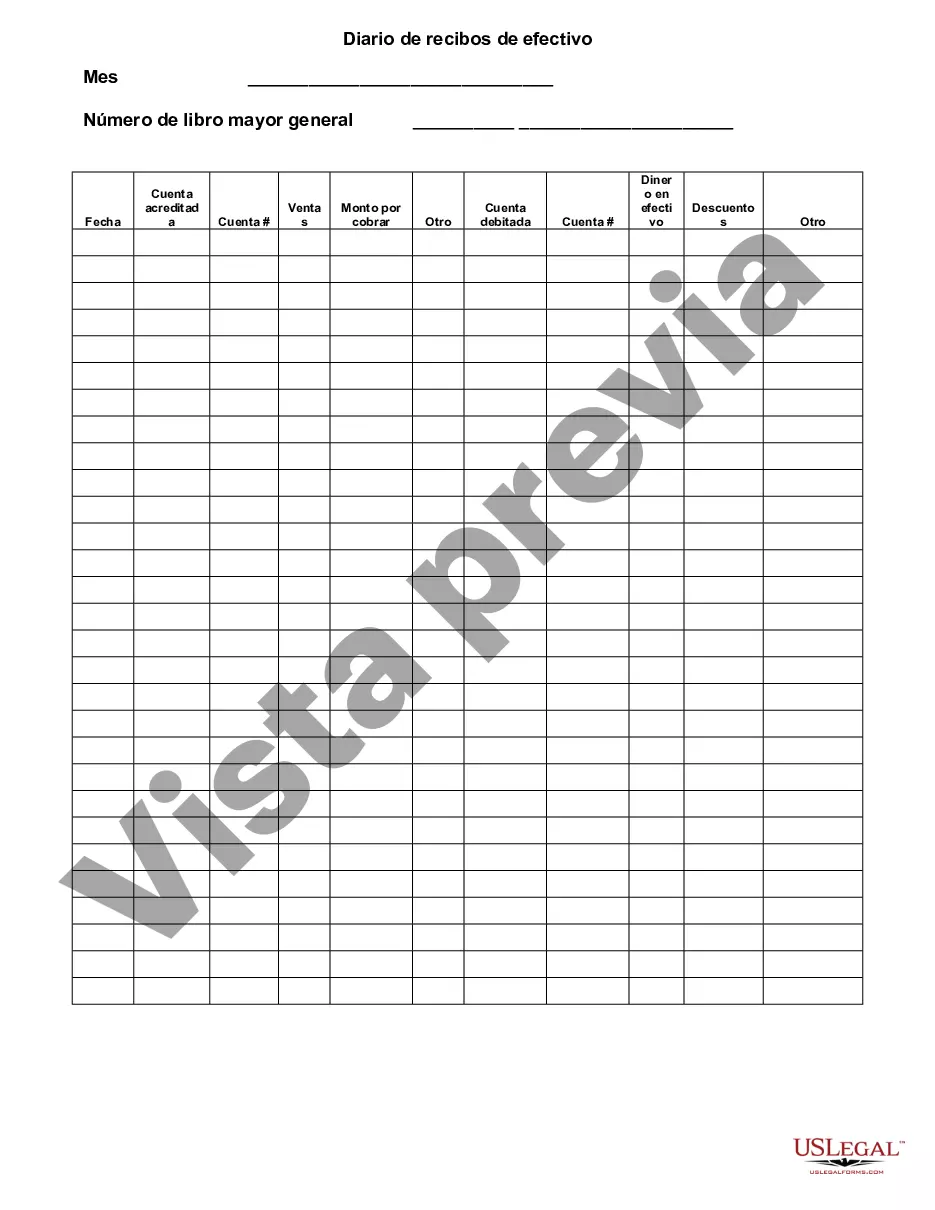

The Broward Florida Cash Receipts Journal is a financial record keeping tool used by businesses and organizations in Broward County, Florida to track and document all cash receipts. It serves as an essential component of an organization's accounting system, ensuring accurate and transparent financial reporting. Keywords: Broward Florida, Cash Receipts Journal, financial record keeping, businesses, organizations, Broward County, accounting system, accurate, transparent, financial reporting. There are generally two types of Broward Florida Cash Receipts Journals that can be used: 1. General Cash Receipts Journal: This type of journal is the most commonly used and covers all cash transactions that occur in a business or organization. It records various types of cash inflows, such as sales revenue, rental payments, interest income, loan repayments, and miscellaneous cash receipts. The General Cash Receipts Journal allows for meticulous tracking and categorization of each transaction, providing a comprehensive overview of all cash inflows. 2. Specialized Cash Receipts Journals: Depending on the nature of the business or organization, certain industries or sectors may require specialized cash receipts journals. These journals are designed to capture cash receipts specific to a particular area of operation. Examples of specialized cash receipts journals may include a Rental Receipts Journal for real estate agencies or property management companies, a Membership Dues Receipts Journal for clubs or associations, or a Ticket Sales Receipts Journal for event organizers or entertainment venues. Regardless of the type, the Broward Florida Cash Receipts Journal is structured in a similar format. Each entry within the journal typically includes the date of the transaction, a description of the source of the cash receipt, the amount received, and the method of payment (such as cash, check, credit card, or electronic transfer). Additionally, it may include details about the payer or the purpose of the transaction. Having a Broward Florida Cash Receipts Journal is essential for accurate financial record keeping, enables efficient monitoring of cash inflows, and facilitates the reconciliation of revenue against bank deposits. It ensures that all cash transactions are properly recorded, which in turn assists in preparing financial statements, tracking cash flow, and satisfying internal and external auditing requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Broward Florida Diario De Recibos De Efectivo?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Broward Cash Receipts Journal is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to obtain the Broward Cash Receipts Journal. Adhere to the guidelines below:

- Make certain the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Broward Cash Receipts Journal in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!