In accounting, the Chicago Illinois Cash Receipts Journal is a vital record-keeping tool used to track and document all cash inflows received by an organization or business entity based in Chicago, Illinois. This journal acts as a subledger, providing a detailed breakdown of each cash transaction, including the amount, source, and purpose of the received funds. By meticulously recording cash receipts, the journal allows for accurate financial reporting, reconciliation, and monitoring of cash flow in accordance with accounting principles and regulations. The Chicago Illinois Cash Receipts Journal showcases its significance in maintaining meticulous financial records in compliance with local laws, financial audits, and tax requirements. The specifics included in this journal vary depending on the organization's needs, but generally contain essential information such as dates, customer or payer names, invoice or document numbers, payment methods, and descriptions of the goods or services rendered. Different types of Chicago Illinois Cash Receipts Journals may exist, tailored to the unique characteristics and operations of various businesses. These variations include: 1. Retail Cash Receipts Journal: Primarily utilized by retail establishments in Chicago, this type of journal focuses on recording cash transactions resulting from sales to customers. It documents the total received cash, payments by credit or debit cards, checks, and other forms of payment accepted by the retail business. 2. Service-based Cash Receipts Journal: Businesses providing services, such as consultancy firms, law offices, or healthcare providers localized in Chicago, maintain this journal to document cash receipts from clients or patients. It captures charges for specific services rendered, including consultation fees, hourly rates, medical or legal fees, and related reimbursements. 3. Rental Cash Receipts Journal: Property management companies and landlords based in Chicago adhering to precise record-keeping protocols benefit from maintaining a rental-oriented cash receipts journal. This journal records cash inflows derived from rent payments, security deposits, late fees, and any other payments relevant to lease agreements and tenancy. 4. Miscellaneous Cash Receipts Journal: This type of cash receipts journal in Chicago caters to organizations that receive various forms of cash inflows apart from core business transactions. Examples can include fundraisers, donations, grants, interest income, or any unrelated revenue streams. Overall, regardless of the specific type, maintaining a Chicago Illinois Cash Receipts Journal is crucial for businesses to ensure accurate accounting, financial transparency, and proper cash management. By diligently recording cash receipts and regularly reconciling them with other accounting records, businesses demonstrate their commitment to sound financial practices.

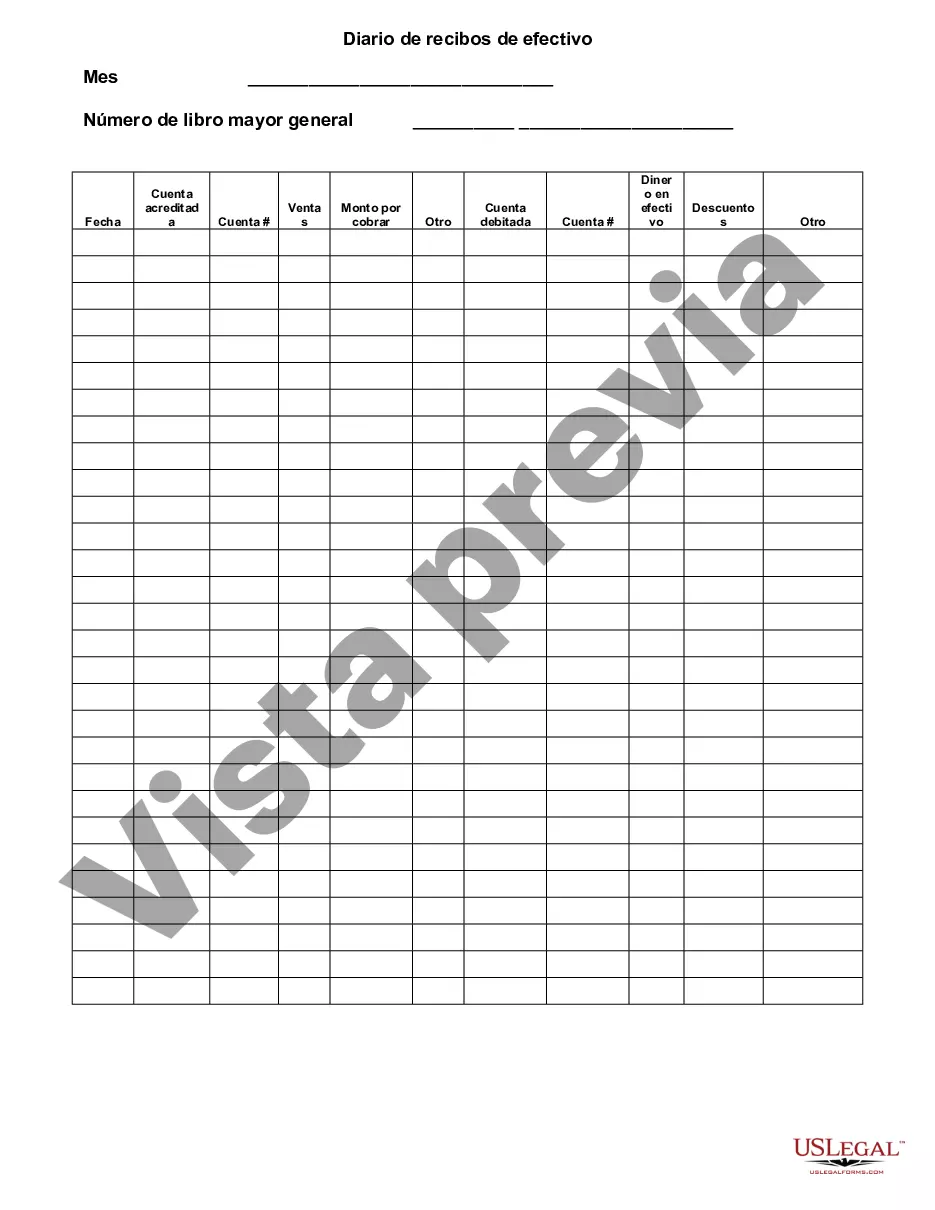

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Chicago Illinois Diario De Recibos De Efectivo?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any personal or business objective utilized in your region, including the Chicago Cash Receipts Journal.

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Chicago Cash Receipts Journal will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the Chicago Cash Receipts Journal:

- Ensure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Chicago Cash Receipts Journal on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!