Franklin Ohio Annual Expense Report is a comprehensive document that provides a detailed breakdown of the municipality's financial expenditures over a specific fiscal year. This report is crucial in demonstrating transparency and accountability in managing public funds. It serves as a valuable tool for both government officials and citizens to understand how taxpayer money is allocated across various departments and programs in Franklin, Ohio. The Franklin Ohio Annual Expense Report encompasses a wide range of expenses incurred by the municipality within a given year. These expenses can be broadly categorized into several key areas, including but not limited to: 1. Personnel Expenses: This category includes salaries, wages, and benefits paid to employees of Franklin, Ohio. It encompasses payments made to city officials, administrative staff, police officers, firefighters, public works employees, and other municipal workers. 2. Operating Expenses: These expenses cover various day-to-day activities necessary to keep the city running smoothly. This includes utility bills, office supplies, maintenance and repairs of city-owned properties and vehicles, technology expenses, and other essential operational costs. 3. Public Safety Expenses: Franklin, Ohio prioritizes the safety of its residents and allocates a significant portion of its budget to public safety. This category encompasses expenses related to law enforcement, emergency services, fire protection, and crime prevention programs. 4. Infrastructure Expenses: Maintaining and improving the city's infrastructure is crucial for the overall development of Franklin, Ohio. This category includes expenses related to road repairs, street lighting, public transportation, parks, recreational facilities, and other infrastructure projects. 5. Community Development Expenses: These expenses are geared towards enhancing the quality of life in Franklin, Ohio. They include investments in community programs, economic development initiatives, housing projects, tourism promotion, and revitalization efforts. 6. Debt Service Expenses: Franklin, Ohio may have outstanding debts from previous capital projects or infrastructure development. Debt service expenses account for interest payments and principal repayments made to service these debts. 7. Other Expenses: This category encompasses any additional miscellaneous expenses incurred by the municipality that may not fall under the previously mentioned categories. It can include legal fees, insurance premiums, professional services, grants, and subsidies. It's important to note that the specific types of Franklin Ohio Annual Expense Reports may vary depending on the reporting requirements and accounting practices of the municipality. Different reports may provide additional details such as revenue sources, fund balances, capital investments, and long-term financial projections. However, the overall purpose remains the same — to provide a comprehensive overview of the municipality's financial activities during a specific fiscal year.

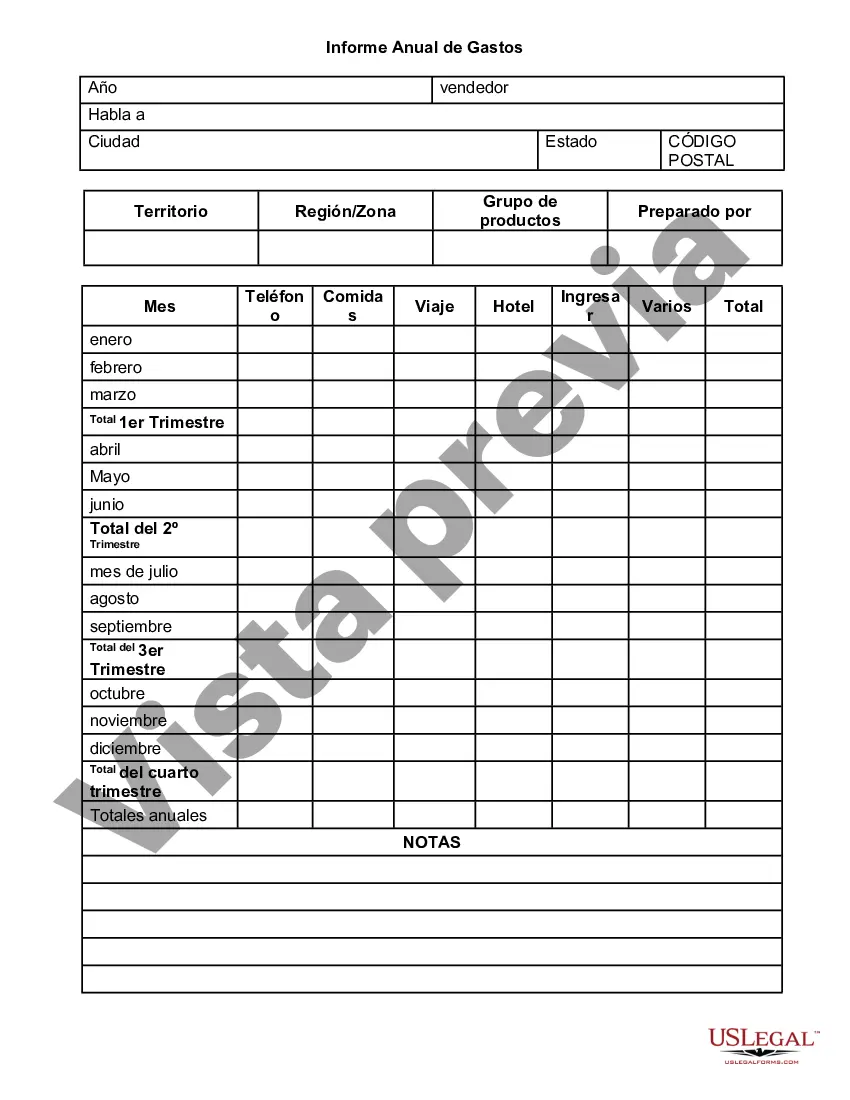

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Informe Anual de Gastos - Annual Expense Report

Description

How to fill out Franklin Ohio Informe Anual De Gastos?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business objective utilized in your region, including the Franklin Annual Expense Report.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Franklin Annual Expense Report will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Franklin Annual Expense Report:

- Ensure you have opened the proper page with your localised form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Franklin Annual Expense Report on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!