Chicago Illinois Annual Expense Report is a comprehensive document that provides a detailed breakdown of the expenses incurred by the city of Chicago, Illinois in a 12-month period. This report is vital for understanding the financial health of the city, analyzing spending patterns, and making informed decisions regarding budget allocations and resource management. The Chicago Illinois Annual Expense Report covers various categories of expenditures, including but not limited to: 1. Personnel Expenses: This category includes salaries, wages, benefits, and allowances paid to city employees, such as police officers, firefighters, teachers, administrative staff, and other public servants. 2. Operating Expenses: These expenses encompass daily operational costs, such as utilities (electricity, water, and gas), maintenance and repairs, office supplies, communication services, software licensing fees, and other essential expenses incurred by city departments. 3. Capital Expenses: This category focuses on investments in the construction, renovation, and maintenance of public infrastructure, including roads, bridges, public transportation systems, parks, libraries, and municipal buildings. It covers expenses related to construction materials, equipment, labor, and contracted services. 4. Debt Servicing Expenses: Chicago may have outstanding debts that require servicing in the form of interest payments or scheduled repayments. This section of the report details the amounts allocated to servicing debts and ensures transparency in financial obligations. 5. Public Welfare Expenses: The report may also include expenses related to public welfare programs, such as healthcare, social services, housing assistance, education, and community development initiatives. These expenses aim to enhance the quality of life for residents of Chicago. 6. Legal Expenses: This category addresses the costs associated with legal matters, including legal fees, settlements, and judgments in lawsuits involving the city, law enforcement, or other municipal departments. Other potential reports that fall under the Chicago Illinois Annual Expense Report may include: — Departmental Expense Reports: These reports provide itemized information on expenditures within each specific city department, such as police, fire, education, transportation, and public works. This level of detail allows for a more granular analysis of expenses and helps identify areas of high or low spending. — Capital Improvement Expense Reports: These reports focus solely on capital expenses related to infrastructure improvements and major projects in the city. They detail the cost breakdowns for specific projects, timelines, and funding sources. Overall, the Chicago Illinois Annual Expense Report plays a crucial role in promoting transparency, accountability, and effective financial management within the city government. By providing comprehensive insights into expenditure patterns, it aids decision-makers in resource allocation, budget planning, and ensuring that taxpayer funds are utilized efficiently for the betterment of Chicago and its residents.

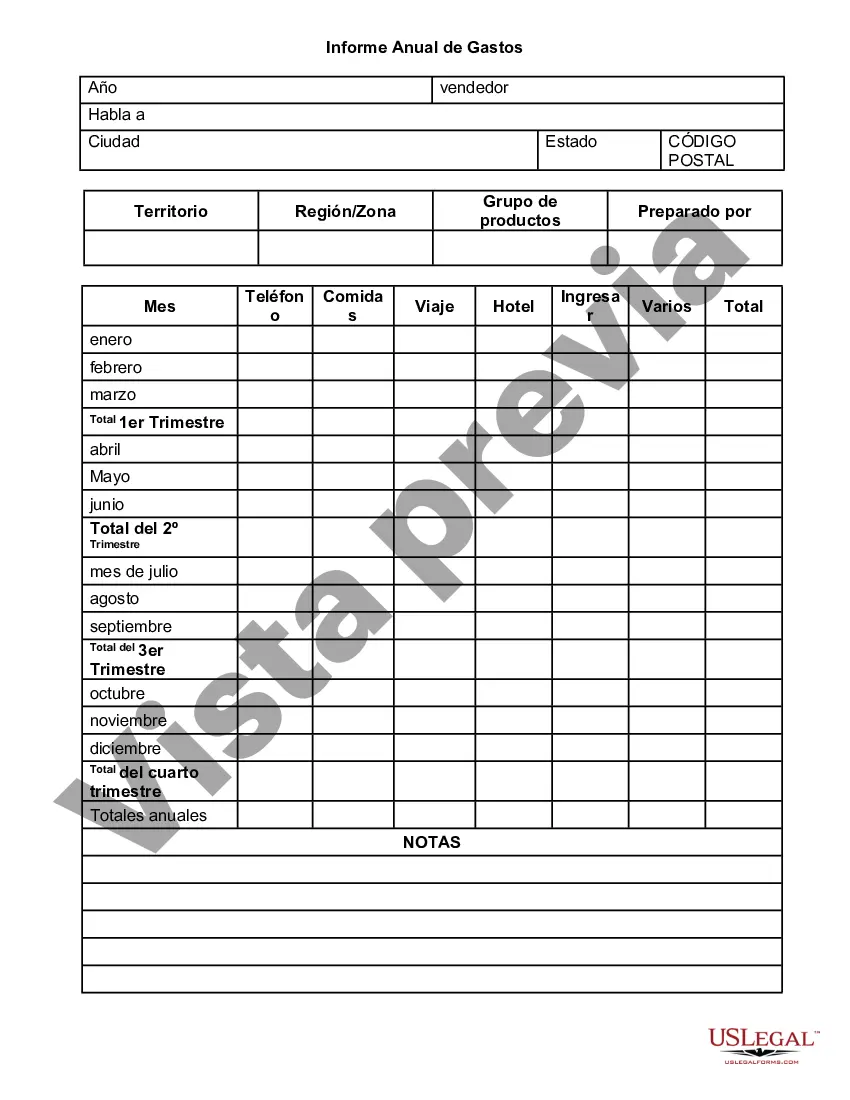

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Informe Anual de Gastos - Annual Expense Report

Description

How to fill out Chicago Illinois Informe Anual De Gastos?

Do you need to quickly draft a legally-binding Chicago Annual Expense Report or probably any other document to manage your personal or business affairs? You can select one of the two options: hire a professional to write a legal document for you or draft it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get professionally written legal papers without paying unreasonable prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant document templates, including Chicago Annual Expense Report and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, double-check if the Chicago Annual Expense Report is tailored to your state's or county's regulations.

- In case the form comes with a desciption, make sure to verify what it's intended for.

- Start the search again if the form isn’t what you were looking for by using the search bar in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Chicago Annual Expense Report template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the documents we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!