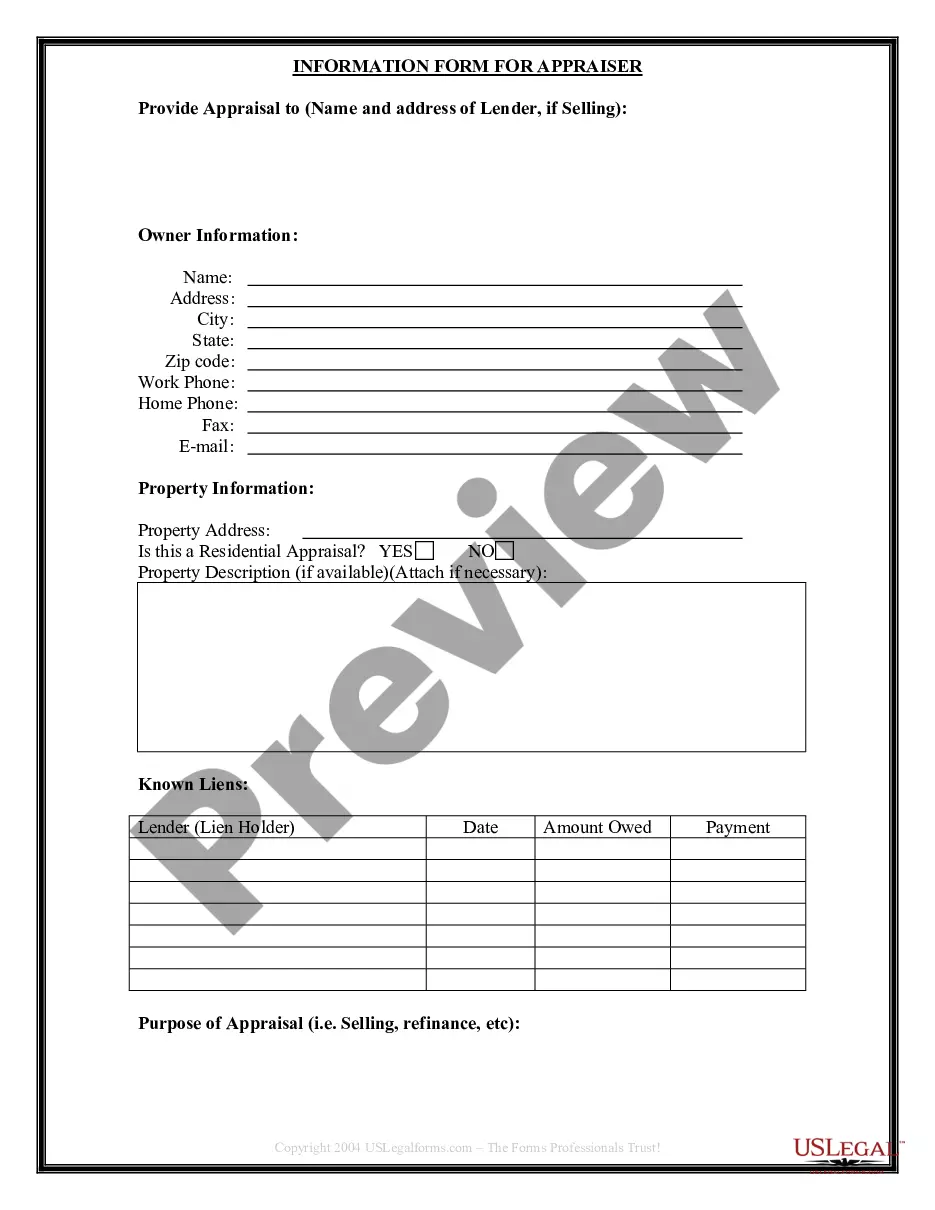

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the validity of some records.

- Check the related forms or start the search over to find the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Dallas Convertible Note Agreement.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Dallas Convertible Note Agreement, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you have to cope with an exceptionally challenging case, we recommend using the services of a lawyer to examine your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and get your state-specific paperwork effortlessly!