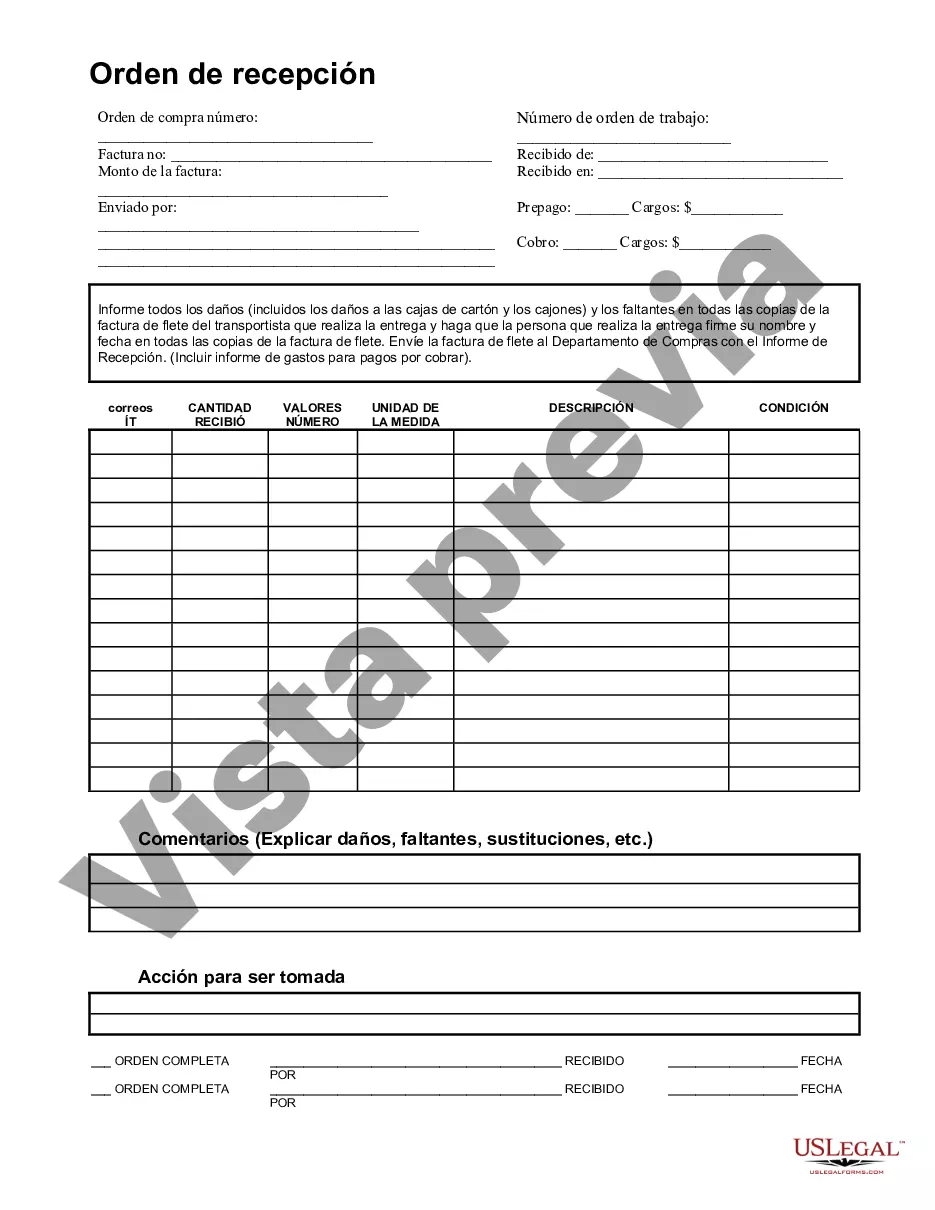

Collin Texas Receiving Order is a legal document issued by the Collin County Court in Texas that grants certain powers to a receiver appointed by the court. This order authorizes the receiver to take custody and control over a specific property or assets for the purpose of preservation, maintenance, and management. The Collin Texas Receiving Order is typically sought by plaintiffs or creditors who have filed a lawsuit and have obtained a judgment against a debtor or defendant. The order is used to enforce the judgment and ensure that the debtor's assets are properly managed and protected during the legal proceedings. There are different types of Collin Texas Receiving Orders that can be issued depending on the specific circumstances of the case. Some common types include: 1. General Receiving Order: This type of receiving order is issued when the receiver is given broad powers to manage and control all or a significant portion of the debtor's assets until the debt is paid off or the court order is lifted. 2. Specific Asset Receiving Order: This order is issued when the court appoints a receiver to take custody and control over a specific asset or property that is relevant to the case. This can include real estate, vehicles, bank accounts, or any other valuable asset. 3. Income Receiving Order: In cases where the debtor receives regular income, such as from a job or rental property, an income receiving order may be issued. This order allows the receiver to collect the income directly from the debtor's employer or tenants to satisfy the judgment. The Collin Texas Receiving Order is an important legal tool that helps protect the rights of creditors and ensure that judgments are properly enforced. It grants receivers the necessary authority to effectively manage and safeguard the debtor's assets, allowing for a fair and orderly resolution of the legal proceedings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Orden de recepción - Receiving Order

Description

How to fill out Collin Texas Orden De Recepción?

If you need to find a trustworthy legal form provider to find the Collin Receiving Order, consider US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can browse from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting resources, and dedicated support make it easy to locate and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to look for or browse Collin Receiving Order, either by a keyword or by the state/county the document is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Collin Receiving Order template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less expensive and more affordable. Set up your first company, organize your advance care planning, draft a real estate contract, or execute the Collin Receiving Order - all from the comfort of your sofa.

Join US Legal Forms now!