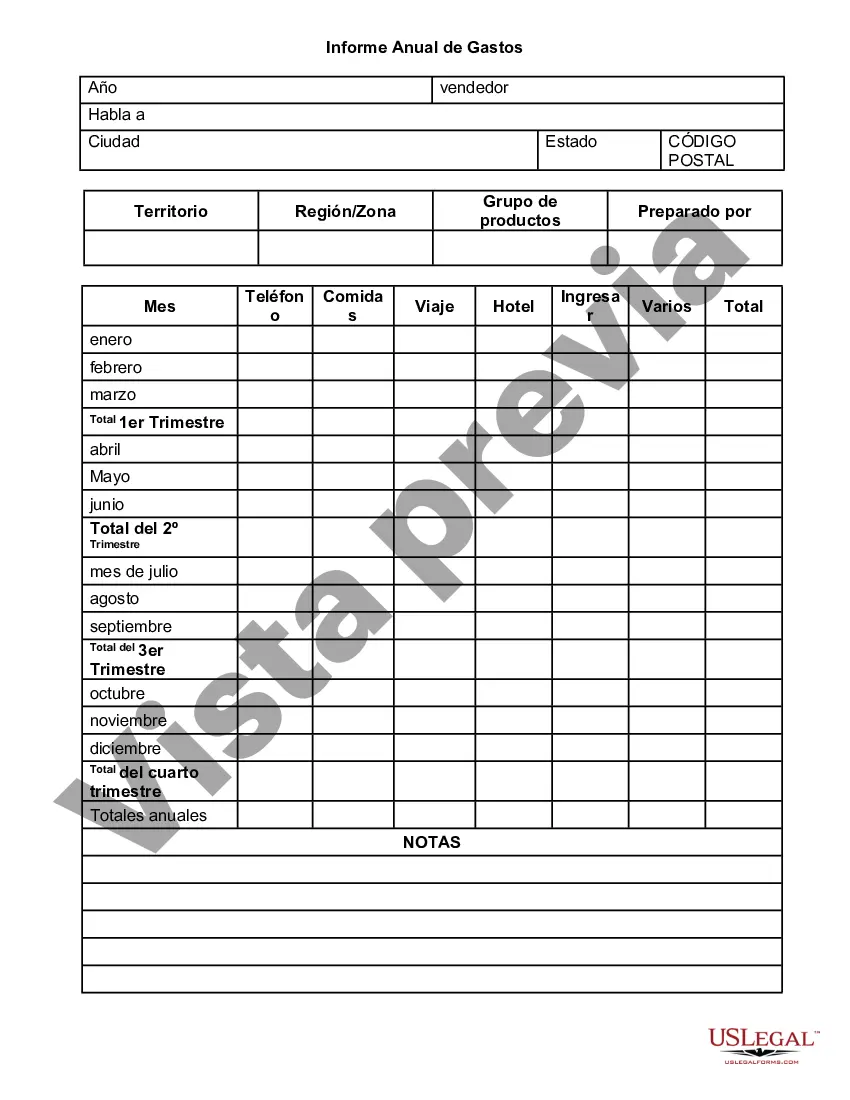

Collin Texas Annual Expense Report is a comprehensive document that provides a detailed breakdown of the expenses incurred by the county of Collin, Texas during a specified fiscal year. This report is an essential tool for understanding the financial health and allocation of resources within the county. The Collin Texas Annual Expense Report encompasses various types of expenses, including but not limited to: 1. General Operating Expenses: This section covers day-to-day costs required for the smooth functioning of the county government. It includes expenses associated with office supplies, utilities, maintenance, and personnel salaries. 2. Public Safety Expenses: This category includes expenses related to law enforcement agencies, emergency services, fire departments, and other public safety initiatives. It covers costs associated with equipment, training, personnel salaries, and community programs. 3. Infrastructure Expenses: This section focuses on expenses pertaining to the development, maintenance, and improvement of county infrastructure. It includes costs related to road construction, transportation systems, public buildings, and utilities. 4. Healthcare and Social Services Expenses: Collin Texas Annual Expense Report details the county's investment in healthcare facilities, social welfare programs, mental health services, and Medicaid assistance. It encompasses expenses incurred for medical equipment, staff salaries, and support services. 5. Education Expenses: This category highlights the county's commitment to education. It encompasses expenses associated with public schools, libraries, and programs aimed at enhancing educational opportunities for residents. It includes costs related to teacher salaries, building maintenance, textbooks, and technology. 6. Parks and Recreation Expenses: This section outlines expenses allocated for maintaining parks, recreational facilities, and the promotion of leisure activities within the county. It covers costs for park maintenance, facility upgrades, community events, and sports programs. 7. Financial and Administrative Expenses: This category includes costs associated with financial management, auditing, legal services, tax collection, and administrative support. It covers expenses related to accounting software, legal counsel, financial advisors, and administrative personnel salaries. Collin Texas Annual Expense Report plays a crucial role in promoting transparency, accountability, and informed decision-making by providing a comprehensive overview of the county's financial activities. It enables the public, policymakers, and stakeholders to understand how taxpayer funds are utilized to meet the diverse needs of the community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Informe Anual de Gastos - Annual Expense Report

Description

How to fill out Collin Texas Informe Anual De Gastos?

Whether you intend to start your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Collin Annual Expense Report is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to get the Collin Annual Expense Report. Follow the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Collin Annual Expense Report in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!