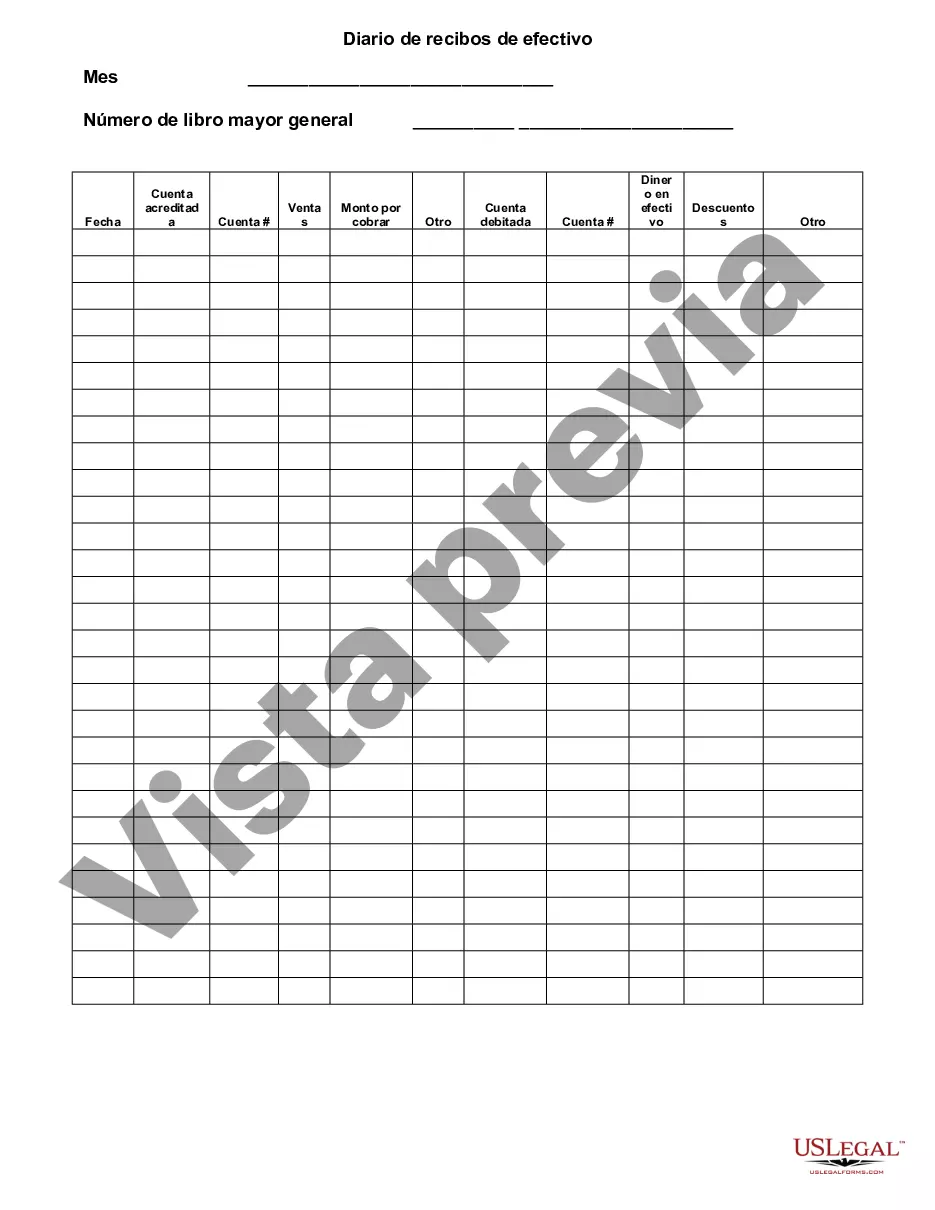

Alameda California Cash Receipts Journal is a financial document used by businesses in Alameda, California to track and record cash transactions. It serves as a record of all the money received by a company during a specific accounting period, providing a detailed breakdown of each transaction. The primary purpose of the Cash Receipts Journal is to monitor and document cash inflows. It includes information such as the date of the transaction, the source of the payment, the amount received, and any relevant references or notes. The Cash Receipts Journal plays a crucial role in the overall accounting process as it helps businesses keep accurate records of their revenue and enables efficient financial analysis. It allows companies to reconcile their cash balances, identify trends in cash receipts, and ensure that all income is properly accounted for. In Alameda, California, there are various types of Cash Receipts Journals that businesses may use, depending on their specific needs. Some common types include: 1. General Cash Receipts Journal: This is the most basic and commonly used form of the Cash Receipts Journal. It records all cash receipts regardless of the source or purpose. 2. Sales Cash Receipts Journal: This specific type of Cash Receipts Journal is used to track cash receipts related to sales transactions. It helps businesses monitor their sales revenue, update inventory records, and reconcile any discrepancies between cash sales and recorded sales. 3. Customer Cash Receipts Journal: Companies frequently use this type of Cash Receipts Journal to focus specifically on cash inflows from customers. It allows businesses to track payments received for invoices, track outstanding balances, and maintain a clear record of customer transactions. 4. Miscellaneous Cash Receipts Journal: This type of Cash Receipts Journal is utilized to record any cash transactions that do not fall under the aforementioned categories. This includes items like interest income, dividends, rent received, donations, or any other form of miscellaneous cash inflow. By diligently maintaining Alameda California Cash Receipts Journals, businesses can facilitate efficient bookkeeping, maintain accurate financial records, and ensure compliance with local, state, and federal regulations. Properly managing these journals contributes to accurate financial reporting, improved cash flow management, and informed decision-making.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Alameda California Diario De Recibos De Efectivo?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Alameda Cash Receipts Journal, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Alameda Cash Receipts Journal from the My Forms tab.

For new users, it's necessary to make several more steps to get the Alameda Cash Receipts Journal:

- Examine the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!