San Bernardino California Receiving Order refers to the legal process initiated by a creditor to seize the debtor's assets in order to satisfy a debt. It is a court-ordered document that states a debtor must hand over certain property or assets to repay the outstanding debts owed to the creditor. This legal action is governed by the laws specific to San Bernardino, California. The San Bernardino California Receiving Order is generally issued by the court after considering a creditor's petition, proving that the debtor has failed to repay the owing debt. This order grants the creditor the right to seize the assets to recover the amount owed. The assets seized could include bank accounts, real estate properties, vehicles, or any other valuable possessions. There may be various types of San Bernardino California Receiving Orders, each with its own specific circumstances and requirements. Some common types include: 1. Personal Receiving Order: This type of order targets individuals who have failed to meet their personal financial obligations, such as unpaid loans, credit card debts, or outstanding bills. 2. Business Receiving Order: Designed for businesses, this type of order allows creditors to recover unpaid debts from businesses that haven't met their financial obligations. It gives the creditor the authority to seize business assets, inventory, or any other valuable property owned by the business. 3. Wage Garnishment: In situations where the debtor is employed, a San Bernardino California Receiving Order may involve wage garnishment. It means a portion of the debtor's wages is deducted by the employer and paid directly to the creditor until the debt is fully settled. 4. Bank Account Seizure: In cases where debtors have funds in their bank accounts, the creditor can obtain a San Bernardino California Receiving Order to freeze the account and seize the funds to satisfy the owed debts. It is important to note that the San Bernardino California Receiving Order must be followed strictly by both parties involved. Failure to comply with the order may lead to further legal consequences for the debtor. Furthermore, the order can impact the debtor's credit score and financial standing, making it important to seek legal guidance or negotiate with the creditor to avoid such legal actions whenever possible.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Bernardino California Orden de recepción - Receiving Order

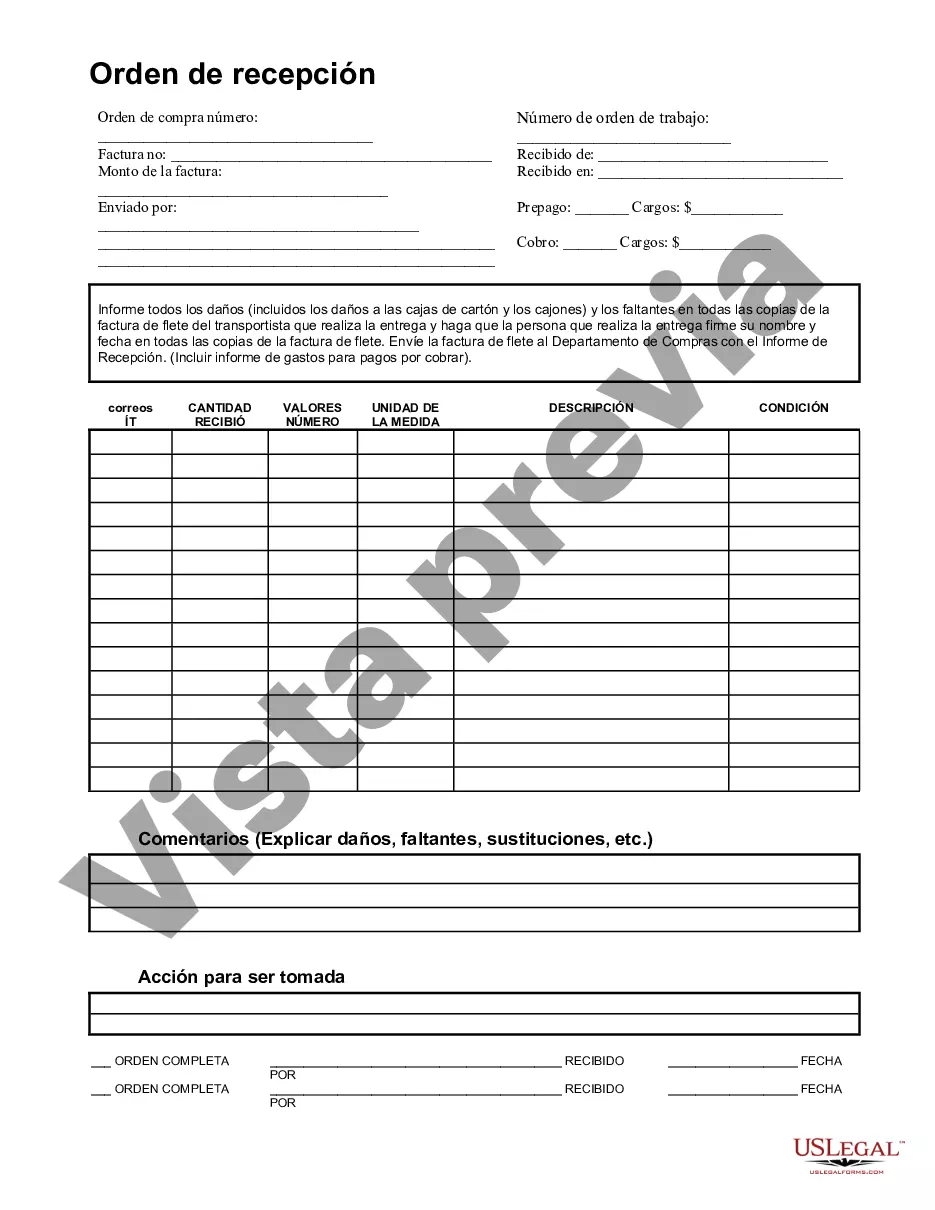

Description

How to fill out San Bernardino California Orden De Recepción?

Drafting paperwork for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create San Bernardino Receiving Order without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid San Bernardino Receiving Order by yourself, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the San Bernardino Receiving Order:

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a couple of clicks!